- Japan

- /

- Diversified Financial

- /

- TSE:7172

Three Stocks Estimated To Be Below Intrinsic Value In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of monetary policy shifts and economic uncertainty, with major indices like the Nasdaq reaching new highs while others falter, investors are increasingly focused on identifying opportunities amid volatility. In this environment, stocks perceived to be trading below their intrinsic value can offer potential for growth as they may be overlooked or undervalued by the broader market.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Strike CompanyLimited (TSE:6196) | ¥3615.00 | ¥7296.03 | 50.5% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1129.35 | ₹2250.95 | 49.8% |

| Wuhan Keqian BiologyLtd (SHSE:688526) | CN¥14.75 | CN¥29.09 | 49.3% |

| Lindab International (OM:LIAB) | SEK225.40 | SEK450.75 | 50% |

| Decisive Dividend (TSXV:DE) | CA$5.93 | CA$11.84 | 49.9% |

| GlobalData (AIM:DATA) | £1.875 | £3.75 | 50% |

| Western Alliance Bancorporation (NYSE:WAL) | US$82.86 | US$165.30 | 49.9% |

| Charter Hall Group (ASX:CHC) | A$14.31 | A$28.75 | 50.2% |

| HealthEquity (NasdaqGS:HQY) | US$94.76 | US$189.22 | 49.9% |

| Hanall Biopharma (KOSE:A009420) | ₩31950.00 | ₩65043.15 | 50.9% |

Let's dive into some prime choices out of the screener.

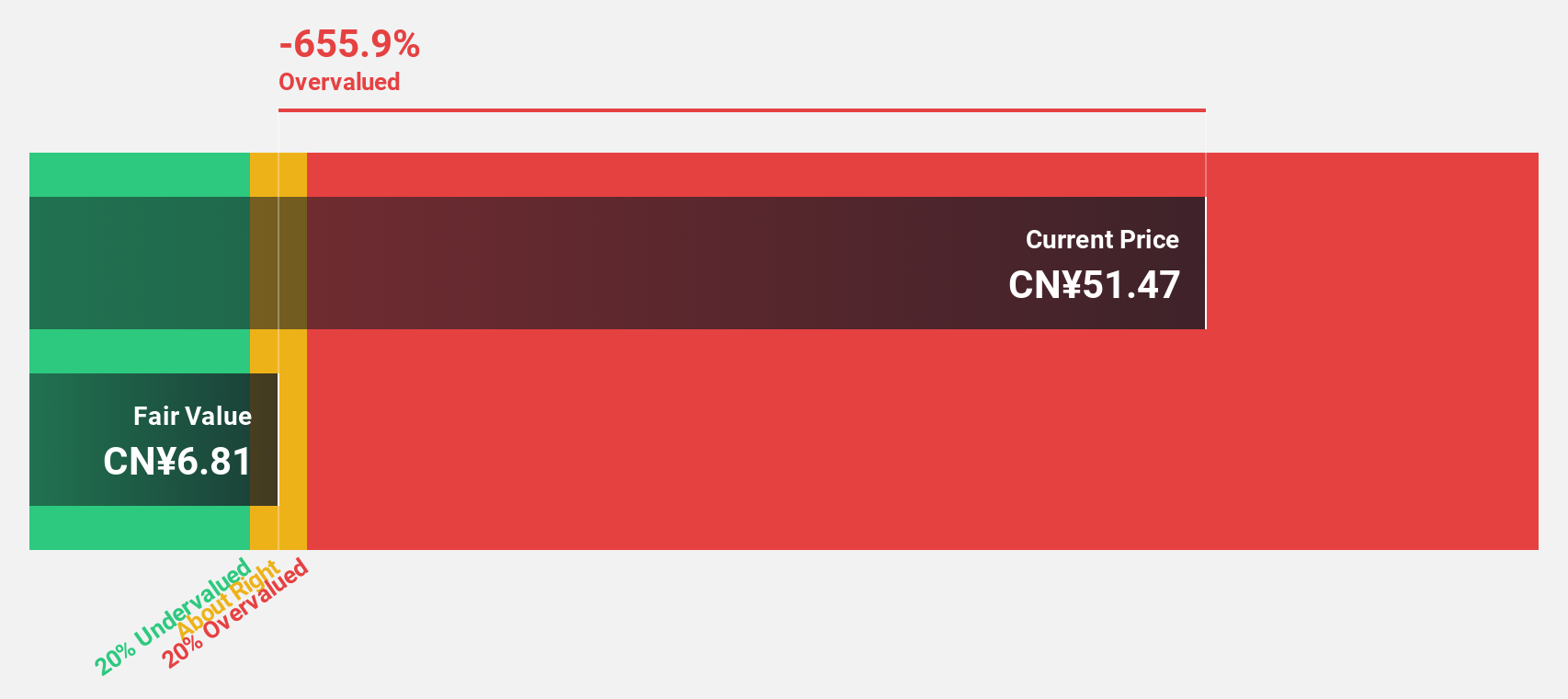

Shenzhen Xinyichang Technology (SHSE:688383)

Overview: Shenzhen Xinyichang Technology Co., Ltd. focuses on the R&D, production, and sale of intelligent manufacturing equipment for industries such as LED, capacitor, semiconductor, and lithium battery in China with a market cap of CN¥4.87 billion.

Operations: Revenue Segments (in millions of CN¥): The company generates revenue through its intelligent manufacturing equipment tailored for the LED, capacitor, semiconductor, and lithium battery industries in China.

Estimated Discount To Fair Value: 12.3%

Shenzhen Xinyichang Technology's recent earnings report shows an increase in net income to CNY 69.47 million, despite a decline in sales. The company is trading at approximately CN¥50.59, below its estimated fair value of CN¥57.69, indicating it may be undervalued based on cash flows. Earnings are expected to grow significantly at 54.9% per year, outpacing the market average, though the stock has shown high volatility recently and carries a high level of debt.

- Upon reviewing our latest growth report, Shenzhen Xinyichang Technology's projected financial performance appears quite optimistic.

- Take a closer look at Shenzhen Xinyichang Technology's balance sheet health here in our report.

Japan Investment Adviser (TSE:7172)

Overview: Japan Investment Adviser Co., Ltd. offers a range of financial solutions in Japan and has a market cap of ¥61.51 billion.

Operations: The company generates revenue of ¥28.10 billion from its Finance Solution segment.

Estimated Discount To Fair Value: 41.9%

Japan Investment Adviser is trading at ¥1,047, significantly below its estimated fair value of ¥1,801.99, suggesting it is undervalued based on cash flows. Despite a recent downward revision in earnings forecasts due to exchange losses from rapid yen appreciation, the company's core Operating Lease Business remains strong. Earnings are projected to grow substantially at 56.2% annually over the next three years; however, recent shareholder dilution and debt coverage issues present challenges.

- Our earnings growth report unveils the potential for significant increases in Japan Investment Adviser's future results.

- Click here to discover the nuances of Japan Investment Adviser with our detailed financial health report.

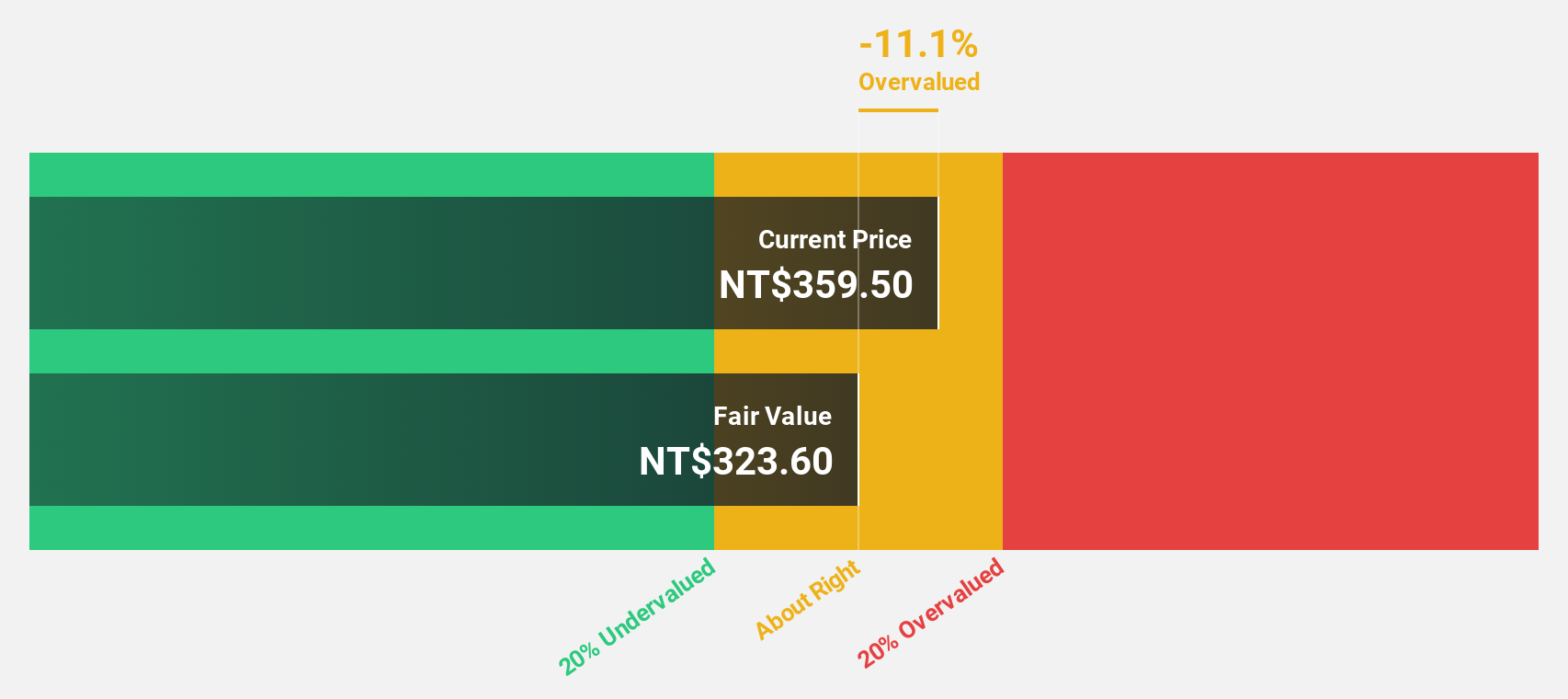

Raydium Semiconductor (TWSE:3592)

Overview: Raydium Semiconductor Corporation designs, develops, and sells integrated circuits (IC) in Taiwan, China, Hong Kong, and internationally with a market cap of NT$28.14 billion.

Operations: The company's revenue primarily comes from its development, design, and sale of integrated circuits, amounting to NT$23.60 billion.

Estimated Discount To Fair Value: 23.7%

Raydium Semiconductor is trading at NT$382, below its estimated fair value of NT$500.61, highlighting its undervaluation based on cash flows. Despite a slower forecasted revenue growth of 8.3% annually compared to the TW market's 12.1%, recent earnings showed significant improvement with Q3 net income rising to TWD 537.18 million from TWD 441.53 million year-on-year. However, an unstable dividend track record and moderate profit growth projections remain concerns for investors seeking consistent returns.

- Our expertly prepared growth report on Raydium Semiconductor implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Raydium Semiconductor.

Seize The Opportunity

- Dive into all 911 of the Undervalued Stocks Based On Cash Flows we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7172

Exceptional growth potential with solid track record.

Market Insights

Community Narratives