- Taiwan

- /

- Semiconductors

- /

- TWSE:3545

Undiscovered Gems Jiangsu Jujie Microfiber Technology Group And 2 Promising Small Cap Stocks

Reviewed by Simply Wall St

In the current global market landscape, uncertainty surrounding the incoming U.S. administration's policies and fluctuating interest rates have created a complex environment for investors, particularly impacting small-cap stocks as reflected in recent declines in indices like the S&P MidCap 400 and Russell 2000. Amid these challenges, identifying promising small-cap companies that demonstrate resilience and potential for growth becomes crucial; such stocks often possess unique business models or operate within niche markets that can offer opportunities despite broader economic volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Jiangsu Jujie Microfiber Technology Group (SZSE:300819)

Simply Wall St Value Rating: ★★★★★☆

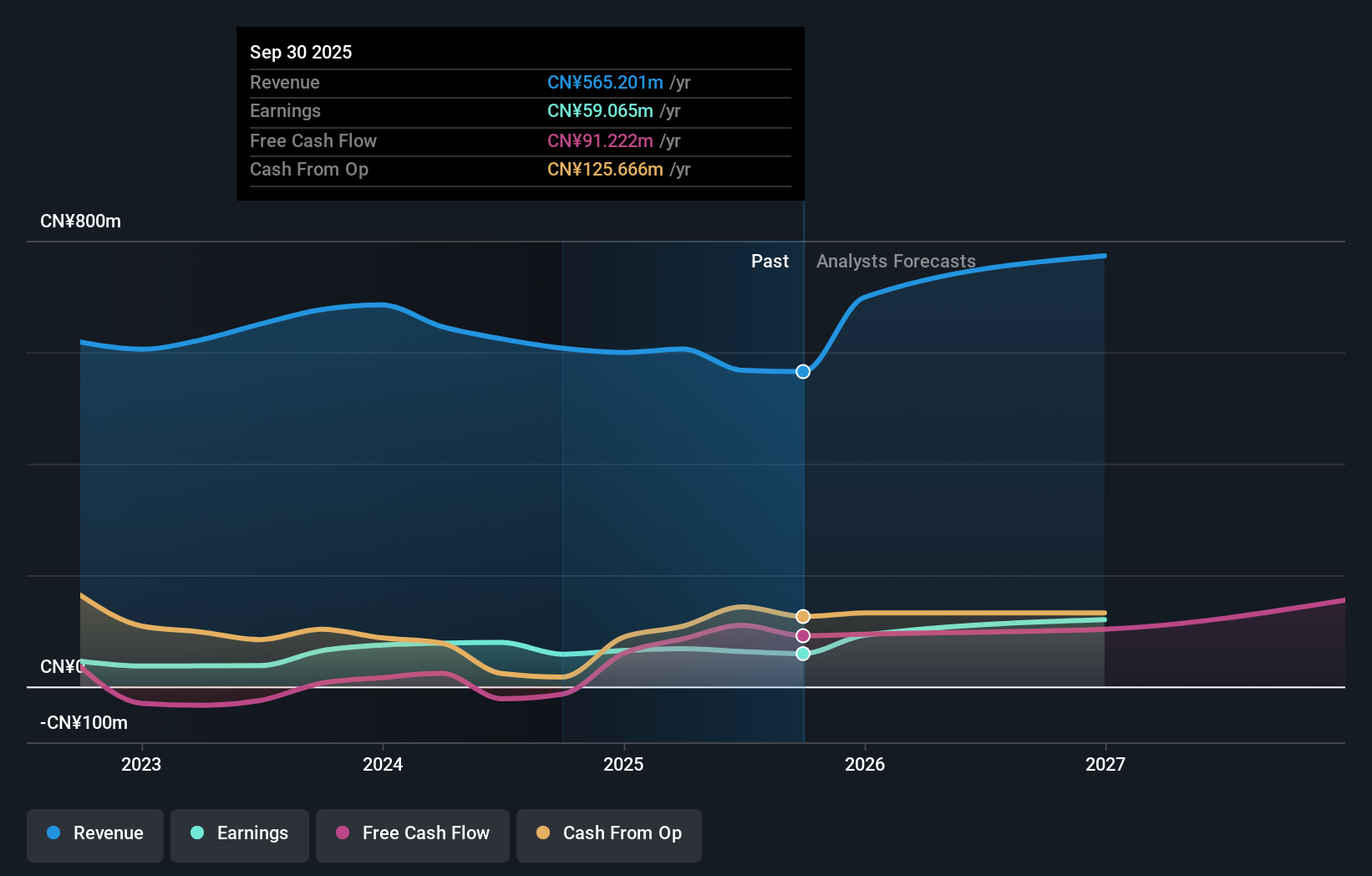

Overview: Jiangsu Jujie Microfiber Technology Group Co., Ltd. operates in the microfiber industry and has a market cap of CN¥2.09 billion.

Operations: Jujie Microfiber generates revenue primarily from the sale of microfiber products. The company focuses on optimizing its cost structure to enhance profitability, with significant attention given to managing production and operational expenses.

Jiangsu Jujie Microfiber Technology Group, a small player in the microfiber industry, recently reported earnings for the nine months ending September 2024 with sales at CNY 482.48 million, down from CNY 560.22 million the previous year. Net income also saw a decrease to CNY 57.87 million from CNY 74.3 million. Despite these challenges, the company maintains more cash than its total debt and has high-quality past earnings, suggesting financial stability amidst market fluctuations. The debt-to-equity ratio rose to 1.1% over five years, indicating some leverage increase but still manageable given their interest coverage capability.

- Take a closer look at Jiangsu Jujie Microfiber Technology Group's potential here in our health report.

Understand Jiangsu Jujie Microfiber Technology Group's track record by examining our Past report.

ISE Chemicals (TSE:4107)

Simply Wall St Value Rating: ★★★★★★

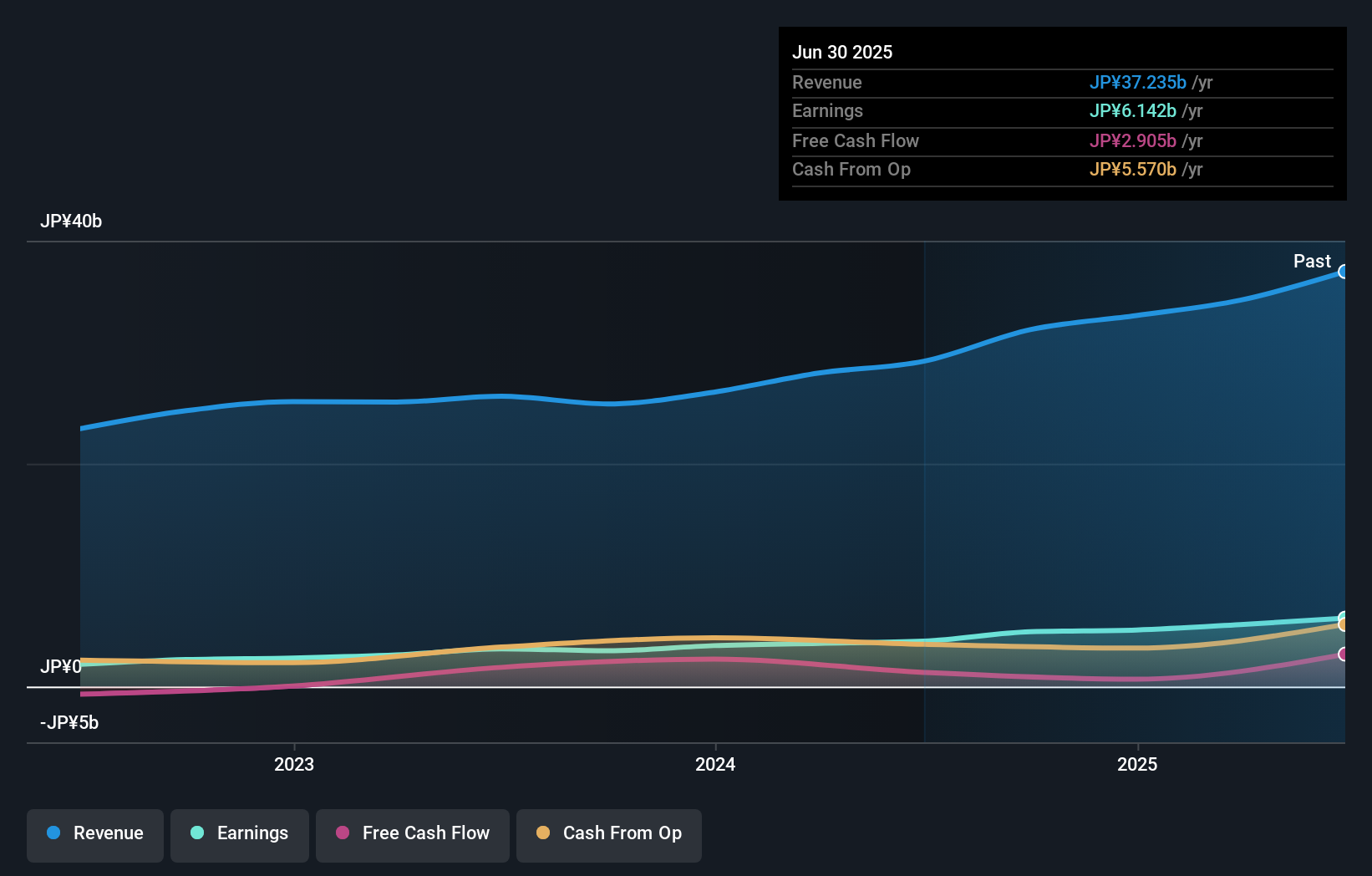

Overview: ISE Chemicals Corporation is involved in the production, processing, and trade of iodine and iodine derivatives as well as nickel and cobalt compounds in Japan, with a market capitalization of ¥102.85 billion.

Operations: ISE Chemicals generates revenue primarily from its iodine and iodine derivatives, along with nickel and cobalt compounds. The company has a market capitalization of ¥102.85 billion.

ISE Chemicals, a nimble player in the industry, has seen its earnings surge by 53% over the past year, outpacing the sector's 16% growth. The company has effectively managed its debt levels, reducing its debt to equity ratio from 2.4 to 1.5 over five years while maintaining more cash than total debt. Despite recent share price volatility, ISE remains profitable with positive free cash flow and high-quality earnings. Recently added to the S&P Global BMI Index on September 23rd, it faces a forecasted average annual earnings decline of 0.6% over the next three years but continues to earn more interest than it pays.

- Click to explore a detailed breakdown of our findings in ISE Chemicals' health report.

Evaluate ISE Chemicals' historical performance by accessing our past performance report.

FocalTech Systems (TWSE:3545)

Simply Wall St Value Rating: ★★★★★☆

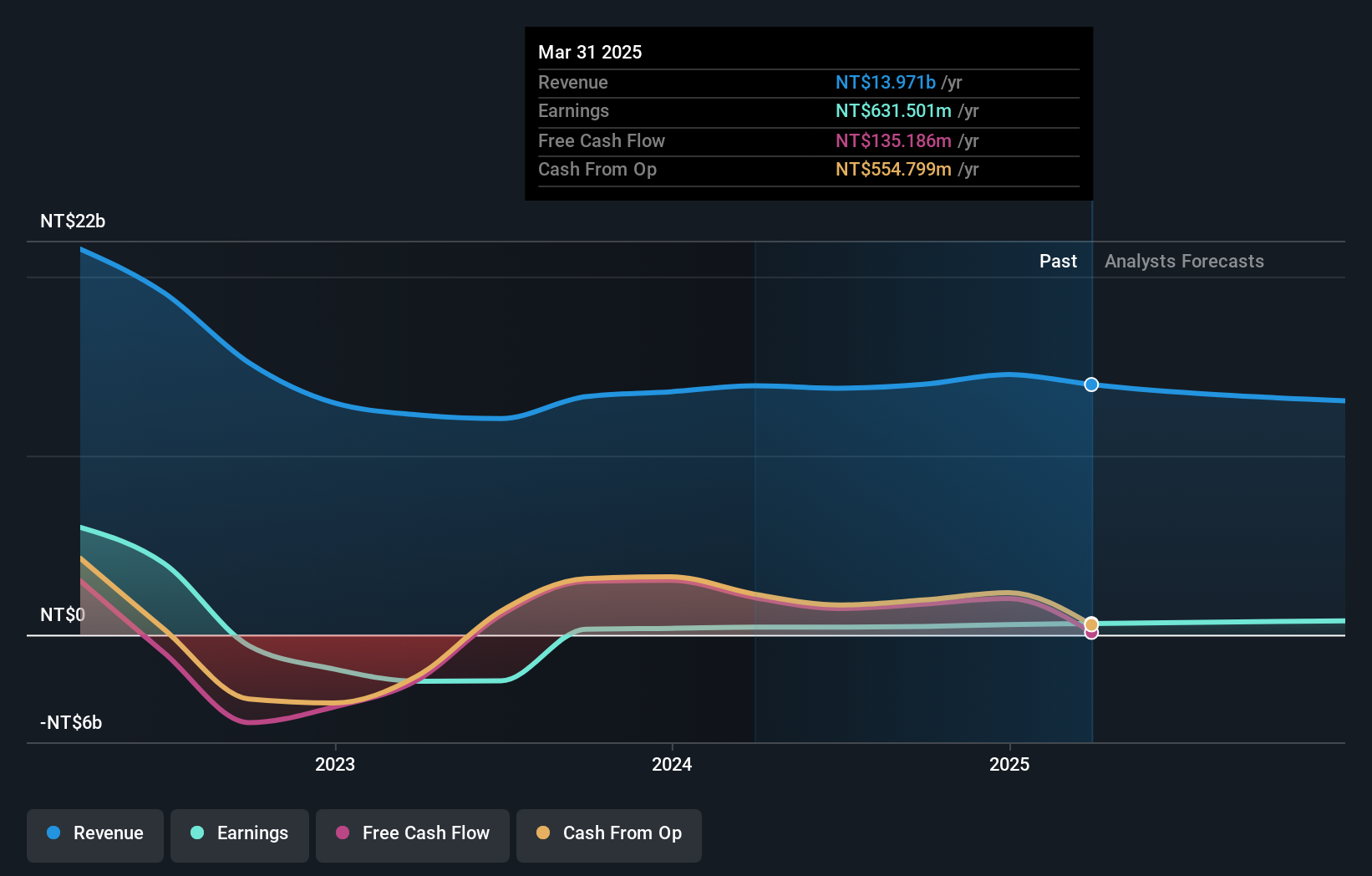

Overview: FocalTech Systems Co., Ltd. specializes in the research, design, development, manufacturing, and sale of human-machine interface solutions across Taiwan, China, and international markets with a market cap of NT$19.51 billion.

Operations: FocalTech generates revenue primarily from its human-machine interface solutions. The company's net profit margin has shown variability, reflecting changes in operational efficiency and market conditions.

FocalTech Systems, a small player in the semiconductor industry, showcases strong financial health with high-quality earnings and positive free cash flow. Over the past year, its earnings surged by 49.8%, outpacing the industry's 5.8% growth rate. The company's debt to equity ratio rose to 21.8% over five years but remains manageable as it holds more cash than total debt, ensuring interest coverage isn't a concern. Recent quarterly results highlight sales of TWD 3,813 million and net income of TWD 168 million, reflecting improved profitability compared to last year’s figures and indicating promising momentum for future growth prospects.

Where To Now?

- Click here to access our complete index of 4651 Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3545

FocalTech Systems

Engages in the research, design, development, manufacturing, and sale of human-machine interface solutions in Taiwan, China, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives