- Taiwan

- /

- Semiconductors

- /

- TWSE:3413

Foxsemicon Integrated Technology (TWSE:3413) Is Paying Out A Larger Dividend Than Last Year

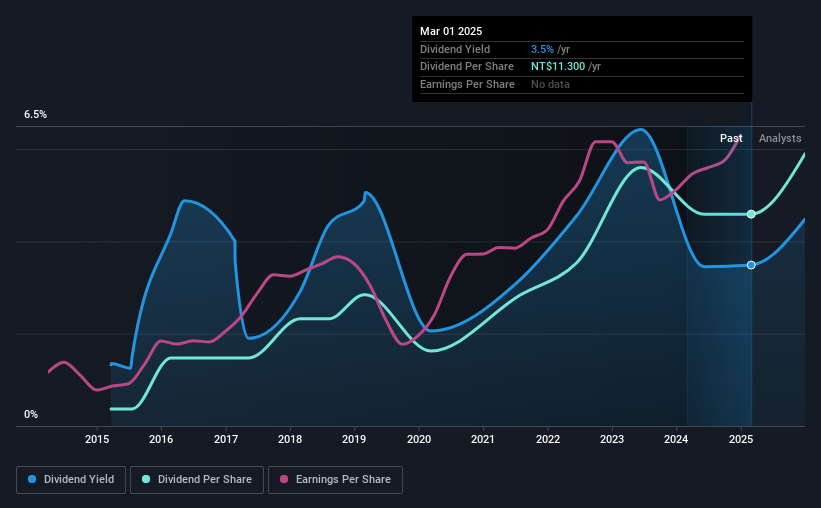

Foxsemicon Integrated Technology Inc. (TWSE:3413) has announced that it will be increasing its periodic dividend on the 18th of July to NT$14.50, which will be 28% higher than last year's comparable payment amount of NT$11.3. This makes the dividend yield about the same as the industry average at 3.5%.

Check out our latest analysis for Foxsemicon Integrated Technology

Foxsemicon Integrated Technology's Future Dividend Projections Appear Well Covered By Earnings

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. Based on the last dividend, Foxsemicon Integrated Technology is earning enough to cover the payment, but then it makes up 466% of cash flows. This signals that the company is more focused on returning cash flow to shareholders, but it could mean that the dividend is exposed to cuts in the future.

Looking forward, earnings per share is forecast to rise by 9.4% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 62%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The dividend has gone from an annual total of NT$0.907 in 2015 to the most recent total annual payment of NT$11.3. This implies that the company grew its distributions at a yearly rate of about 29% over that duration. Foxsemicon Integrated Technology has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

The Dividend Looks Likely To Grow

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. It's encouraging to see that Foxsemicon Integrated Technology has been growing its earnings per share at 26% a year over the past five years. The company's earnings per share has grown rapidly in recent years, and it has a good balance between reinvesting and paying dividends to shareholders, so we think that Foxsemicon Integrated Technology could prove to be a strong dividend payer.

Our Thoughts On Foxsemicon Integrated Technology's Dividend

Overall, we always like to see the dividend being raised, but we don't think Foxsemicon Integrated Technology will make a great income stock. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 2 warning signs for Foxsemicon Integrated Technology (of which 1 is concerning!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3413

Foxsemicon Integrated Technology

Engages in the research, development, design, manufacturing, and sale of semiconductor equipment subsystems and system integration in Taiwan, the United States, China, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026