- Taiwan

- /

- Semiconductors

- /

- TWSE:3413

3 Excellent Dividend Stocks Yielding At Least 4.3%

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, global markets have experienced some turbulence, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching highs before pulling back. Amidst this volatility, investors are increasingly looking towards dividend stocks as a source of steady income, especially those yielding at least 4.3%, which can offer stability in uncertain times. A good dividend stock typically combines reliable payouts with strong fundamentals, making it an attractive option for those seeking to navigate the current market landscape effectively.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Globeride (TSE:7990) | 4.10% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.06% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.45% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.91% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.76% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.18% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.55% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.36% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.83% | ★★★★★★ |

Click here to see the full list of 2012 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

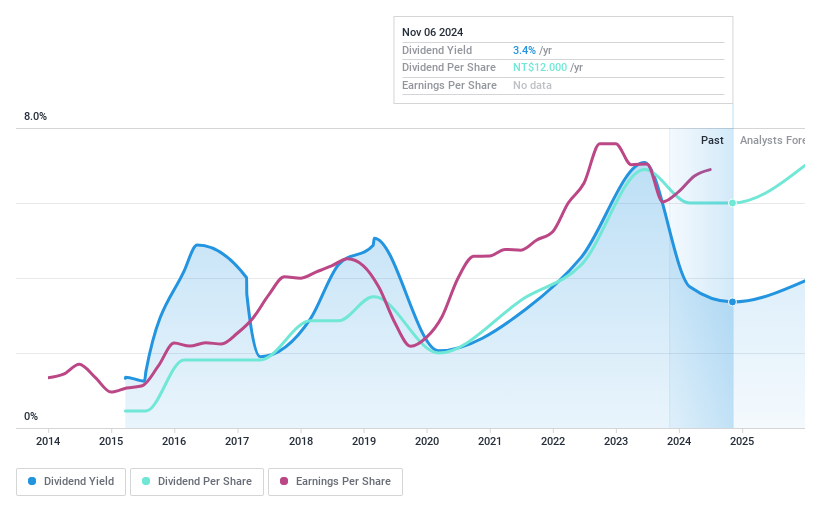

Getac Holdings (TWSE:3005)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Getac Holdings Corporation, with a market cap of NT$69.78 billion, is engaged in the research, development, manufacturing, and sale of notebook computers and related products across China, the United States, Europe, and other international markets.

Operations: Getac Holdings Corporation generates revenue from three primary segments: Machine Parts (NT$13.88 billion), Electronic Parts (NT$18.13 billion), and Aerospace Fasteners (NT$3.36 billion).

Dividend Yield: 4.4%

Getac Holdings offers a mixed dividend profile, with past volatility and unreliability in its payments. However, dividends are currently sustainable, covered by earnings (72.3% payout ratio) and cash flows (66.1% cash payout ratio). Despite trading at a good value relative to peers, its 4.38% dividend yield is slightly below the top quartile in Taiwan's market. Recent partnerships and strategic initiatives could enhance long-term financial stability but may not immediately impact dividend consistency.

- Take a closer look at Getac Holdings' potential here in our dividend report.

- Our valuation report unveils the possibility Getac Holdings' shares may be trading at a discount.

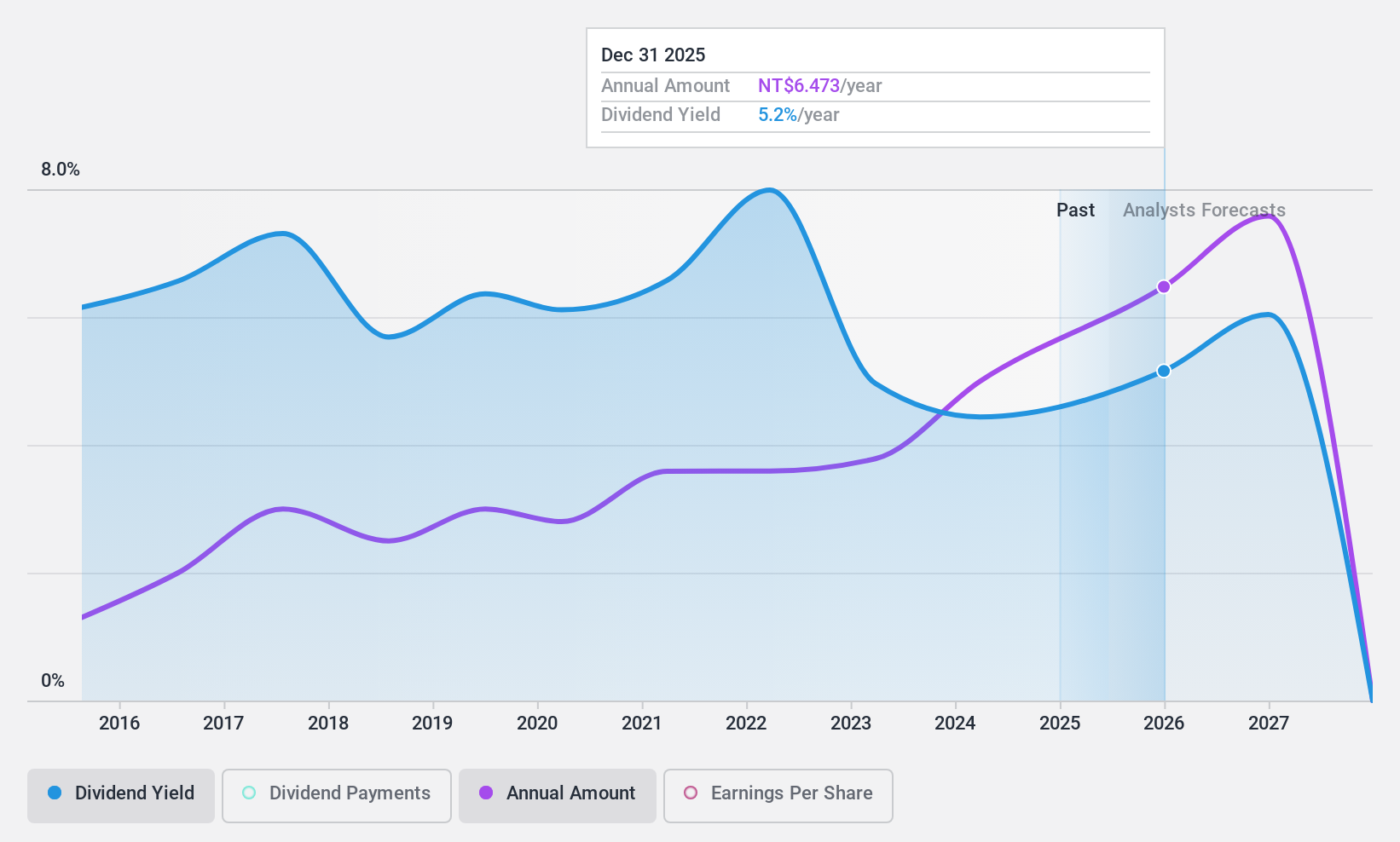

Foxsemicon Integrated Technology (TWSE:3413)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Foxsemicon Integrated Technology Inc. specializes in the research, development, design, manufacturing, and sale of semiconductor equipment subsystems and system integration across Taiwan, the United States, China, and other international markets with a market cap of NT$36.35 billion.

Operations: Foxsemicon Integrated Technology Inc. generates revenue of NT$13.40 billion from its semiconductor equipment and services segment.

Dividend Yield: 3.4%

Foxsemicon Integrated Technology's dividend profile shows sustainability with a payout ratio of 53.6% and cash payout ratio of 66.1%, indicating coverage by earnings and cash flows. Despite past volatility and unreliability in payments, dividends have increased over the last decade. The company trades at a favorable value with a price-to-earnings ratio of 16.4x, below the market average, but its dividend yield of 3.39% lags behind Taiwan's top quartile payers at 4.43%.

- Click here and access our complete dividend analysis report to understand the dynamics of Foxsemicon Integrated Technology.

- According our valuation report, there's an indication that Foxsemicon Integrated Technology's share price might be on the cheaper side.

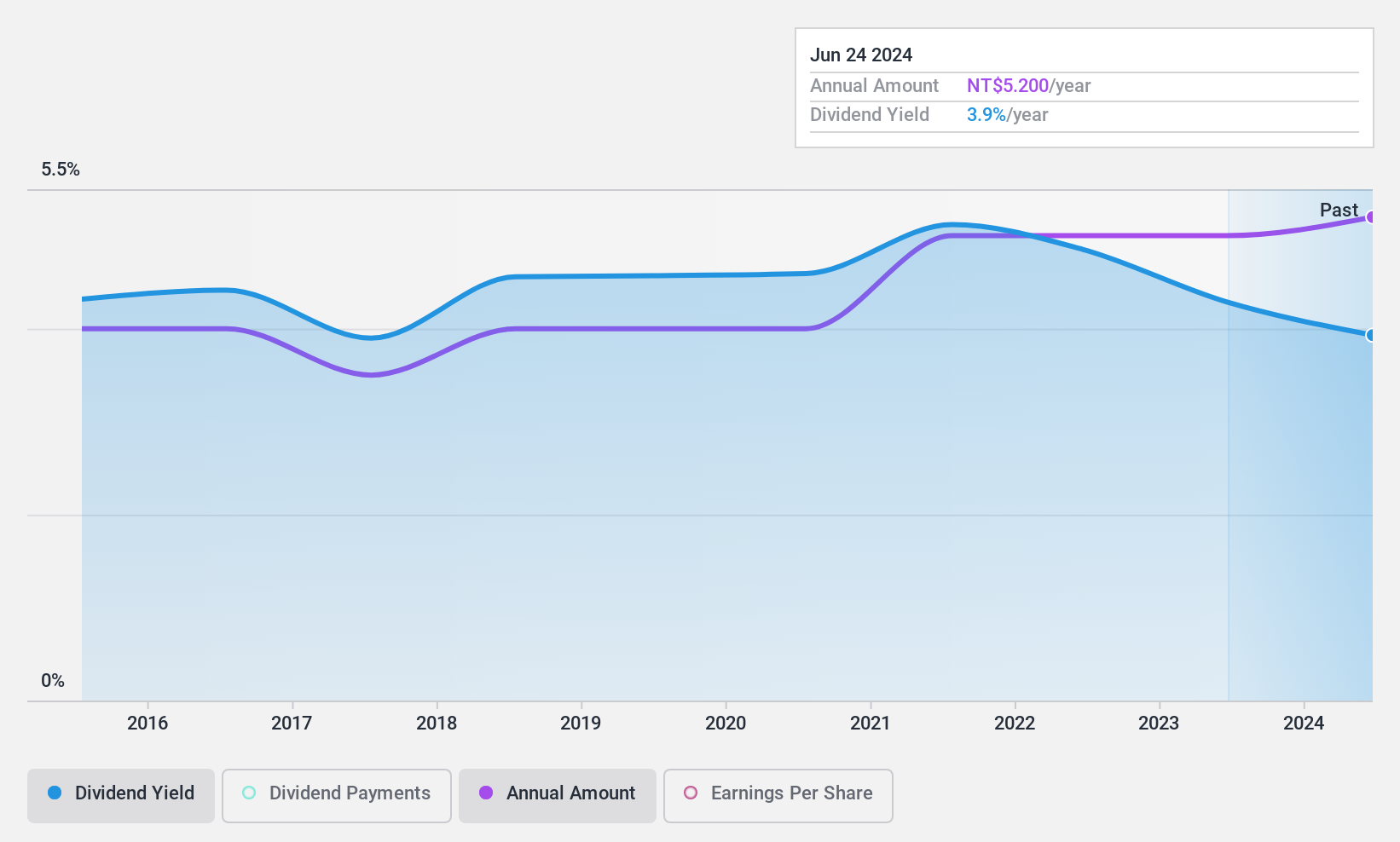

Taiwan Secom (TWSE:9917)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taiwan Secom Co., Ltd. offers security services in Taiwan and has a market cap of NT$62.29 billion.

Operations: Taiwan Secom Co., Ltd.'s revenue segments include NT$1.78 billion from Restaurant Services, NT$1.08 billion from the Logistics Department, NT$4.83 billion from Other Business Department, NT$1.69 billion from Banknote Service Department, NT$2.61 billion from Stay in Security Department, and NT$7.53 billion from the Electronic Systems Department.

Dividend Yield: 3.7%

Taiwan Secom's dividend payments have been reliable and stable over the past decade, with consistent growth. However, the current 3.7% yield is lower than Taiwan's top quartile payers at 4.43%. The payout ratio of 83.8% suggests coverage by earnings, yet a high cash payout ratio of 123% indicates insufficient free cash flow support. Recent earnings showed improvement with net income reaching TWD 788.96 million for Q2 2024, reflecting solid financial performance amidst these challenges.

- Click here to discover the nuances of Taiwan Secom with our detailed analytical dividend report.

- Our valuation report here indicates Taiwan Secom may be overvalued.

Turning Ideas Into Actions

- Embark on your investment journey to our 2012 Top Dividend Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3413

Foxsemicon Integrated Technology

Engages in the research, development, design, manufacturing, and sale of semiconductor equipment subsystems and system integration in Taiwan, the United States, China, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives