- Taiwan

- /

- Semiconductors

- /

- TWSE:3014

Undiscovered Gems With Potential To Watch In December 2024

Reviewed by Simply Wall St

As global markets continue to reach new heights, with small-cap indices like the Russell 2000 hitting record levels, investor sentiment remains buoyant despite geopolitical uncertainties and tariff concerns. Amid this backdrop of robust market activity, identifying stocks that possess strong fundamentals and resilience in fluctuating economic conditions can be key for those looking to uncover potential opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Saha-Union | 0.48% | -1.12% | 8.28% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Thai Steel Cable | NA | 2.46% | 16.55% | ★★★★★★ |

| Indofood Agri Resources | 34.58% | 4.29% | 50.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

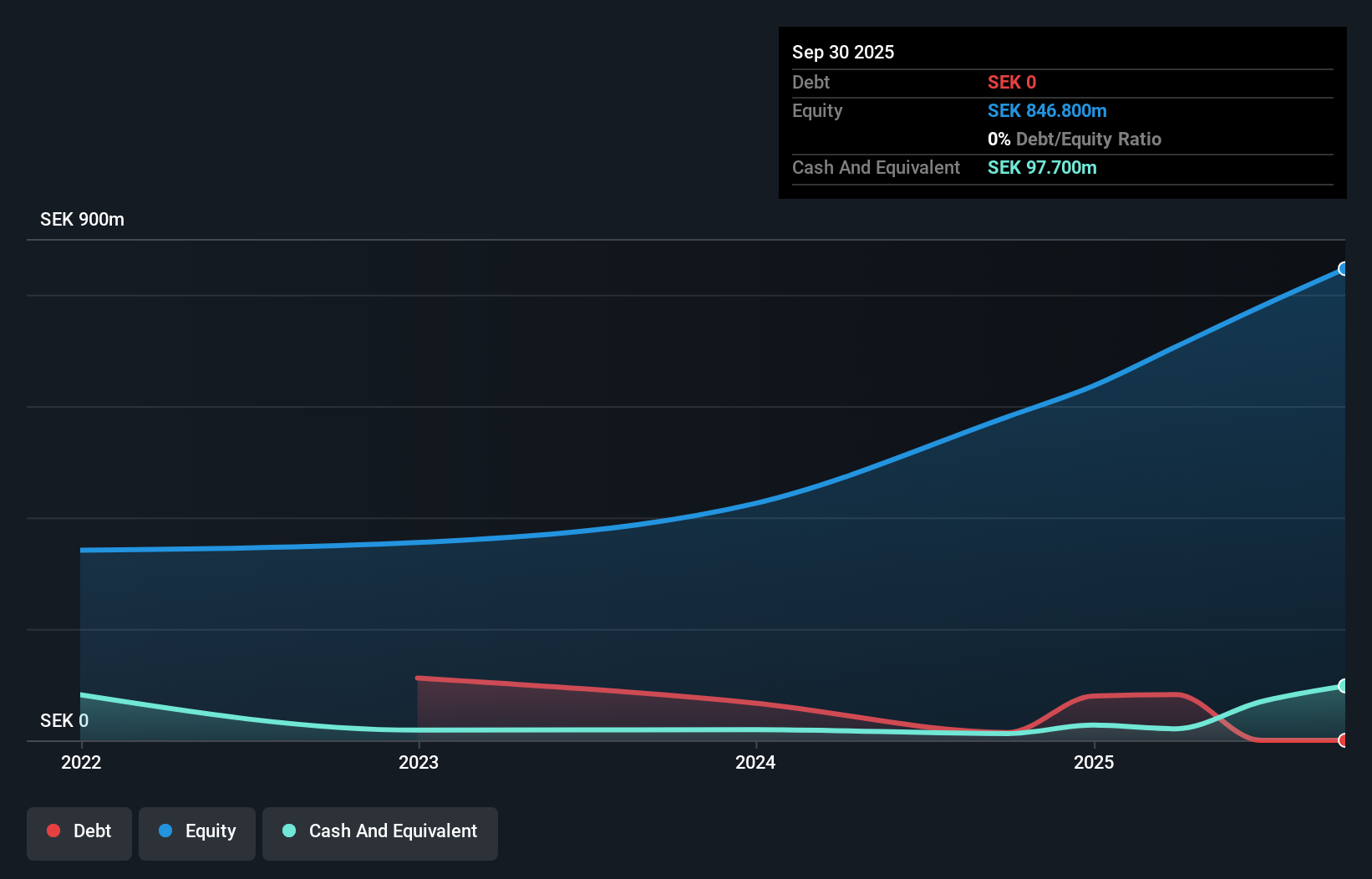

Apotea (OM:APOTEA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Apotea AB (publ) operates as an online pharmacy in Sweden with a market capitalization of approximately SEK5.93 billion.

Operations: Apotea AB generates revenue primarily through its online retail operations, with sales amounting to SEK6.30 billion.

Apotea, a burgeoning player in the consumer retailing sector, showcases impressive financial health with earnings growth of 174.5% over the past year, outpacing the industry average of 8.3%. The company's interest payments are comfortably covered by EBIT at an 88.3x ratio, indicating strong financial management. Despite its illiquid shares and satisfactory net debt to equity ratio of 0.3%, Apotea is trading at a significant discount—61.5% below estimated fair value—making it an intriguing prospect for investors seeking undervalued opportunities in this space. Recently filing for an IPO suggests potential future growth and market expansion opportunities.

- Dive into the specifics of Apotea here with our thorough health report.

Assess Apotea's past performance with our detailed historical performance reports.

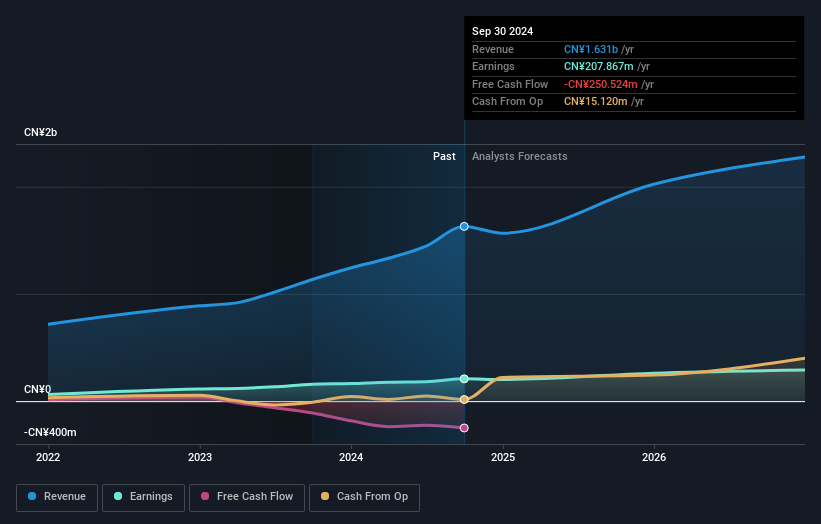

Hwaway Technology (SZSE:001380)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hwaway Technology Corporation Limited specializes in the research, development, production, and sale of springs both in China and internationally, with a market cap of CN¥4.33 billion.

Operations: Hwaway Technology generates revenue primarily from the sale of springs. The company's focus on research and development supports its production capabilities, impacting its cost structure. Notably, the net profit margin has shown variability over recent periods.

Hwaway Technology has been making waves with its impressive financial performance. For the nine months ended September 2024, sales reached CNY 1.23 billion, a significant rise from CNY 846.13 million the previous year. Net income also climbed to CNY 153.49 million from CNY 109.7 million, showcasing robust growth in earnings by 31.8%, outpacing the overall Machinery industry which saw a -0.4% change last year. The company's price-to-earnings ratio of 20.8x is notably lower than the CN market average of 36.1x, suggesting potential undervaluation and attractiveness for investors seeking value opportunities in emerging firms within this sector.

- Get an in-depth perspective on Hwaway Technology's performance by reading our health report here.

Gain insights into Hwaway Technology's past trends and performance with our Past report.

ITE Tech (TWSE:3014)

Simply Wall St Value Rating: ★★★★★★

Overview: ITE Tech. Inc is a fabless IC design company that offers I/O, keyboard, and embedded controller technology products both in Taiwan and internationally, with a market capitalization of approximately NT$24.74 billion.

Operations: ITE Tech generates revenue primarily from its integrated circuits segment, amounting to NT$6.44 billion. The company's market capitalization is approximately NT$24.74 billion.

ITE Tech, a nimble player in the semiconductor space, showcases a solid performance with earnings growth of 11.9% over the past year, outpacing the industry average of 5.9%. With no debt on its books for five years, financial stability is evident and interest coverage isn't an issue. Its price-to-earnings ratio stands at 15x, offering good value compared to Taiwan's market average of 21x. Recent quarterly sales hit TWD 1.86 billion while net income reached TWD 495 million, reflecting consistent profitability despite shareholder dilution in the last year. High-quality earnings further bolster its investment appeal amidst executive changes ahead.

- Take a closer look at ITE Tech's potential here in our health report.

Review our historical performance report to gain insights into ITE Tech's's past performance.

Where To Now?

- Embark on your investment journey to our 4633 Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3014

ITE Tech

A fabless IC design company, provides I/O, keyboard, and embedded controller technology products in Taiwan and internationally.

Flawless balance sheet average dividend payer.