Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative Among 3 Top Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate the complexities of rising inflation and fluctuating interest rates, U.S. stock indexes are nearing record highs, buoyed by growth stocks and strategic policy decisions. In this dynamic environment, dividend stocks like Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative offer investors a potential avenue for steady income streams, especially when market volatility is top of mind.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.92% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.33% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.97% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

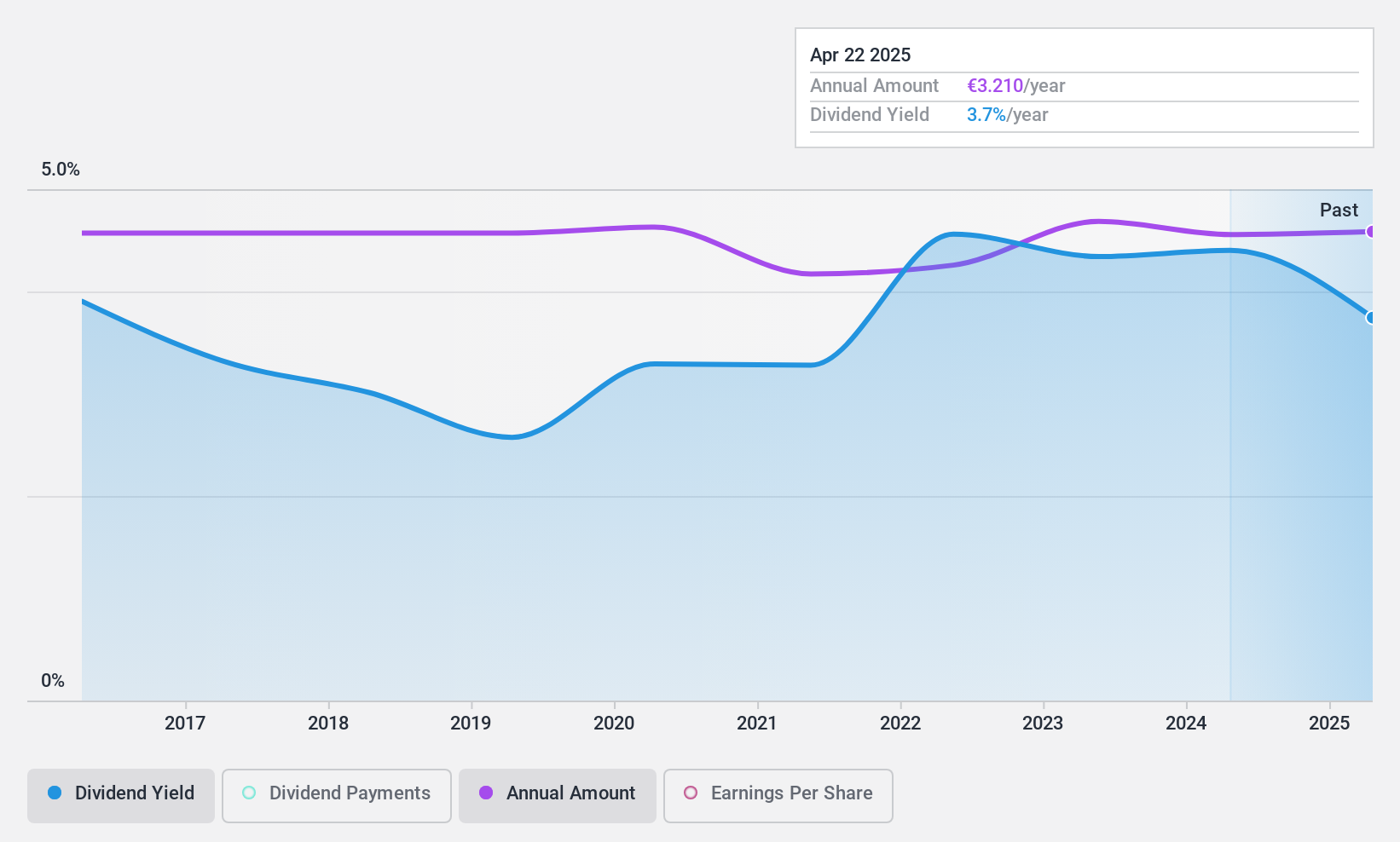

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative (ENXTPA:CRTO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative offers a range of banking products and services in France, with a market cap of €548.38 million.

Operations: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative generates revenue primarily from its Proximity Bank segment, which accounts for €254.46 million, and Management for Own Account and Miscellaneous activities, contributing €94.09 million.

Dividend Yield: 3.6%

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative offers a stable and reliable dividend, having consistently increased payments over the past decade. Although its 3.65% yield is below the top tier in France, dividends are well-covered by earnings with a low payout ratio of 17.9%. The stock trades at 42.6% below estimated fair value, suggesting potential for appreciation despite insufficient data on future dividend coverage.

- Dive into the specifics of Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative is trading behind its estimated value.

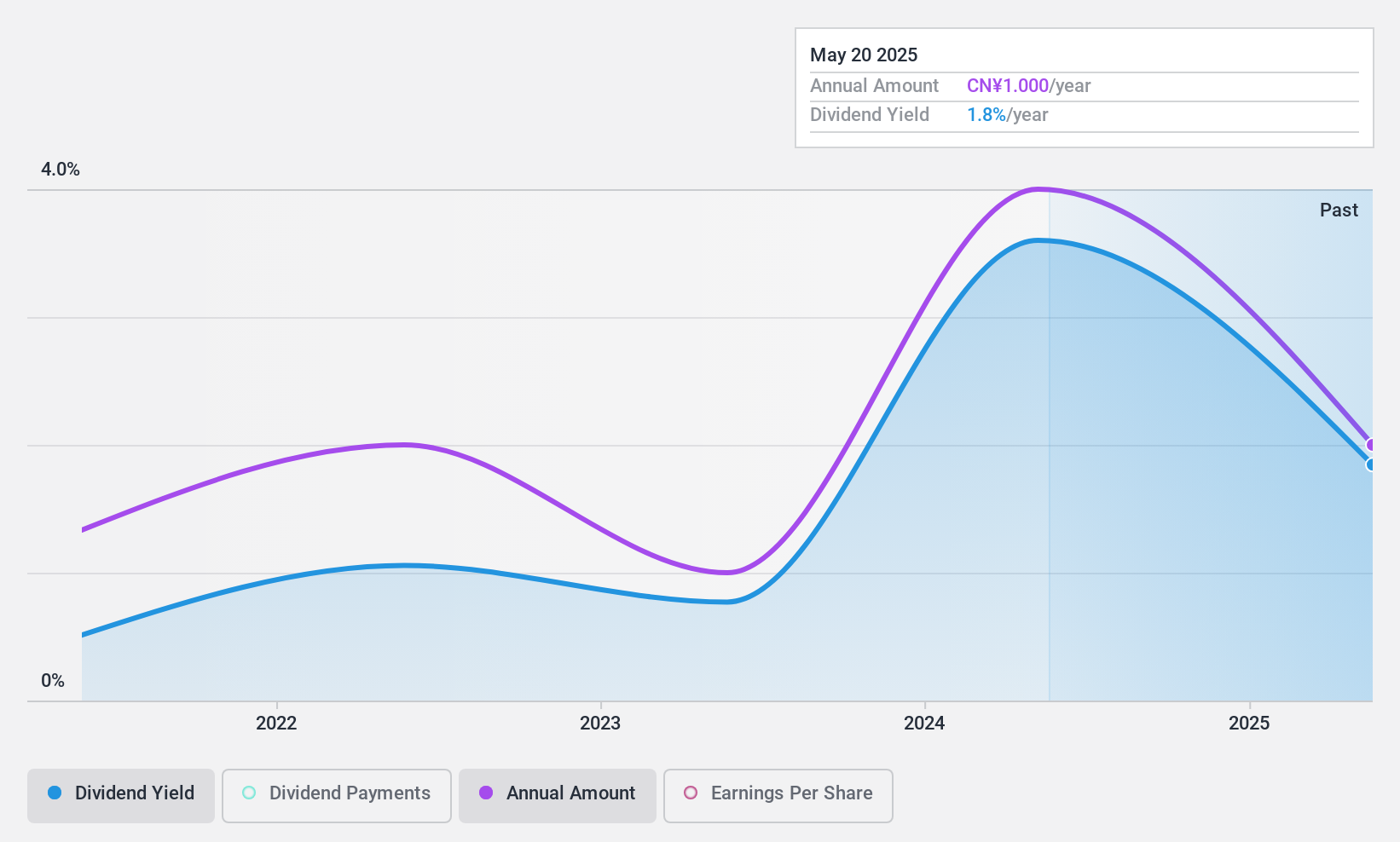

Chengdu Kanghua Biological Products (SZSE:300841)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chengdu Kanghua Biological Products Co., Ltd. (SZSE:300841) is a company engaged in the development, production, and sale of biological products with a market cap of CN¥7.21 billion.

Operations: Chengdu Kanghua Biological Products Co., Ltd. does not have any specified revenue segments in the provided text.

Dividend Yield: 3.6%

Chengdu Kanghua Biological Products presents a mixed picture for dividend investors. Its 3.56% yield is among the top in China, supported by a payout ratio of 48.6%, indicating dividends are well-covered by earnings. However, with only four years of payments and volatility including annual drops over 20%, its track record remains unstable. Despite trading at a significant discount to fair value, the sustainability of its dividend growth is uncertain given its brief history.

- Click to explore a detailed breakdown of our findings in Chengdu Kanghua Biological Products' dividend report.

- Upon reviewing our latest valuation report, Chengdu Kanghua Biological Products' share price might be too pessimistic.

ITE Tech (TWSE:3014)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ITE Tech Inc, a fabless IC design company, specializes in I/O, keyboard, and embedded controller technology products for both Taiwan and international markets, with a market cap of NT$25.82 billion.

Operations: ITE Tech Inc generates its revenue primarily from Integrated Circuits, amounting to NT$6.44 billion.

Dividend Yield: 5.1%

ITE Tech's dividend yield of 5.14% ranks in the top 25% in Taiwan but is not well-supported by cash flows, with a high cash payout ratio of 106.9%. Despite a favorable P/E ratio of 15.8x compared to the market's 21.3x, dividends have been volatile and unreliable over the past decade, with payments not fully covered by earnings or free cash flow despite recent earnings growth of 11.9%.

- Delve into the full analysis dividend report here for a deeper understanding of ITE Tech.

- In light of our recent valuation report, it seems possible that ITE Tech is trading beyond its estimated value.

Summing It All Up

- Discover the full array of 1970 Top Dividend Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CRTO

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative

Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative provides various banking products and services in France.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives