- Thailand

- /

- Auto Components

- /

- SET:STA

Insider-Favored Growth Companies Including Sri Trang Agro-Industry

Reviewed by Simply Wall St

Amid recent market fluctuations driven by tariff uncertainties and mixed economic indicators, investors are increasingly focused on identifying growth opportunities that may offer resilience in a volatile environment. Companies with high insider ownership often signal confidence from those with intimate knowledge of the business, making them attractive candidates for investors seeking to navigate these challenging conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Pharma Mar (BME:PHM) | 11.9% | 44.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Let's explore several standout options from the results in the screener.

Sri Trang Agro-Industry (SET:STA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sri Trang Agro-Industry Public Company Limited, along with its subsidiaries, operates in the manufacturing and distribution of natural rubber products across Thailand, China, the United States, Singapore, Japan and internationally with a market cap of approximately THB22.43 billion.

Operations: The company's revenue segments include Gloves at THB23.30 billion and Natural Rubbers at THB86.85 billion.

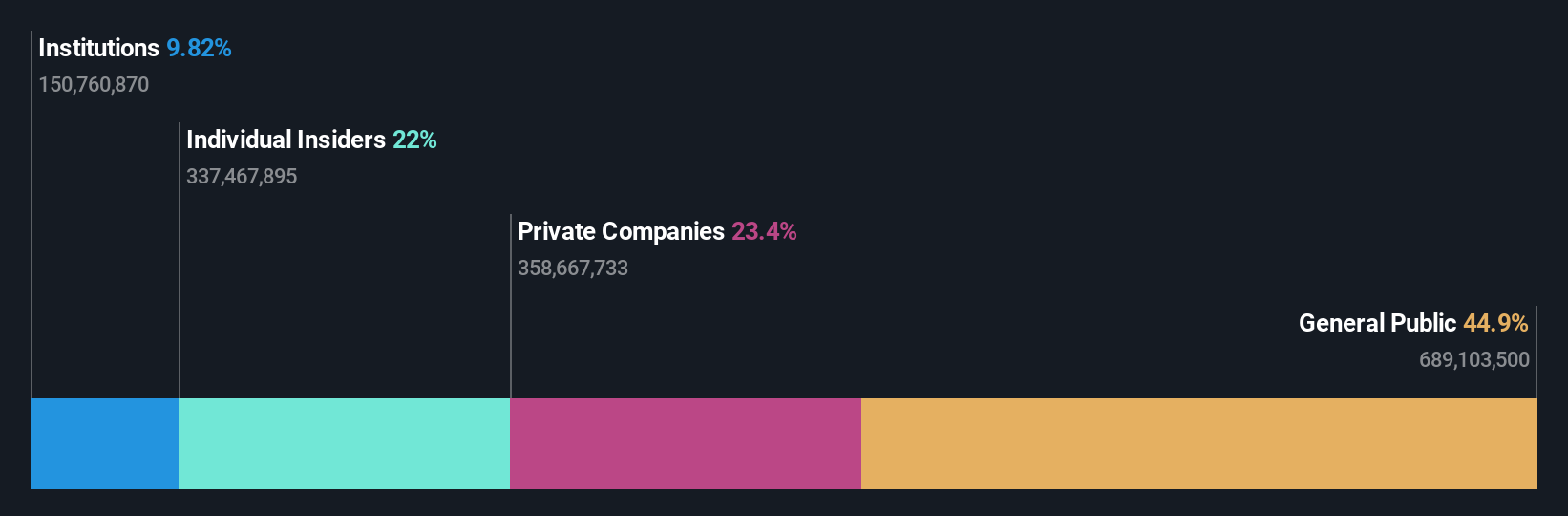

Insider Ownership: 21.6%

Revenue Growth Forecast: 11.8% p.a.

Sri Trang Agro-Industry is experiencing significant earnings growth, forecasted at 58.1% annually, outpacing the Thai market's 16.4%. However, revenue growth of 11.8% remains below the desired 20%, and profit margins have declined from last year. The recent fixed-income offering with debentures due in 2028 may impact financial flexibility. Insider trading data is limited for the past three months, and dividends are not well covered by earnings or cash flow.

- Click here and access our complete growth analysis report to understand the dynamics of Sri Trang Agro-Industry.

- Our valuation report here indicates Sri Trang Agro-Industry may be overvalued.

GENDA (TSE:9166)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GENDA Inc. operates amusement arcades primarily under the GiGO brand in Japan, with a market cap of ¥226.31 billion.

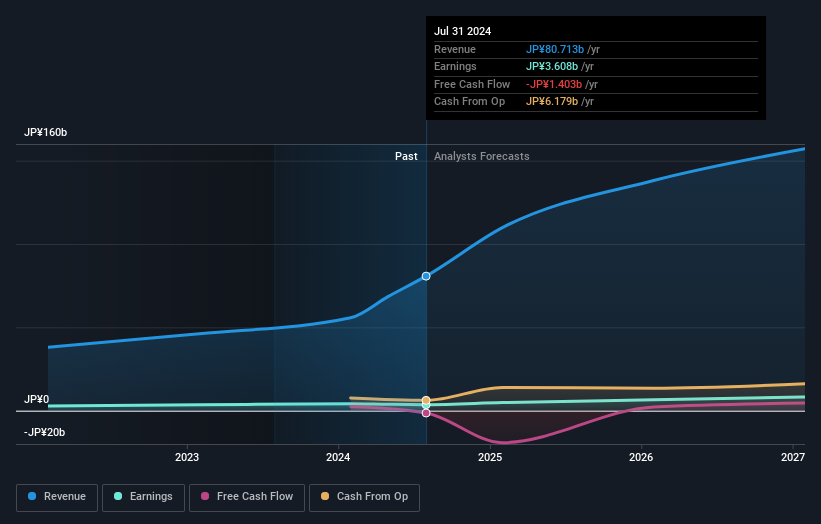

Operations: The company's revenue is derived from two main segments: Entertainment Content, contributing ¥12.28 billion, and Entertainment Platform, generating ¥85.01 billion.

Insider Ownership: 21.4%

Revenue Growth Forecast: 11.8% p.a.

GENDA is forecasted to achieve significant earnings growth of 20.6% annually, surpassing the JP market's 7.7%, while revenue is expected to grow at 11.8% per year, faster than the market average but below a high-growth threshold. Despite strong growth prospects, profit margins have halved over the past year and debt coverage by operating cash flow remains inadequate. Insider trading data for recent months is unavailable, and share price volatility has been high recently.

- Click to explore a detailed breakdown of our findings in GENDA's earnings growth report.

- Our comprehensive valuation report raises the possibility that GENDA is priced higher than what may be justified by its financials.

Panjit International (TWSE:2481)

Simply Wall St Growth Rating: ★★★★☆☆

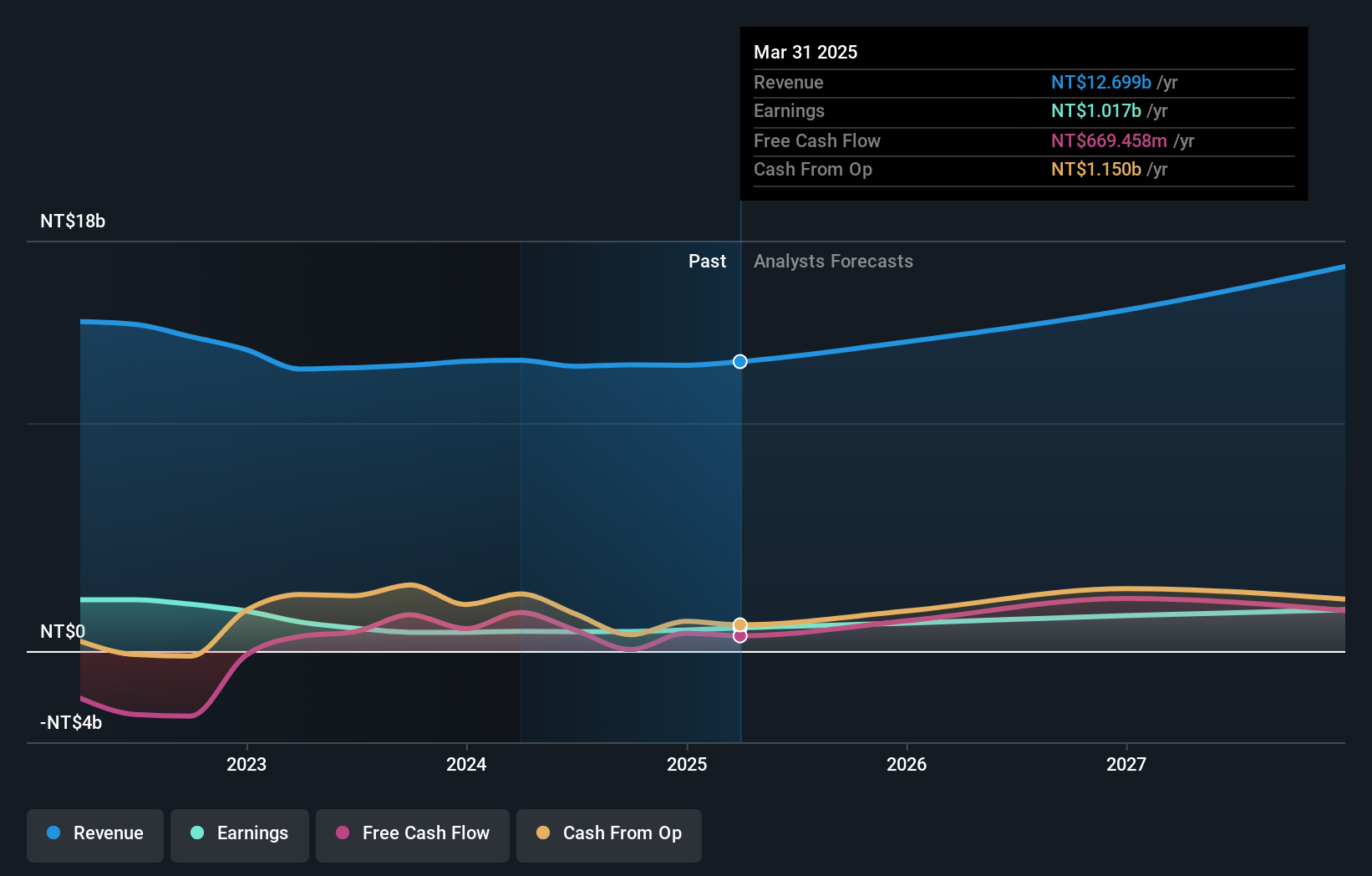

Overview: Panjit International Inc. is involved in the manufacturing, processing, assembling, importing, and exporting of semiconductors across various countries including Taiwan, China, Korea, the United States, Japan, Germany, and Italy with a market cap of NT$18.70 billion.

Operations: The company's revenue is primarily derived from Power Split Components at NT$11.40 billion, followed by Power Integrated Circuits and Components at NT$943.64 million, and Solar at NT$220.88 million.

Insider Ownership: 10.1%

Revenue Growth Forecast: 13.2% p.a.

Panjit International's earnings are projected to grow significantly at 30.3% annually, outpacing the Taiwan market's 17.8%. Revenue growth is also expected to exceed the market average, though not at a high-growth rate. The price-to-earnings ratio of 22.7x suggests better value compared to industry peers. However, dividend sustainability is questionable as it isn't well covered by free cash flows, and insider trading data for recent months is unavailable.

- Get an in-depth perspective on Panjit International's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Panjit International's shares may be trading at a premium.

Seize The Opportunity

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1448 more companies for you to explore.Click here to unveil our expertly curated list of 1451 Fast Growing Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:STA

Sri Trang Agro-Industry

Manufactures and distributes natural rubber products in Thailand, China, the United States, Japan, Korea, India, Germany, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion