- Taiwan

- /

- Semiconductors

- /

- TWSE:2454

A Piece Of The Puzzle Missing From MediaTek Inc.'s (TWSE:2454) 27% Share Price Climb

MediaTek Inc. (TWSE:2454) shareholders have had their patience rewarded with a 27% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 55% in the last year.

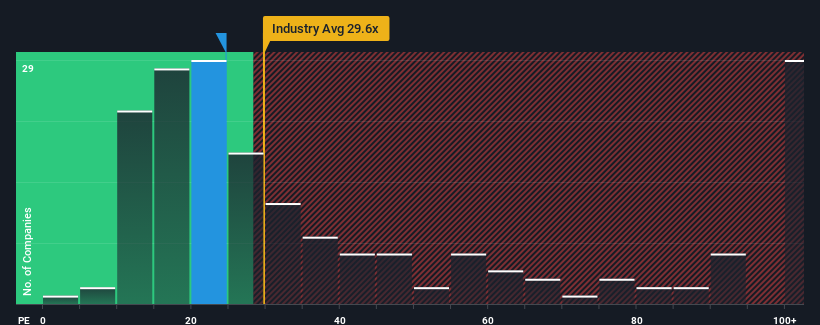

Although its price has surged higher, it's still not a stretch to say that MediaTek's price-to-earnings (or "P/E") ratio of 24.6x right now seems quite "middle-of-the-road" compared to the market in Taiwan, where the median P/E ratio is around 22x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

MediaTek has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for MediaTek

How Is MediaTek's Growth Trending?

The only time you'd be comfortable seeing a P/E like MediaTek's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 35%. Still, the latest three year period has seen an excellent 86% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 16% per annum during the coming three years according to the analysts following the company. With the market only predicted to deliver 13% per year, the company is positioned for a stronger earnings result.

With this information, we find it interesting that MediaTek is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On MediaTek's P/E

MediaTek's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that MediaTek currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Having said that, be aware MediaTek is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on MediaTek, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2454

MediaTek

Engages in the research, development, production, manufacture, and marketing of multimedia integrated circuits (ICs) in Taiwan, rest of Asia, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.