- Taiwan

- /

- Semiconductors

- /

- TWSE:2393

Discovering Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets navigate the complexities of cautious Federal Reserve commentary and looming government shutdowns, smaller-cap indexes have faced notable challenges, with broad-based declines impacting investor sentiment. In this environment, identifying promising small-cap stocks requires a keen eye for companies that can demonstrate resilience and potential growth amidst economic uncertainty.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Namuga | 14.66% | -1.45% | 33.57% | ★★★★★★ |

| Bharat Rasayan | 5.93% | -0.27% | -7.65% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Likhami Consulting | NA | 1.68% | -12.74% | ★★★★★★ |

| TechNVision Ventures | 14.35% | 20.69% | 63.60% | ★★★★★☆ |

| Abans Holdings | 94.08% | 16.32% | 18.24% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Gulf Medical Projects Company (PJSC) (ADX:GMPC)

Simply Wall St Value Rating: ★★★★★★

Overview: Gulf Medical Projects Company (PJSC) operates hospitals in the United Arab Emirates and has a market capitalization of AED1.43 billion.

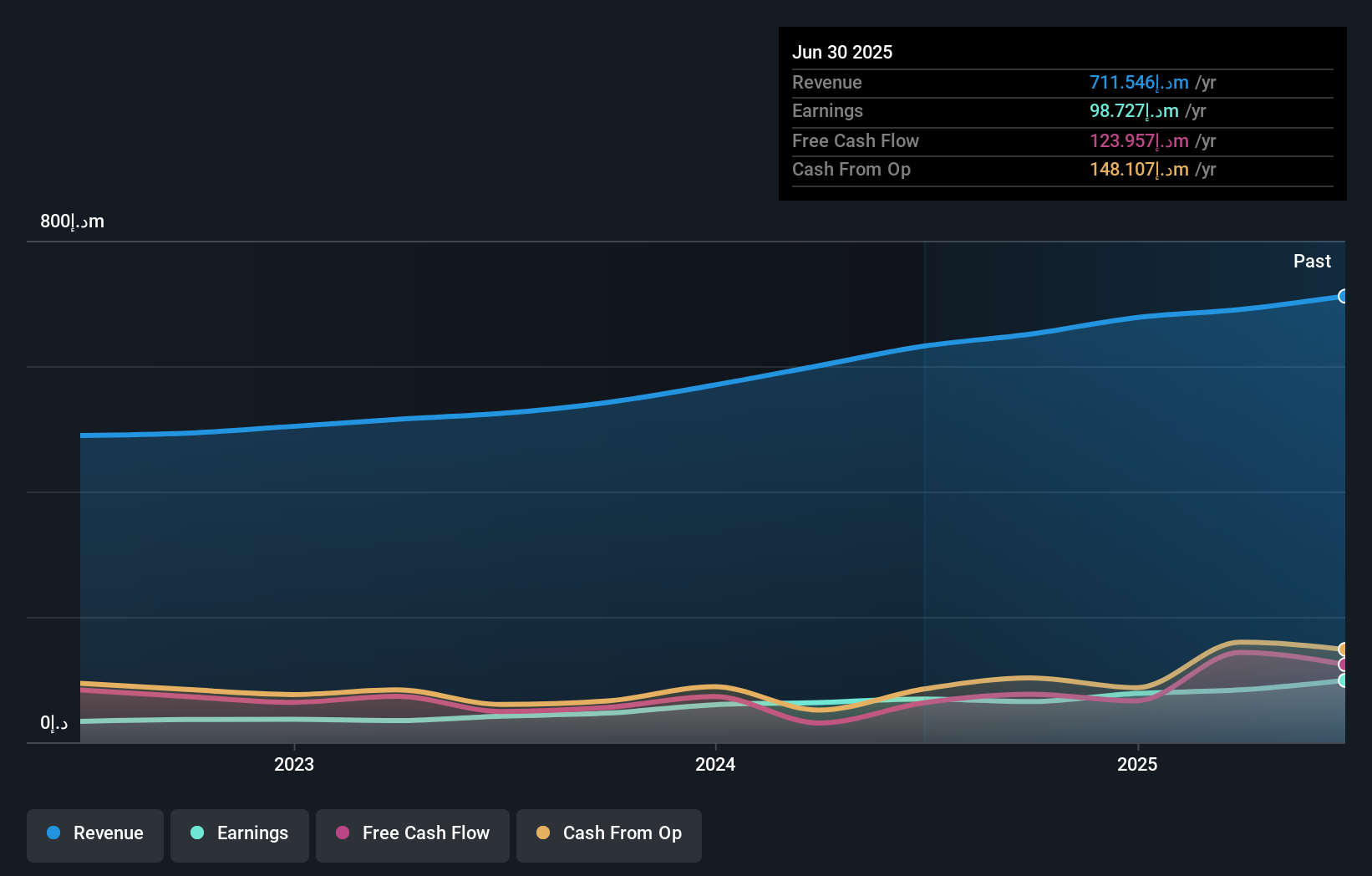

Operations: Gulf Medical Projects Company (PJSC) generates revenue primarily from its health services, accounting for AED650.98 million, while investments contribute AED19.03 million.

Gulf Medical Projects Company, a small player in the healthcare sector, has shown a mixed bag of financial results. Recently, its earnings grew by 39.7%, surpassing industry growth of 7.6%, yet it reported a net income drop to AED 8.06 million for Q3 from AED 12.06 million last year, highlighting some volatility. Despite this, the company is debt-free now compared to five years ago when its debt-to-equity ratio was at 8.9%. Trading at a significant discount of 39% below estimated fair value and maintaining positive free cash flow suggests potential for value-seeking investors despite recent earnings challenges.

Japan Lifeline (TSE:7575)

Simply Wall St Value Rating: ★★★★★★

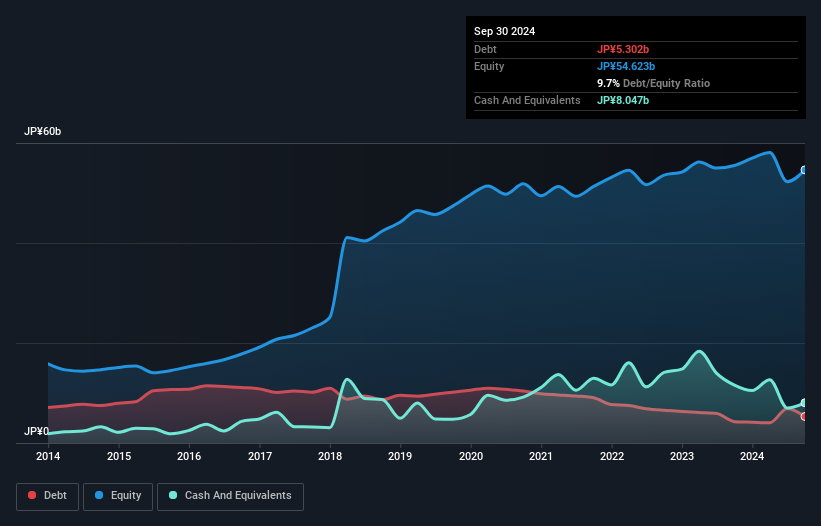

Overview: Japan Lifeline Co., Ltd. is a medical device company that develops, produces, imports, distributes, and trades cardiovascular-related medical devices in Japan with a market cap of ¥96.53 billion.

Operations: The company generates revenue primarily from the manufacture and sale of medical devices, amounting to ¥54.24 billion.

In the realm of medical equipment, Japan Lifeline stands out with a promising profile. It's trading at 43.9% below its estimated fair value, suggesting potential for investors seeking undervalued opportunities. Over the past year, earnings grew by 9.6%, outpacing the industry average of 5.6%, and it boasts high-quality earnings alongside positive free cash flow. The company's debt-to-equity ratio has improved from 21.4% to 9.7% over five years, indicating prudent financial management with more cash than total debt on hand. Recent developments include a dividend increase to JPY 46 per share and an exclusive distribution deal with Terumo Corporation for a liver cancer treatment system, highlighting strategic growth initiatives in its operations.

- Take a closer look at Japan Lifeline's potential here in our health report.

Understand Japan Lifeline's track record by examining our Past report.

Everlight Electronics (TWSE:2393)

Simply Wall St Value Rating: ★★★★★★

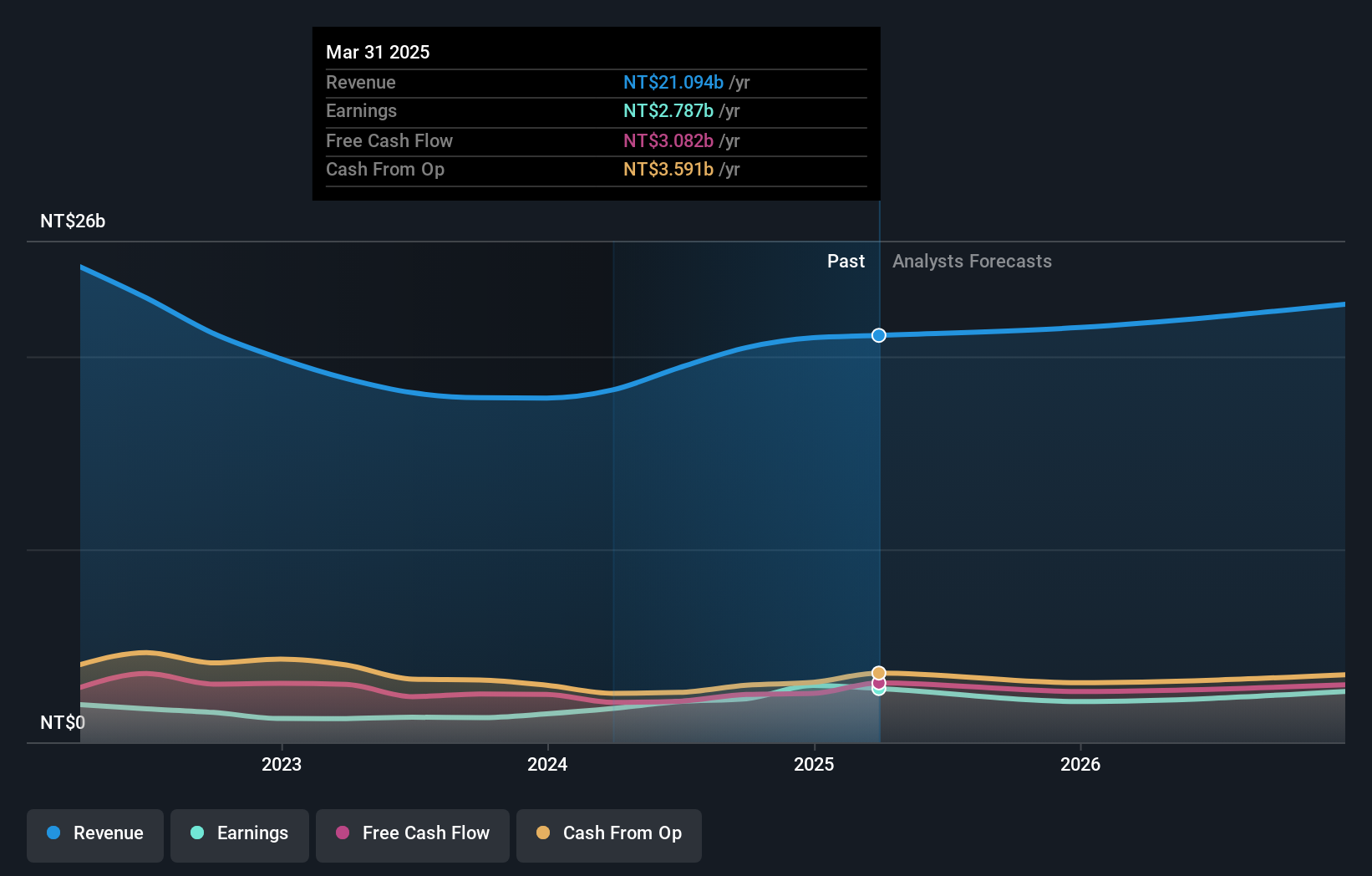

Overview: Everlight Electronics Co., Ltd. is involved in the manufacture and sale of light-emitting diodes (LEDs) across Taiwan, other parts of Asia, the United States, and globally, with a market capitalization of approximately NT$35.21 billion.

Operations: Everlight Electronics generates revenue primarily from its LED sector, contributing NT$19.02 billion, followed by the lighting segment at NT$787.06 million and the LCD sector at NT$567.83 million.

Everlight Electronics, a promising player in the semiconductor industry, has shown robust performance with earnings growth of 76.5% over the past year, outpacing the industry's 5.9%. The recent quarter saw sales hit TWD 5.56 billion and net income rise to TWD 554.73 million from TWD 404.89 million a year ago, reflecting strong operational execution. Trading at approximately 29% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities. With a reduced debt-to-equity ratio from 23.9% to just 3.8% over five years and more cash than total debt, Everlight appears financially stable and well-positioned for future growth prospects.

- Dive into the specifics of Everlight Electronics here with our thorough health report.

Explore historical data to track Everlight Electronics' performance over time in our Past section.

Next Steps

- Access the full spectrum of 4622 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Everlight Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2393

Everlight Electronics

Engages in the manufacture and sale of light-emitting diode (LED) in Taiwan, rest of Asia, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.