- Taiwan

- /

- Semiconductors

- /

- TPEX:3188

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are eyeing dividend stocks as a potential source of stability amidst the volatility. With U.S. stocks experiencing broad-based declines and concerns about future interest rate cuts, selecting dividend-paying stocks can offer a steady income stream while potentially mitigating some market risks.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.77% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.72% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1953 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

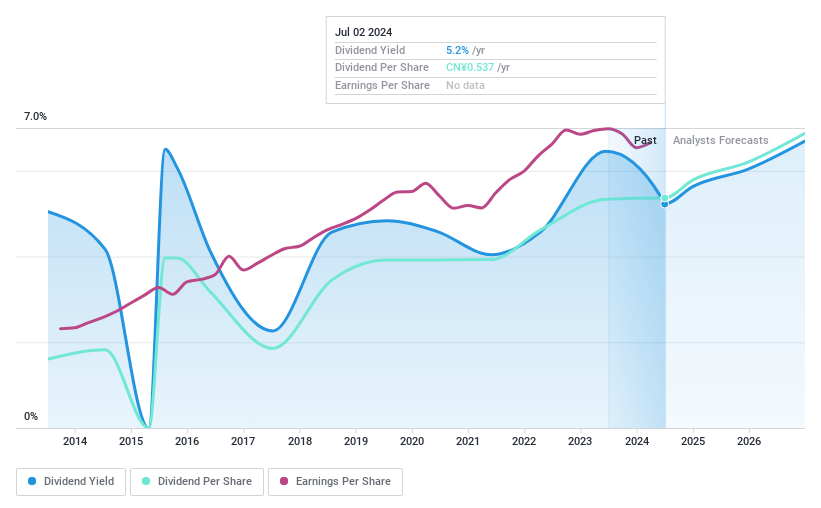

Bank of Nanjing (SHSE:601009)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Nanjing Co., Ltd. offers a range of financial products and services in China with a market cap of CN¥115.04 billion.

Operations: Bank of Nanjing Co., Ltd. generates revenue through its diverse financial offerings and services within China.

Dividend Yield: 6.4%

Bank of Nanjing's dividend yield ranks in the top 25% of the Chinese market, supported by a moderate payout ratio of 48.7%, suggesting dividends are well covered by earnings. However, its dividend history is marked by volatility and unreliability over the past decade. Recent inclusion in the Shanghai Stock Exchange 180 Value Index highlights its market relevance. Earnings have shown consistent growth, with Q3 net income rising to C¥5.07 billion from C¥4.60 billion year-on-year.

- Navigate through the intricacies of Bank of Nanjing with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Bank of Nanjing is trading beyond its estimated value.

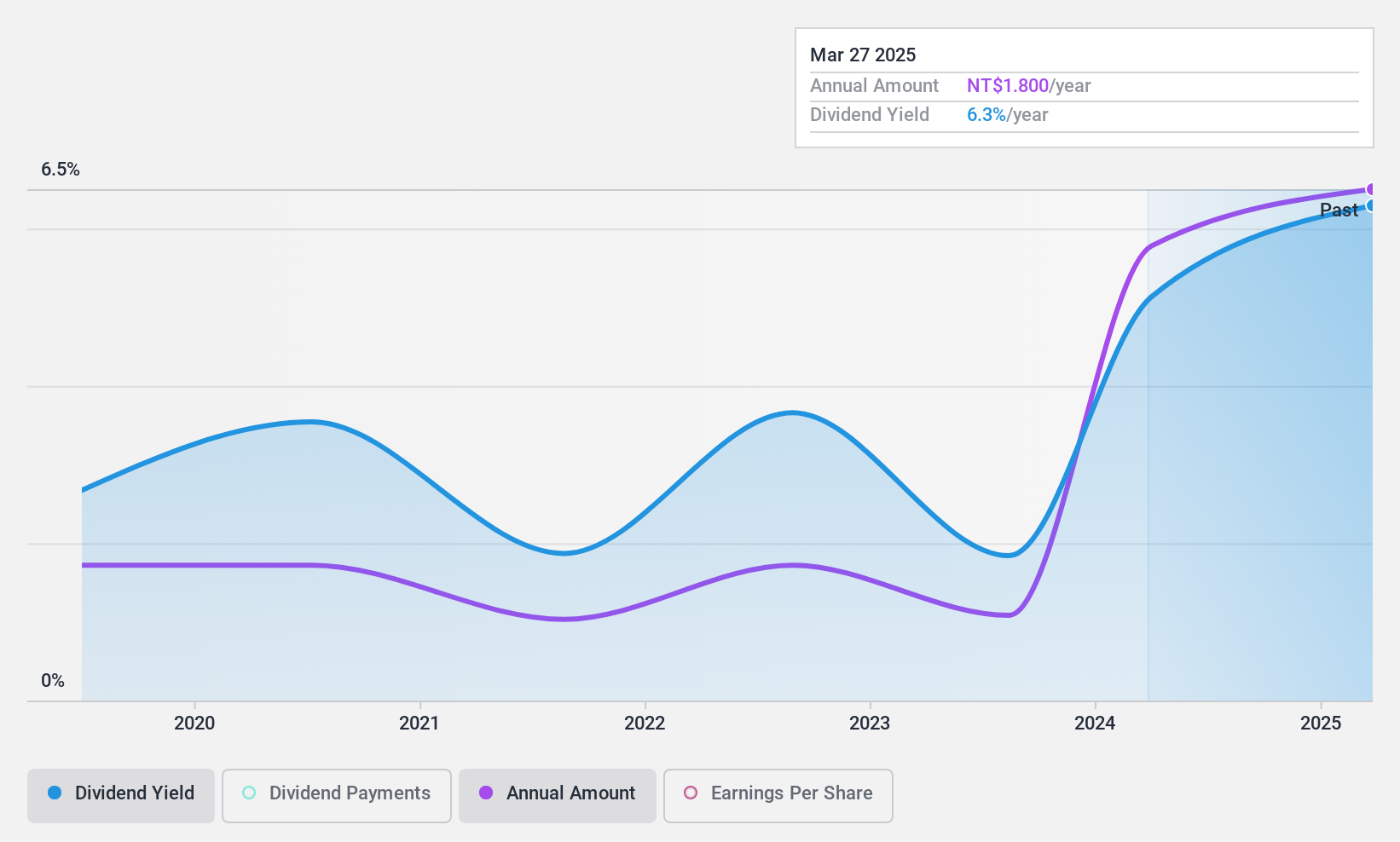

Golden Long Teng Development (TPEX:3188)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Golden Long Teng Development Co., Ltd. is involved in the development, sale, and lease of residential and commercial buildings with a market cap of NT$5.11 billion.

Operations: Golden Long Teng Development Co., Ltd. generates its revenue primarily from Construction and Development, amounting to NT$3.05 billion.

Dividend Yield: 5.7%

Golden Long Teng Development's dividend yield is among the top 25% in Taiwan, supported by a modest payout ratio of 41.2%, indicating dividends are well covered by earnings. Despite this, its dividend history over six years has been volatile and unreliable. Recent financials show significant growth, with Q3 sales at TWD 406.76 million and net income rising to TWD 137.79 million year-on-year, suggesting improved profitability but not necessarily stable dividends.

- Unlock comprehensive insights into our analysis of Golden Long Teng Development stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Golden Long Teng Development shares in the market.

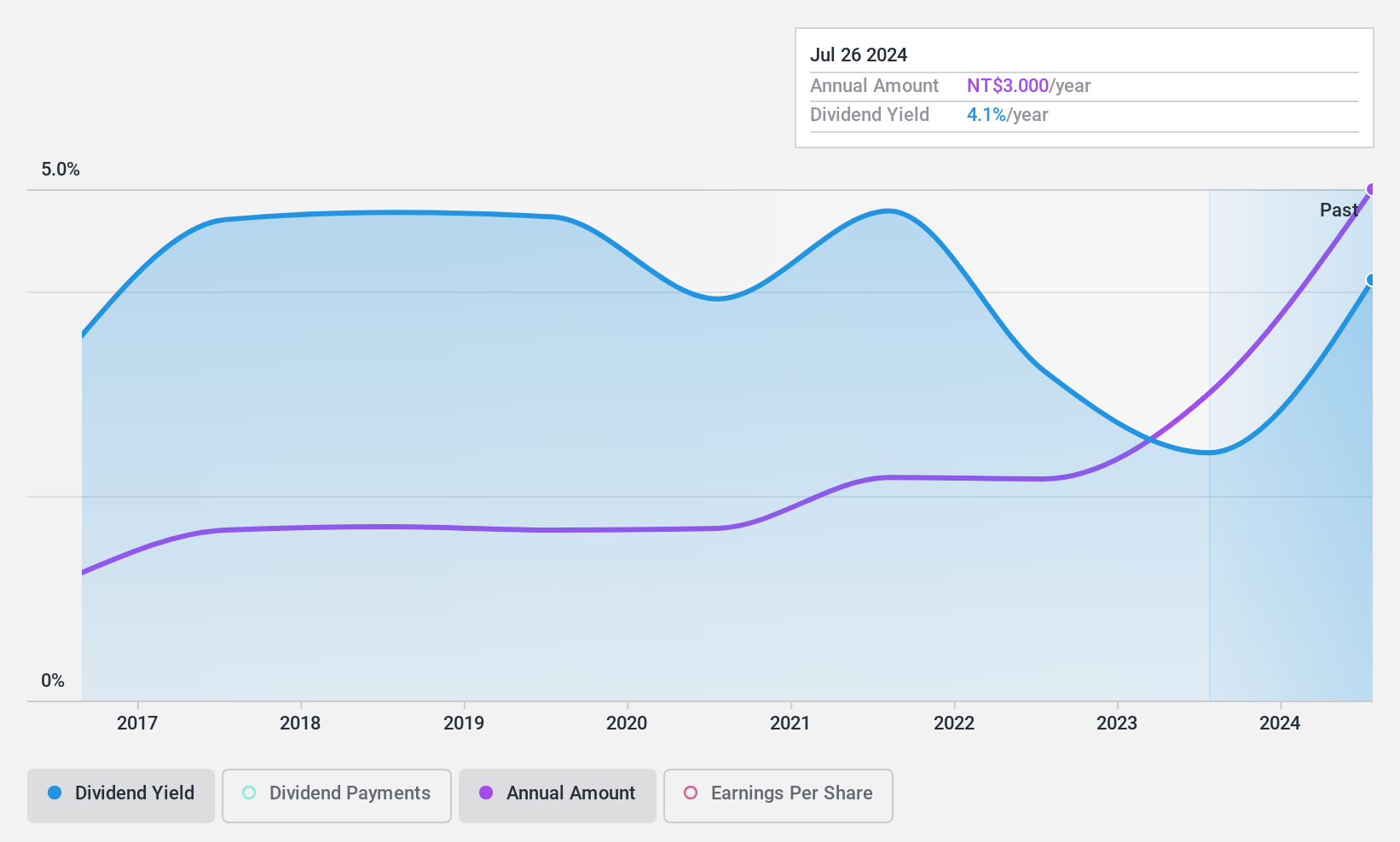

Sanyang Motor (TWSE:2206)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sanyang Motor Co., Ltd. is engaged in the manufacturing and sale of automobiles, locomotives, and their parts across Taiwan, China, Asia, Europe, and other international markets with a market cap of NT$55.21 billion.

Operations: Sanyang Motor Co., Ltd. generates revenue from two main segments: the Foreign Sector, contributing NT$14.79 billion, and the Domestic Sector, which brings in NT$57.37 billion.

Dividend Yield: 4.3%

Sanyang Motor's dividend yield is slightly below Taiwan's top 25% dividend payers, with a payout ratio of 46.4%, indicating coverage by earnings. However, dividends have been volatile over the past decade, lacking reliability. Despite a cash payout ratio of 77.2%, dividends remain covered by cash flows. Recent financials show a decline in Q3 net income to TWD 1,050.73 million from TWD 1,268.52 million year-on-year, highlighting potential challenges in sustaining dividends amidst fluctuating earnings and high debt levels.

- Click to explore a detailed breakdown of our findings in Sanyang Motor's dividend report.

- The valuation report we've compiled suggests that Sanyang Motor's current price could be inflated.

Make It Happen

- Reveal the 1953 hidden gems among our Top Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3188

Golden Long Teng Development

Engages in the development, sale, and lease of residential and buildings.

Solid track record, good value and pays a dividend.