- Taiwan

- /

- Construction

- /

- TWSE:2597

Exploring December 2024's Hidden Gems With Promising Potential

Reviewed by Simply Wall St

In December 2024, global markets are navigating a complex landscape marked by the Federal Reserve's cautious rate cuts and political uncertainties such as the looming U.S. government shutdown. Amid these challenges, smaller-cap indexes have been hit particularly hard, underscoring the importance of identifying resilient stocks that can thrive in volatile conditions. In this environment, finding promising investment opportunities often involves looking at companies with strong fundamentals and innovative growth strategies that can weather economic fluctuations and capitalize on market shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Namuga | 14.66% | -1.45% | 33.57% | ★★★★★★ |

| Bharat Rasayan | 5.93% | -0.27% | -7.65% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Likhami Consulting | NA | 1.68% | -12.74% | ★★★★★★ |

| TechNVision Ventures | 14.35% | 20.69% | 63.60% | ★★★★★☆ |

| Abans Holdings | 94.08% | 16.32% | 18.24% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Zhejiang Tengen ElectricsLtd (SHSE:605066)

Simply Wall St Value Rating: ★★★★★★

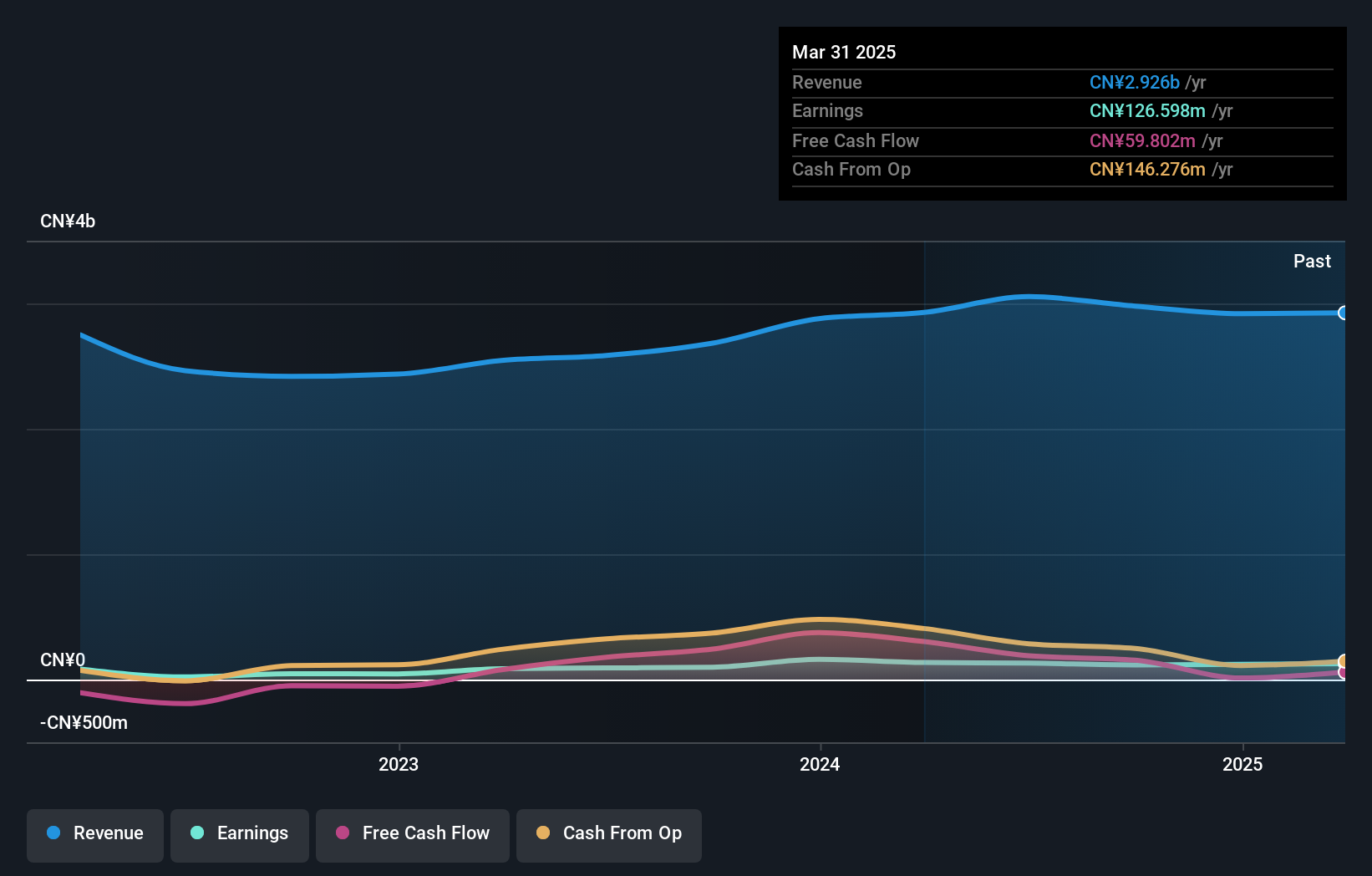

Overview: Zhejiang Tengen Electrics Co., Ltd. specializes in the manufacturing and sale of industrial electrical products in China, with a market capitalization of CN¥2.99 billion.

Operations: Tengen Electrics generates revenue primarily from the sale of industrial electrical products in China. The company's financial performance is highlighted by a net profit margin of 10.5%, indicating its profitability relative to total revenue.

Zhejiang Tengen Electrics, a nimble player in the electrical industry, showcases an intriguing profile with its recent earnings growth of 18.4%, outpacing the industry's 1.1%. The company is debt-free, a significant improvement from five years ago when its debt-to-equity ratio was 20.9%. Despite this progress, earnings have seen a yearly drop of 22.3% over five years. Recent reports reveal sales rising to ¥2.20 billion from ¥2.10 billion last year, though net income slipped to ¥103.85 million from ¥148.55 million previously noted figures suggest robust free cash flow and high-quality earnings support potential future resilience amidst fluctuating profits.

Jiangsu HHCK Advanced MaterialsLtd (SHSE:688535)

Simply Wall St Value Rating: ★★★★★★

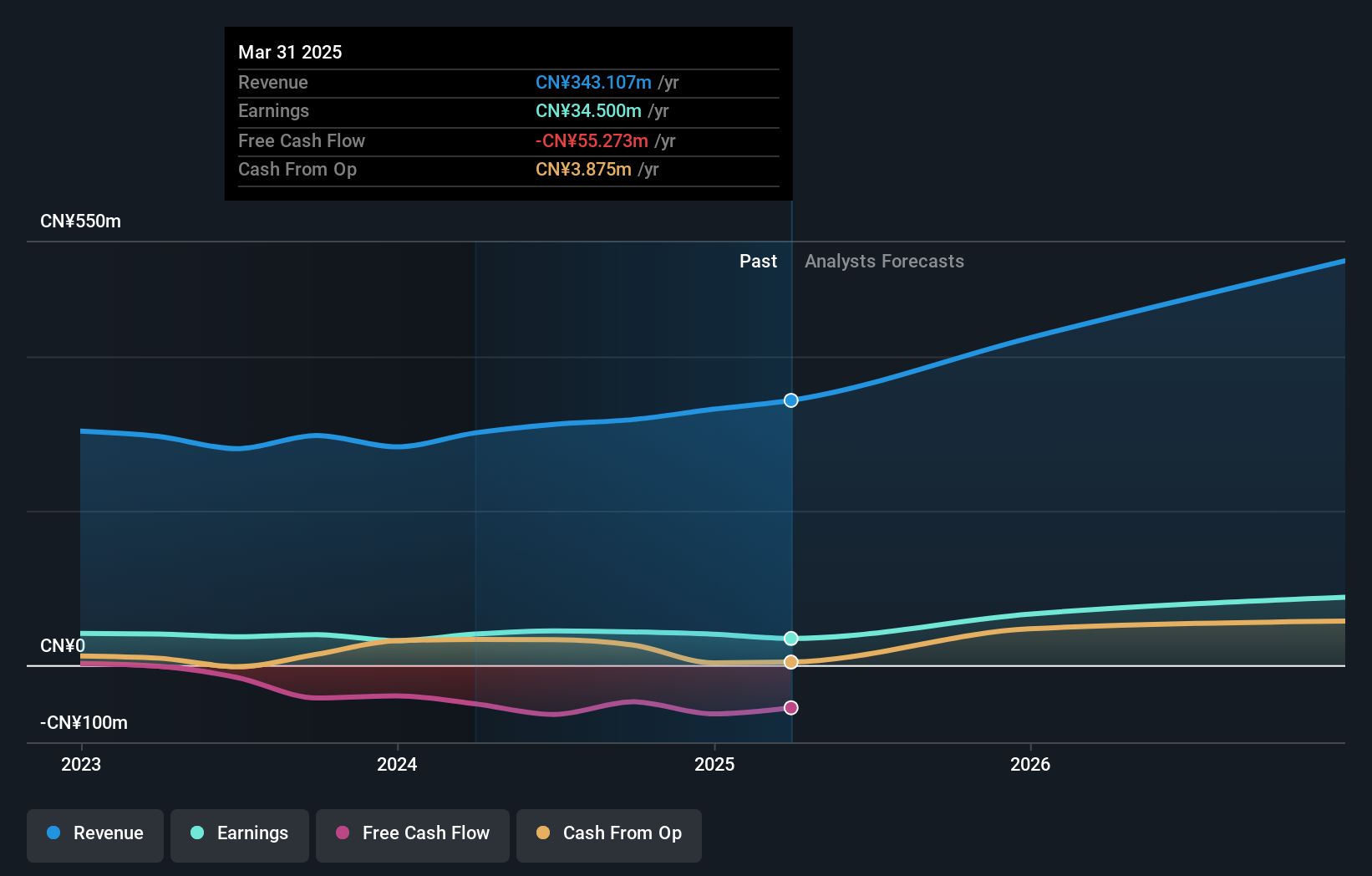

Overview: Jiangsu HHCK Advanced Materials Co., Ltd. focuses on the research, development, production, and sale of electronic packaging materials in China, with a market capitalization of CN¥5.97 billion.

Operations: HHCK generates revenue primarily from its specialty chemicals segment, amounting to CN¥318.30 million.

Jiangsu HHCK Advanced Materials, a smaller player in the materials sector, has shown promising financial health with earnings growing 24.8% annually over the past five years. Its debt to equity ratio impressively shrank from 108.1% to a manageable 5.9%, highlighting improved financial discipline. Despite volatile share prices recently, the company remains profitable and forecasts suggest a robust annual growth rate of 31%. Recent earnings reports indicate net income rose to CNY 34.92 million from CNY 23.58 million last year, reflecting strong operational performance amidst industry challenges and ongoing strategic initiatives like its recent private placement announcement for A shares issuance.

Ruentex Engineering & Construction (TWSE:2597)

Simply Wall St Value Rating: ★★★★★★

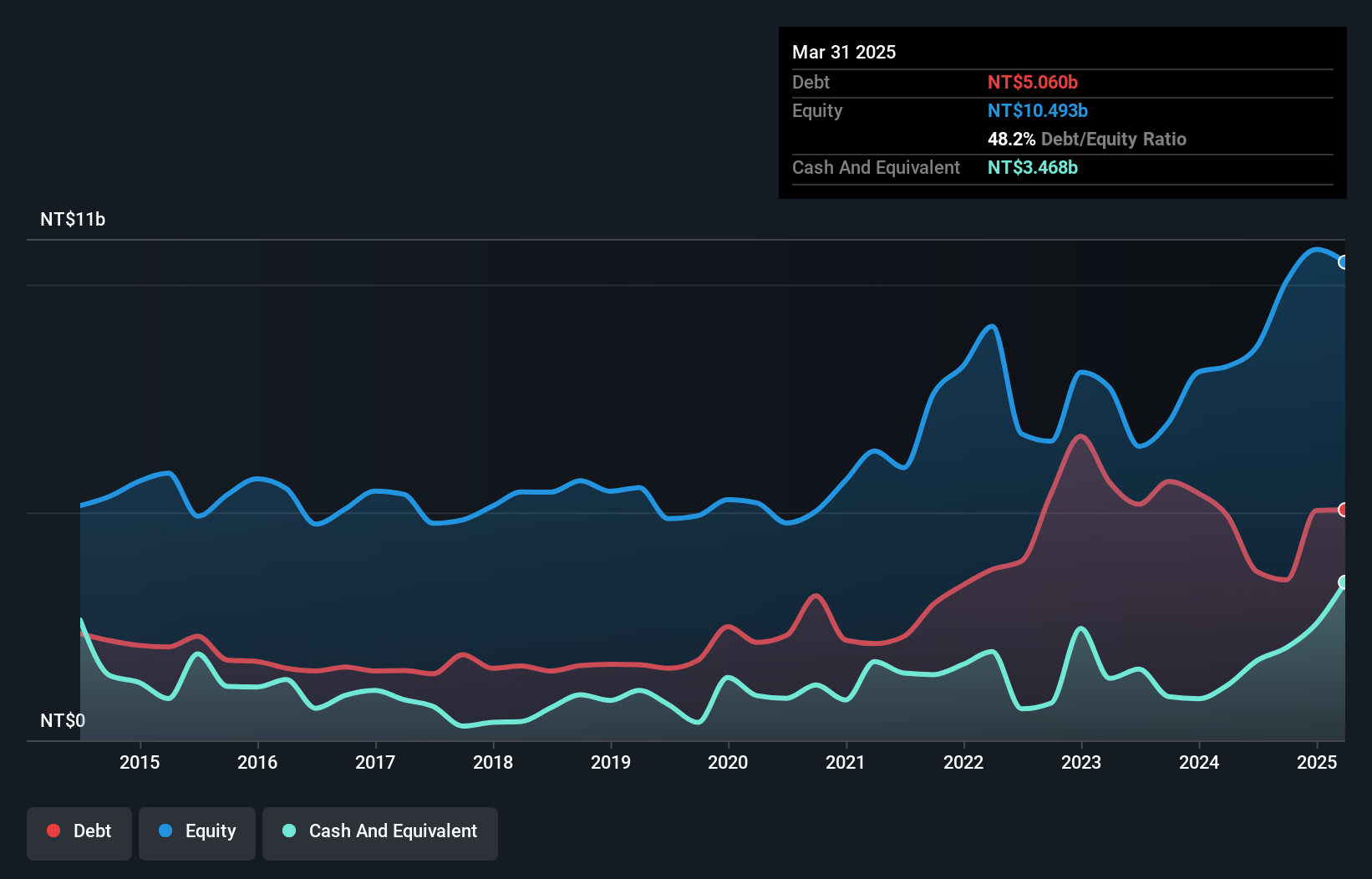

Overview: Ruentex Engineering & Construction Co., Ltd. operates in the construction and engineering sector, focusing on various segments including interior decoration design and construction materials, with a market cap of NT$39.36 billion.

Operations: Ruentex Engineering & Construction generates its revenue primarily from the Construction Division, contributing NT$19.10 billion, followed by the Construction Materials Business Segment with NT$4.54 billion and the Interior Decoration Design Segment at NT$1.90 billion. The company's financial performance is significantly influenced by these segments, with a notable emphasis on the construction division as a major revenue driver.

Ruentex Engineering & Construction has shown impressive growth, with earnings rising by 39% over the past year, outpacing the construction industry's 9%. Trading at a substantial discount of 78.5% below its estimated fair value, it presents a compelling opportunity. The company's debt to equity ratio has slightly improved from 35.7% to 34.9% over five years, and its net debt to equity stands at a satisfactory level of 14.7%. Recent earnings reports highlight sales of TWD 18.90 billion for nine months ending September, with net income reaching TWD 1.74 billion compared to last year's TWD 1.20 billion.

Key Takeaways

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4622 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2597

Ruentex Engineering & Construction

Ruentex Engineering & Construction Co., Ltd.

Outstanding track record, good value and pays a dividend.

Market Insights

Community Narratives