- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3356

December 2024's Best Dividend Stocks For Steady Income

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary, rate adjustments, and political uncertainties, investors are increasingly focused on strategies that offer stability amid volatility. In such an environment, dividend stocks can provide a reliable income stream, making them an attractive option for those looking to balance potential market fluctuations with steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.77% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.72% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1953 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

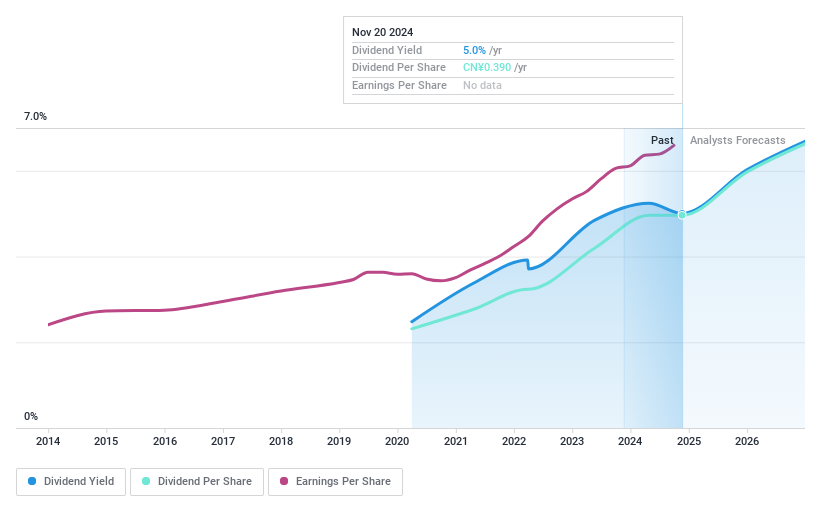

Bank of Suzhou (SZSE:002966)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Suzhou Co., Ltd. operates as a commercial bank offering various financial products and services in Suzhou, with a market capitalization of approximately CN¥29.57 billion.

Operations: Bank of Suzhou Co., Ltd. generates revenue through its diverse range of commercial banking products and services in Suzhou.

Dividend Yield: 4.9%

Bank of Suzhou's dividend payments are well covered by earnings, with a current payout ratio of 44.7% and forecasted coverage improving to 31.9% in three years. The company recently affirmed its cash dividend distribution for A shares at CNY 2 per 10 shares. Despite only five years of dividend history, payments have been stable and growing, supported by a steady increase in earnings, which rose by 7.1% over the past year.

- Click here to discover the nuances of Bank of Suzhou with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Bank of Suzhou is trading beyond its estimated value.

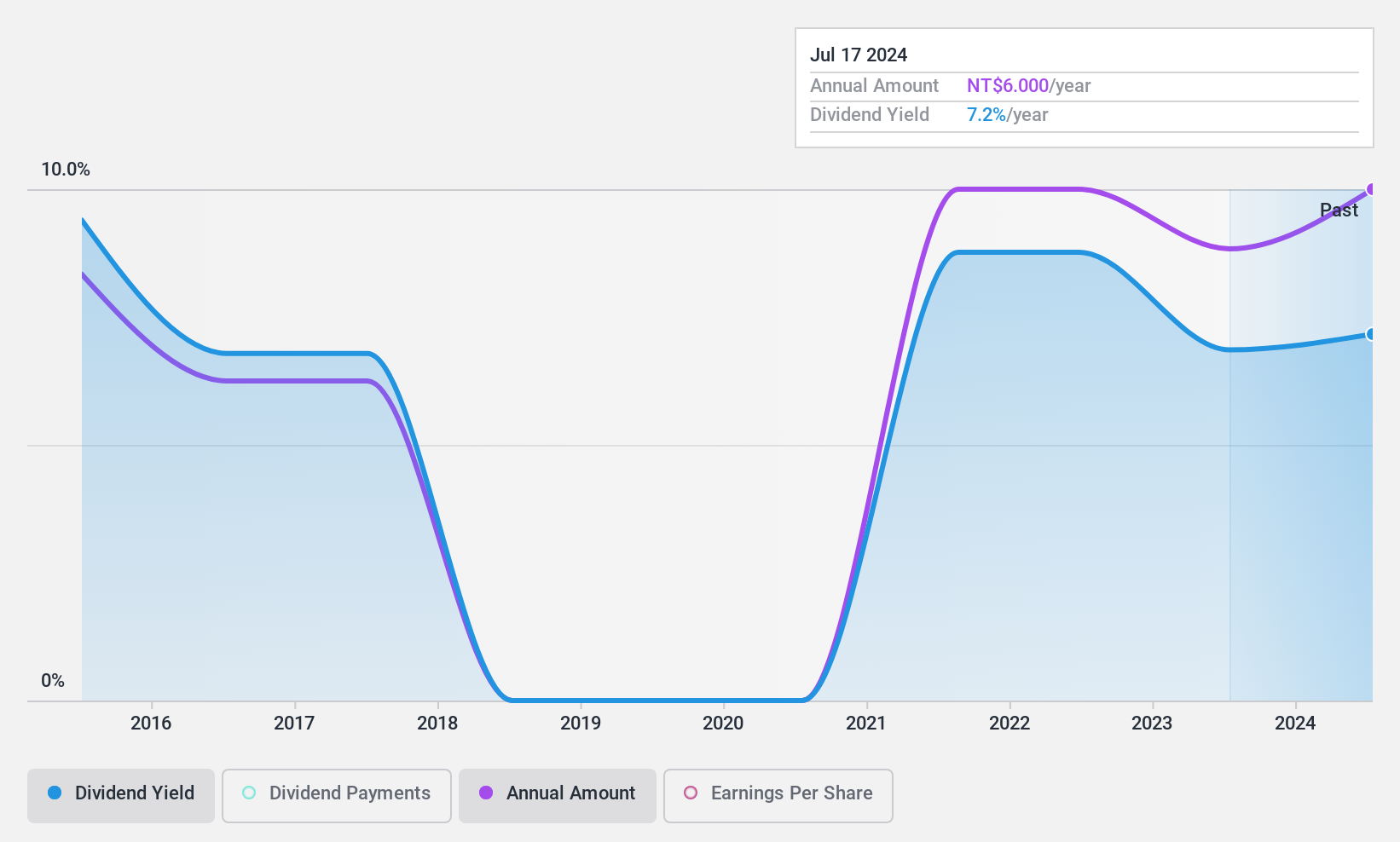

Interactive Digital Technologies (TPEX:6486)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Interactive Digital Technologies Inc. offers professional consulting and implementation services in telecom, media, IT and cloud, and geographical information systems in Taiwan, with a market cap of NT$4.16 billion.

Operations: Interactive Digital Technologies Inc. generates revenue from its Internet Telephone services, amounting to NT$2.70 billion.

Dividend Yield: 7.3%

Interactive Digital Technologies faces challenges with its dividend sustainability, as payments are not fully covered by earnings, indicated by a high payout ratio of 91.6%. However, dividends are supported by cash flows with a reasonable cash payout ratio of 67.1%. The company's dividend yield is attractive at 7.27%, ranking in the top quarter of Taiwan's market payers. Despite past volatility and unreliability in dividends over ten years, recent earnings growth shows potential for improvement.

- Take a closer look at Interactive Digital Technologies' potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Interactive Digital Technologies is priced lower than what may be justified by its financials.

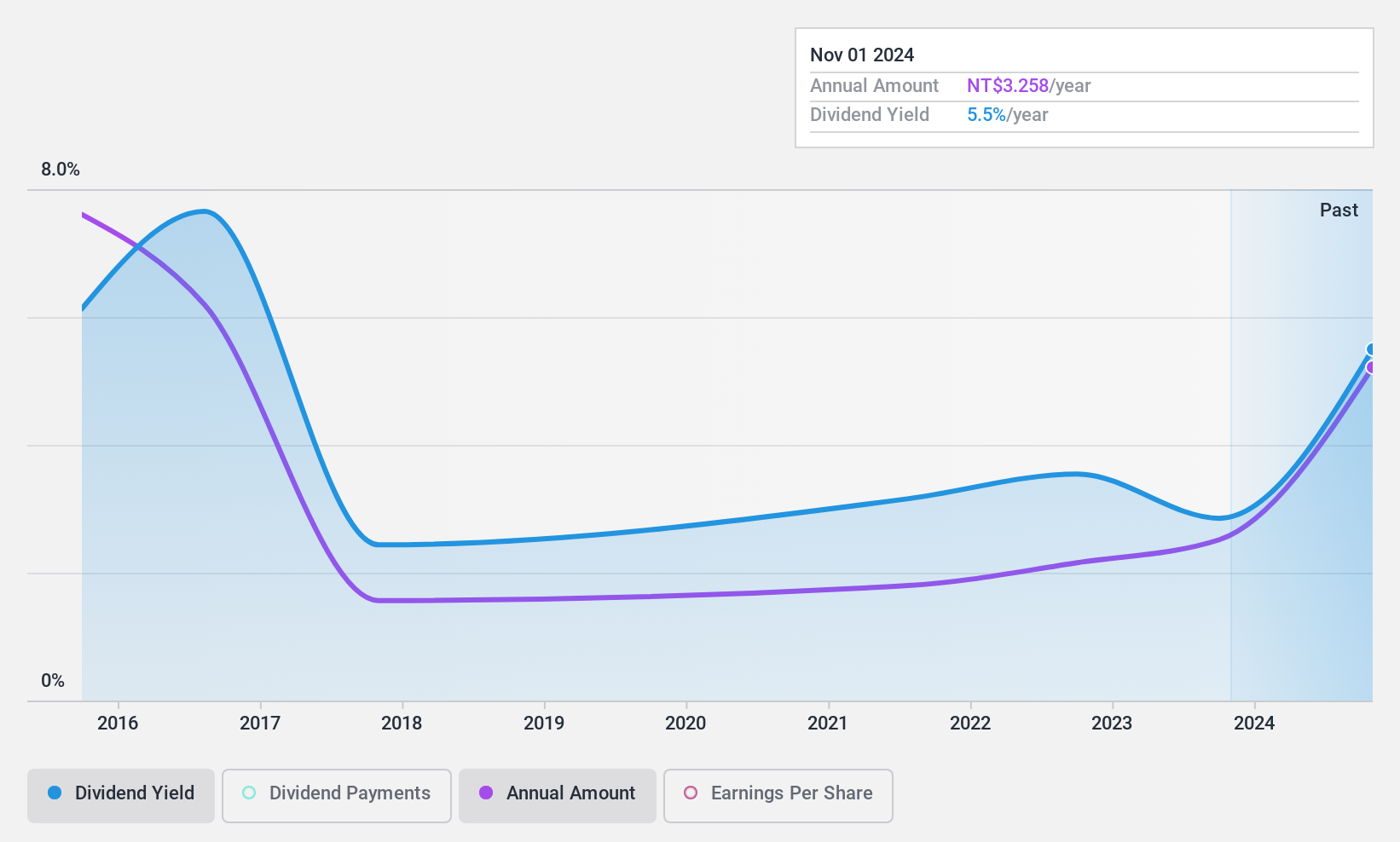

GeoVision (TWSE:3356)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GeoVision Inc., along with its subsidiaries, operates globally as a digital and networked video surveillance company with a market cap of NT$3.98 billion.

Operations: GeoVision Inc.'s revenue segments are distributed as follows: NT$591.95 million from Taiwan, NT$888.11 million from the United States, and NT$186.72 million from the Czech Republic.

Dividend Yield: 5.7%

GeoVision's dividends are supported by earnings and cash flows, with a payout ratio of 54% and a cash payout ratio of 76.4%. Its dividend yield is competitive, ranking in the top 25% in Taiwan. However, the company's dividend history is marked by volatility and unreliability over the past decade. Recent earnings reports show mixed results; despite a significant increase in nine-month net income to TWD 450.78 million, quarterly figures reveal declining sales and profits year-over-year.

- Click here and access our complete dividend analysis report to understand the dynamics of GeoVision.

- Our expertly prepared valuation report GeoVision implies its share price may be too high.

Where To Now?

- Click here to access our complete index of 1953 Top Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3356

GeoVision

Operates as a digital and networked video surveillance company worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives