- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:6088

3 Asian Stocks Estimated To Be Trading At Discounts Of Up To 48%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious consumer behavior and uncertain macroeconomic conditions, Asian stocks have been drawing attention for their potential value opportunities. In this context, identifying undervalued stocks can be particularly appealing to investors seeking to capitalize on discrepancies between market prices and intrinsic values, especially in regions where economic indicators suggest room for growth despite broader challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥153.00 | CN¥302.28 | 49.4% |

| Xi'an International Medical Investment (SZSE:000516) | CN¥4.72 | CN¥9.38 | 49.7% |

| Wuhan Guide Infrared (SZSE:002414) | CN¥12.59 | CN¥25.15 | 49.9% |

| Sinolong New Materials (SZSE:301565) | CN¥28.19 | CN¥55.57 | 49.3% |

| Nan Juen International (TPEX:6584) | NT$346.50 | NT$687.11 | 49.6% |

| JUSUNG ENGINEERINGLtd (KOSDAQ:A036930) | ₩29050.00 | ₩56951.72 | 49% |

| HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540) | ₩447500.00 | ₩892280.49 | 49.8% |

| COVER (TSE:5253) | ¥1569.00 | ¥3100.50 | 49.4% |

| China Ruyi Holdings (SEHK:136) | HK$2.45 | HK$4.82 | 49.2% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥27.94 | CN¥55.75 | 49.9% |

Let's uncover some gems from our specialized screener.

Simcere Pharmaceutical Group (SEHK:2096)

Overview: Simcere Pharmaceutical Group Limited is an investment holding company involved in the research, development, manufacture, and sale of pharmaceutical products to various distributors and pharmacy chains in China with a market cap of HK$35.82 billion.

Operations: The company's revenue primarily stems from its pharmaceuticals segment, which generated CN¥7.11 billion.

Estimated Discount To Fair Value: 24.4%

Simcere Pharmaceutical Group is trading at HK$13.8, significantly below its estimated fair value of HK$18.26, indicating potential undervaluation based on cash flows. The company's earnings are expected to grow at 24.3% annually, outpacing the Hong Kong market's growth rate of 12.1%. Recent strategic moves include a licensing agreement with Vigonvita for Deuterated Remdesivir and advancements in clinical trials for SIM0278, enhancing its product pipeline and market positioning in Asia's pharmaceutical sector.

- Our comprehensive growth report raises the possibility that Simcere Pharmaceutical Group is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Simcere Pharmaceutical Group.

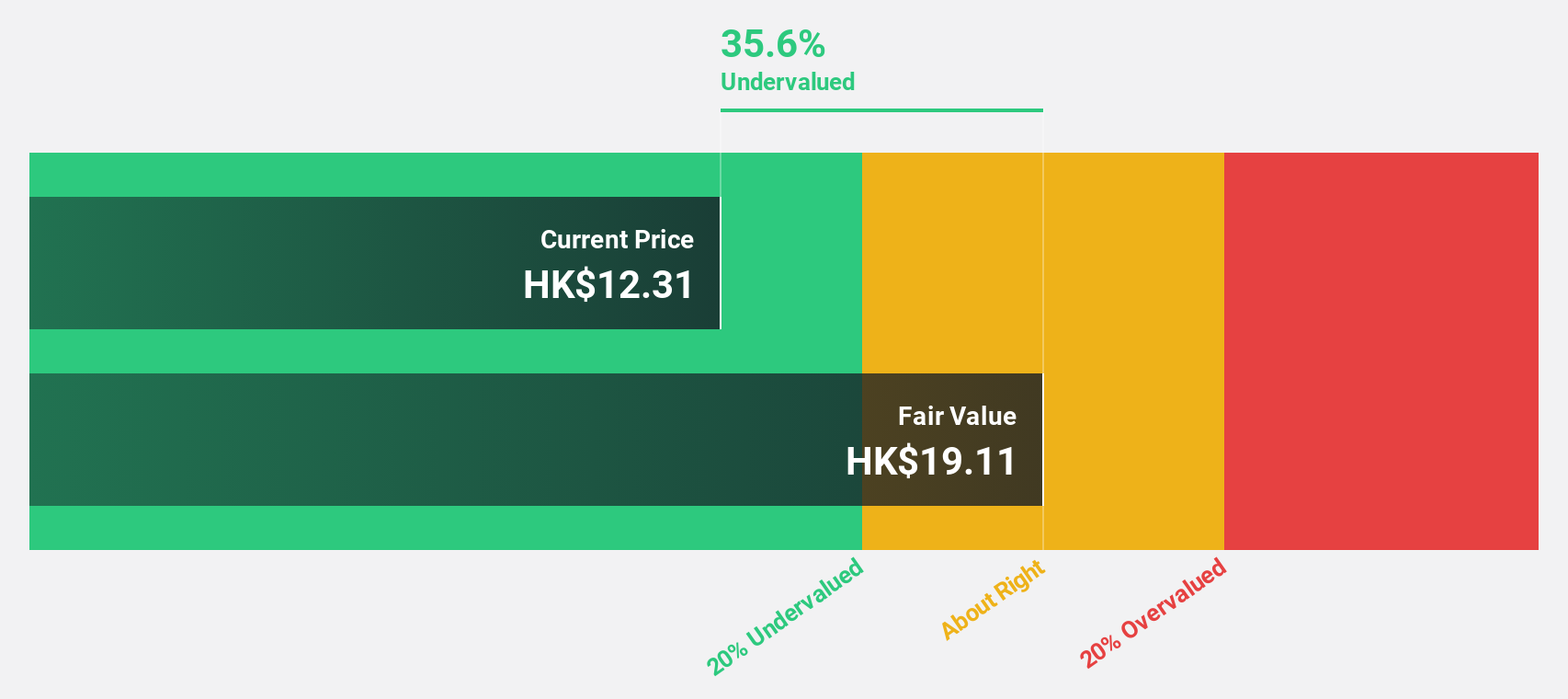

FIT Hon Teng (SEHK:6088)

Overview: FIT Hon Teng Limited manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally, with a market cap of HK$41.57 billion.

Operations: The company's revenue is primarily derived from Consumer Products at $671.57 million and Intermediate Products at $4.13 billion.

Estimated Discount To Fair Value: 48%

FIT Hon Teng is trading at HK$5.86, well below its estimated fair value of HK$11.27, highlighting potential undervaluation based on cash flows. Revenue growth is forecasted at 12.8% annually, surpassing the Hong Kong market's 8.5%. Earnings are expected to grow significantly by 32.3% per year despite a volatile share price recently and low future return on equity projections (10.4%). Recent board appointments may influence strategic direction positively in the near term.

- Our earnings growth report unveils the potential for significant increases in FIT Hon Teng's future results.

- Click to explore a detailed breakdown of our findings in FIT Hon Teng's balance sheet health report.

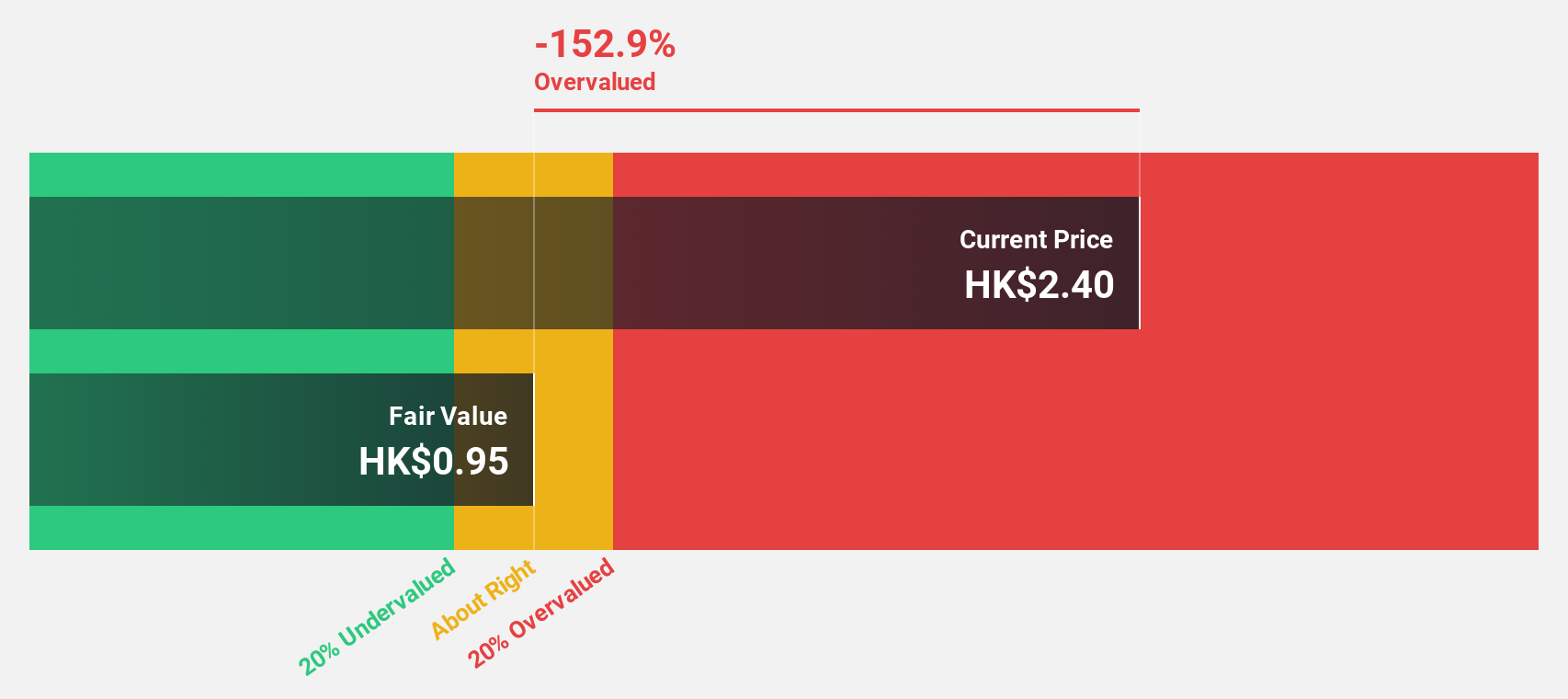

Macronix International (TWSE:2337)

Overview: Macronix International Co., Ltd. designs, manufactures, and supplies integrated circuits and memory chips with a market cap of NT$71.84 billion.

Operations: The company generates revenue of NT$27.06 billion from its Memory Products and Wafer Fabrication segment.

Estimated Discount To Fair Value: 13.7%

Macronix International is trading at NT$38.75, below its estimated fair value of NT$44.9, suggesting undervaluation based on cash flows. Revenue is projected to grow at 23.4% annually, outpacing the Taiwan market's 13.8%. Despite a forecasted low return on equity (5.8%) and recent volatility in share price, earnings are expected to grow significantly by 126.69% per year with profitability anticipated within three years, indicating potential for future financial improvement despite current net losses.

- In light of our recent growth report, it seems possible that Macronix International's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Macronix International.

Where To Now?

- Embark on your investment journey to our 284 Undervalued Asian Stocks Based On Cash Flows selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6088

FIT Hon Teng

Manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026