- Taiwan

- /

- Semiconductors

- /

- TWSE:2330

Assessing TSMC's (TWSE:2330) Valuation After a Steady Share Price Rise

Reviewed by Simply Wall St

Something’s been stirring with Taiwan Semiconductor Manufacturing (TWSE:2330) lately, and even without a big headline event to point to, it’s catching investors’ eyes. A slow but steady grind upward in the share price has some wondering if there’s a signal buried in this move. The question isn’t about a sudden catalyst, but whether the shift reflects subtle changes in how the market is valuing one of the world's most essential chipmakers.

Over the past year, Taiwan Semiconductor Manufacturing’s share price has climbed roughly 25%, gaining significant ground across both the trailing month and the past three months. While there has been a modest dip in the past week, it comes after a powerful rally this spring. This year, double-digit returns have arrived alongside steady revenue and profit growth, suggesting momentum is still on the company’s side—especially when compared to broader semiconductor peers who have seen more volatility.

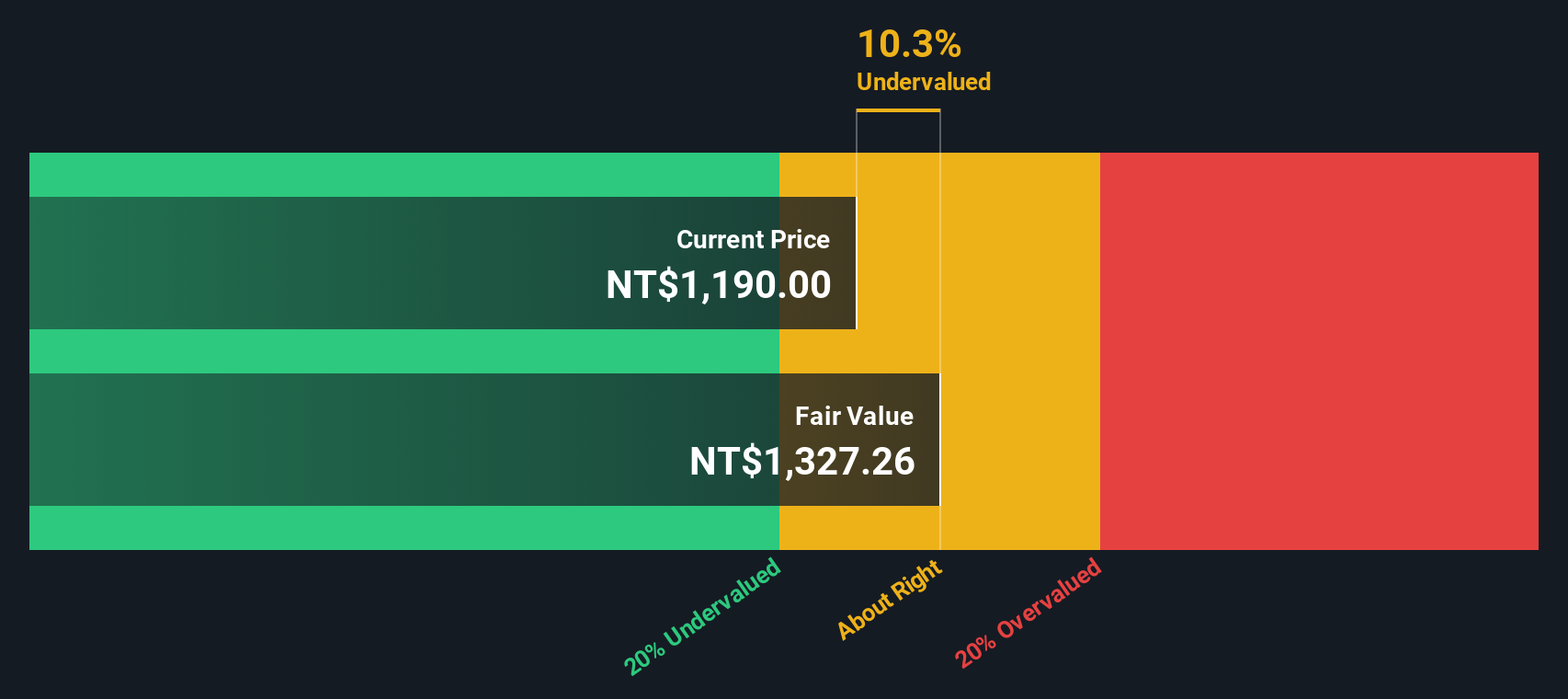

That brings us to the big question: after this impressive run, is Taiwan Semiconductor Manufacturing undervalued at current levels, or is the market already factoring in much of its future growth?

Most Popular Narrative: 13.9% Undervalued

According to community narrative, Taiwan Semiconductor Manufacturing is trading notably below fair value. This view is driven by a blend of aggressive growth assumptions and ongoing strength in core profitability measures, all filtered through a rigorous discount rate.

*Very strong and accelerating demand for advanced process nodes (3nm, 5nm, and soon 2nm) driven by expanding AI workloads, HPC, and edge/on-device AI is fueling significant and sustained capacity tightness. This supports both pricing power and revenue growth potential in coming years.*

Curious what’s powering this bullish outlook? The analyst narrative points to a combination of rapid chip demand, premium margins, and future profits that compare with the industry’s leading companies. Wonder which bold projections are integrated into this target, and which market trends could shift the outlook? Explore what’s driving this eye-catching fair value estimate.

Result: Fair Value of $1358.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent cost pressures from overseas expansions and currency volatility could weigh on future margins and challenge the bullish outlook for Taiwan Semiconductor Manufacturing.

Find out about the key risks to this Taiwan Semiconductor Manufacturing narrative.Another View: SWS DCF Model Perspective

Taking a fresh look, our DCF model arrives at the same undervalued conclusion but through a different lens. It focuses on projected future cash flows, rather than multiples, to assess whether the stock is really offering a bargain now. Could these two methods be pointing to something bigger for Taiwan Semiconductor Manufacturing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Taiwan Semiconductor Manufacturing Narrative

If you think there are other angles to consider or want to dig into the numbers yourself, you can shape your own analysis and perspective in just a few minutes. do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Taiwan Semiconductor Manufacturing.

Looking for More Compelling Investment Opportunities?

Why focus on just one success story when you could be tapping into fresh possibilities? Use the Simply Wall Street Screener to guide your next financial move and identify powerful stocks aligned with your vision. Miss out now, and you might watch others claim the next big win first.

- Unlock a stream of regular income as you search for established companies offering dividend stocks with yields > 3% and strong long-term payout potential.

- Get ahead of transformative technology trends by spotting the most promising AI penny stocks driving innovation in artificial intelligence across industries.

- Capture additional upside by focusing on undervalued stocks based on cash flows that the market may be underestimating, creating more opportunities for your portfolio to perform well.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Semiconductor Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2330

Taiwan Semiconductor Manufacturing

Manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives