- Taiwan

- /

- Semiconductors

- /

- TWSE:2330

3 Stocks Estimated To Be Undervalued By Up To 32.6%

Reviewed by Simply Wall St

In recent weeks, global markets have been characterized by mixed performances across major indices, with the S&P 500 and Nasdaq Composite showing gains driven by sectors like utilities and real estate, while European markets responded positively to interest rate cuts from the European Central Bank. Amid these varied market conditions, identifying undervalued stocks becomes crucial for investors seeking opportunities; such stocks often present potential for growth when their intrinsic value is not fully recognized by current market prices.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3320.00 | ¥6606.40 | 49.7% |

| Anhui Huaheng Biotechnology (SHSE:688639) | CN¥36.99 | CN¥73.48 | 49.7% |

| Western Alliance Bancorporation (NYSE:WAL) | US$82.34 | US$163.41 | 49.6% |

| Lindab International (OM:LIAB) | SEK264.40 | SEK527.01 | 49.8% |

| Sejin Heavy Industries (KOSE:A075580) | ₩7460.00 | ₩14915.55 | 50% |

| Securitas (OM:SECU B) | SEK130.35 | SEK260.50 | 50% |

| Foxtons Group (LSE:FOXT) | £0.596 | £1.19 | 49.9% |

| BATM Advanced Communications (LSE:BVC) | £0.18725 | £0.37 | 49.7% |

| Mercari (TSE:4385) | ¥2120.00 | ¥4215.09 | 49.7% |

| Genel Energy (LSE:GENL) | £0.762 | £1.51 | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

ASML Holding (ENXTAM:ASML)

Overview: ASML Holding N.V. is a company that develops, produces, markets, sells, and services advanced semiconductor equipment systems for chipmakers with a market cap of approximately €258.93 billion.

Operations: The company's revenue primarily comes from its Semiconductor Equipment and Services segment, totaling approximately €26.24 billion.

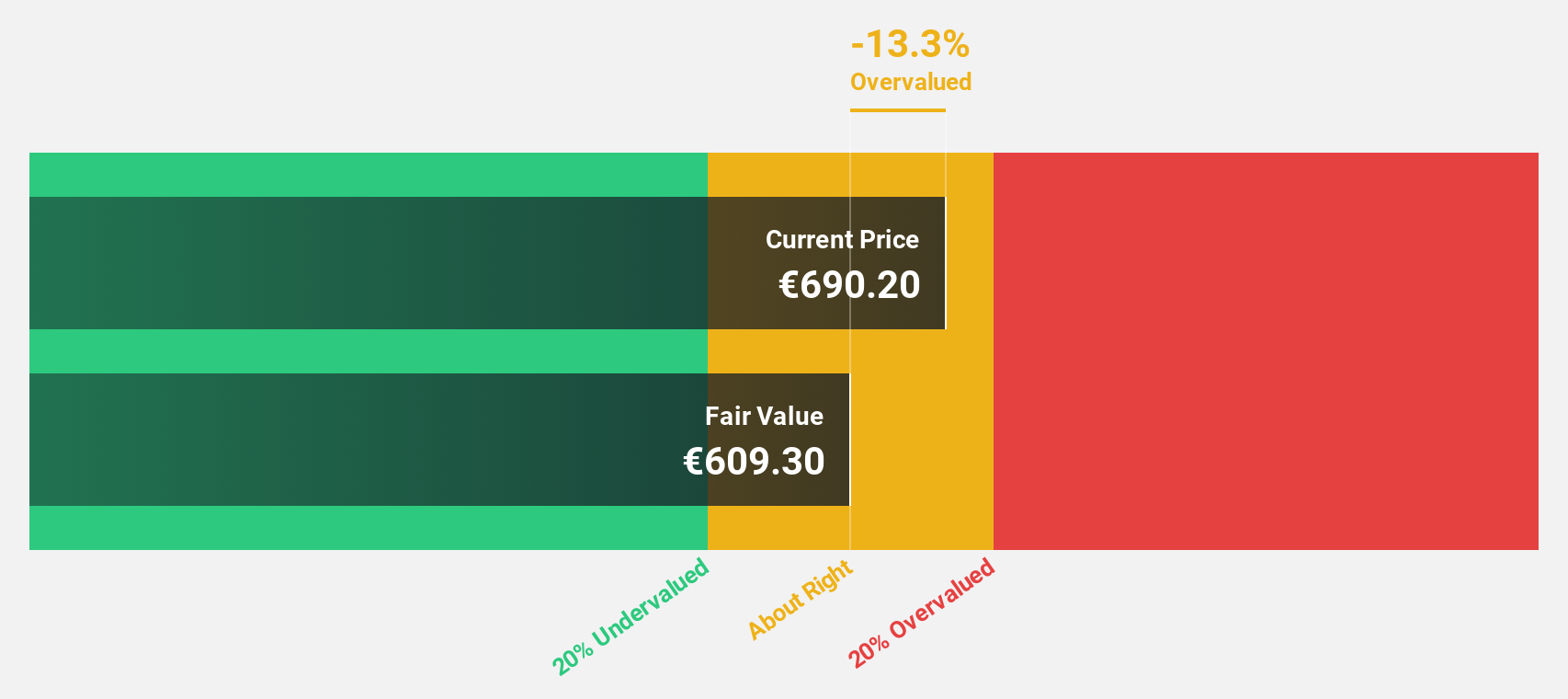

Estimated Discount To Fair Value: 32.6%

ASML Holding is trading at approximately 32.6% below its estimated fair value, with a discounted cash flow valuation suggesting significant undervaluation. Despite recent earnings volatility, the company projects robust revenue growth, forecasting net sales of €28 billion for 2024 and up to €35 billion in 2025. Analysts predict ASML's earnings will grow faster than the Dutch market average, with a very high return on equity expected in three years.

- According our earnings growth report, there's an indication that ASML Holding might be ready to expand.

- Click to explore a detailed breakdown of our findings in ASML Holding's balance sheet health report.

Taiwan Semiconductor Manufacturing (TWSE:2330)

Overview: Taiwan Semiconductor Manufacturing Company Limited, along with its subsidiaries, is engaged in the manufacturing, packaging, testing, and selling of integrated circuits and semiconductor devices across Taiwan and globally, with a market cap of NT$27.49 trillion.

Operations: The company's revenue is primarily derived from its Foundry segment, which generated NT$2.65 trillion.

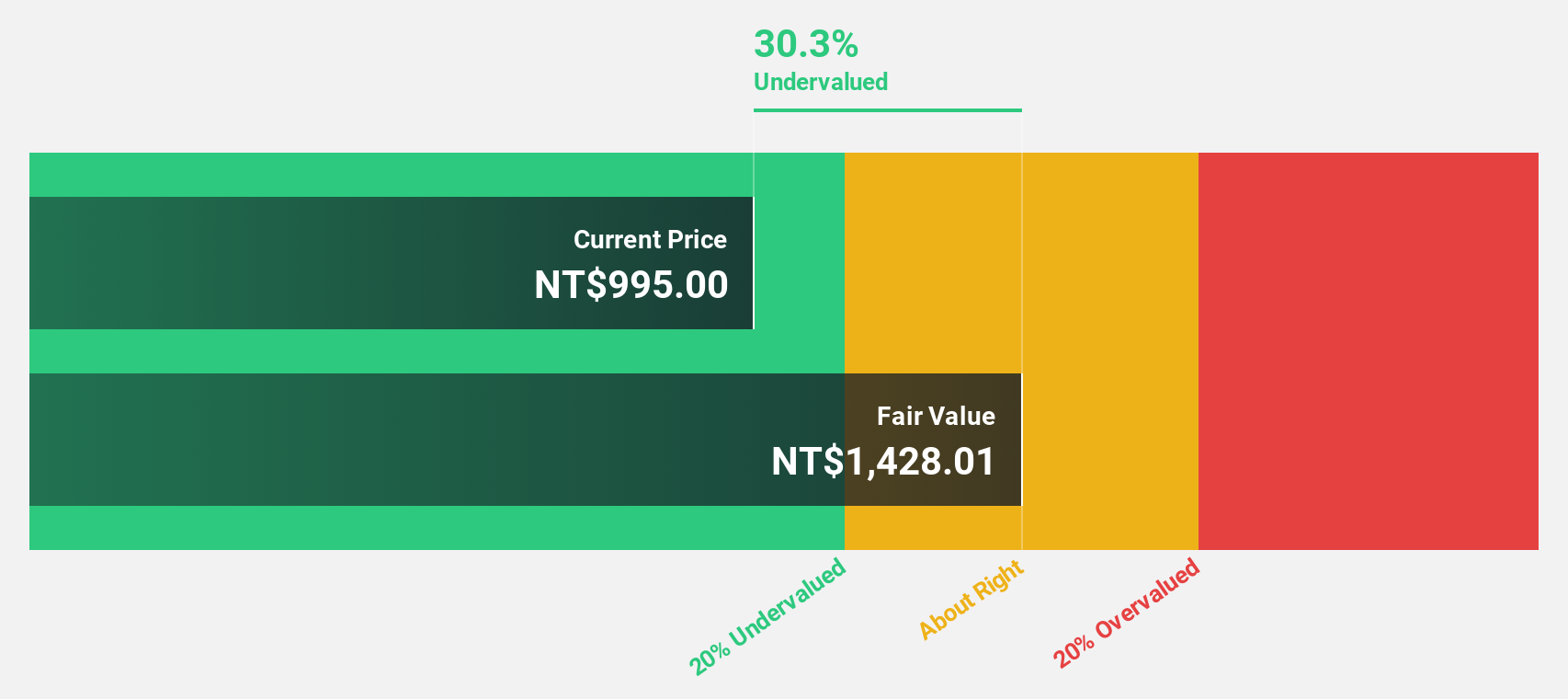

Estimated Discount To Fair Value: 18.8%

Taiwan Semiconductor Manufacturing is trading at about 18.8% below its estimated fair value, with a discounted cash flow valuation showing it as undervalued. The company reported strong third-quarter results with sales of TWD 759.69 billion and net income of TWD 325.26 billion, showcasing robust profit growth over the past year. Analysts expect earnings to grow annually by 19.24%, outpacing the broader Taiwan market, while revenue growth is forecasted at a solid pace of 17% per year.

- Our earnings growth report unveils the potential for significant increases in Taiwan Semiconductor Manufacturing's future results.

- Get an in-depth perspective on Taiwan Semiconductor Manufacturing's balance sheet by reading our health report here.

Quanta Computer (TWSE:2382)

Overview: Quanta Computer Inc. is a global manufacturer and seller of notebook computers, with operations in Asia, the Americas, Europe, and other international markets, and has a market cap of approximately NT$1.22 trillion.

Operations: The Electronics Sector generates NT$2.50 billion in revenue for the company.

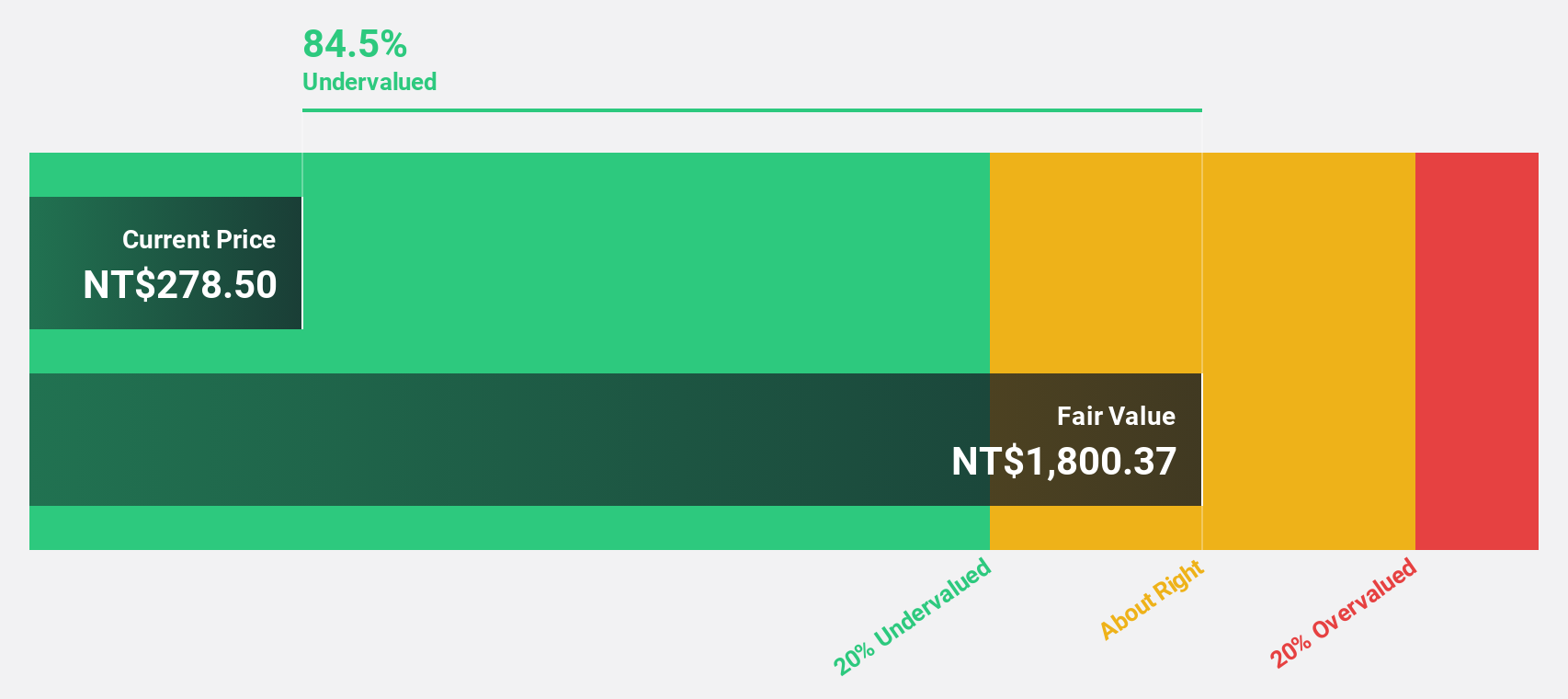

Estimated Discount To Fair Value: 12.5%

Quanta Computer is trading 12.5% below its estimated fair value, with a discounted cash flow valuation indicating it as undervalued. Recent earnings show significant growth, with Q2 net income rising to TWD 15.13 billion from TWD 10.12 billion a year ago, and sales increasing to TWD 309.95 billion from TWD 245.03 billion. Analysts forecast revenue growth at an impressive rate of 36.8% annually, surpassing the Taiwan market's average growth expectations.

- Our growth report here indicates Quanta Computer may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Quanta Computer.

Key Takeaways

- Click through to start exploring the rest of the 946 Undervalued Stocks Based On Cash Flows now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Semiconductor Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2330

Taiwan Semiconductor Manufacturing

Manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally.

Undervalued with excellent balance sheet and pays a dividend.