- Taiwan

- /

- Semiconductors

- /

- TWSE:6239

Is Powertech Technology Inc.'s (TPE:6239) Recent Performance Tethered To Its Attractive Financial Prospects?

Powertech Technology's (TPE:6239) stock up by 7.4% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Particularly, we will be paying attention to Powertech Technology's ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

View our latest analysis for Powertech Technology

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Powertech Technology is:

15% = NT$8.5b ÷ NT$56b (Based on the trailing twelve months to September 2020).

The 'return' is the income the business earned over the last year. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.15 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Powertech Technology's Earnings Growth And 15% ROE

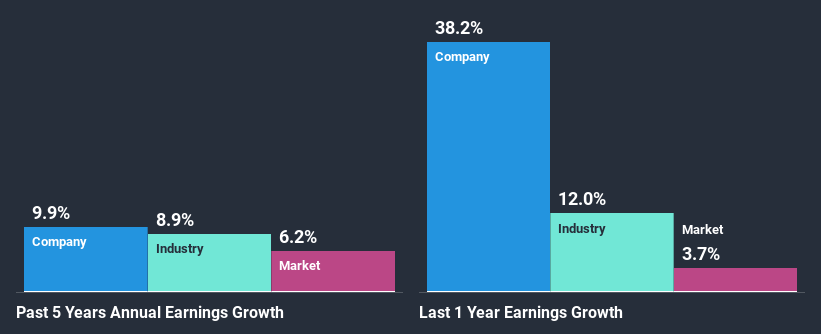

At first glance, Powertech Technology seems to have a decent ROE. On comparing with the average industry ROE of 11% the company's ROE looks pretty remarkable. This probably laid the ground for Powertech Technology's moderate 9.9% net income growth seen over the past five years.

We then performed a comparison between Powertech Technology's net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 8.9% in the same period.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Powertech Technology is trading on a high P/E or a low P/E, relative to its industry.

Is Powertech Technology Efficiently Re-investing Its Profits?

Powertech Technology has a significant three-year median payout ratio of 59%, meaning that it is left with only 41% to reinvest into its business. This implies that the company has been able to achieve decent earnings growth despite returning most of its profits to shareholders.

Additionally, Powertech Technology has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 60%. Accordingly, forecasts suggest that Powertech Technology's future ROE will be 17% which is again, similar to the current ROE.

Summary

In total, we are pretty happy with Powertech Technology's performance. In particular, its high ROE is quite noteworthy and also the probable explanation behind its considerable earnings growth. Yet, the company is retaining a small portion of its profits. Which means that the company has been able to grow its earnings in spite of it, so that's not too bad. The latest industry analyst forecasts show that the company is expected to maintain its current growth rate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

When trading Powertech Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:6239

Powertech Technology

Researches, designs, develops, assembles, manufactures, packages, tests, and sells various integrated circuit (IC) products in Taiwan, Japan, Singapore, the United States, Europe, China, Hong Kong, Macao, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026