- Taiwan

- /

- Semiconductors

- /

- TWSE:4968

RichWave Technology (TPE:4968) Has Rewarded Shareholders With An Exceptional 424% Total Return On Their Investment

We think all investors should try to buy and hold high quality multi-year winners. While not every stock performs well, when investors win, they can win big. To wit, the RichWave Technology Corporation (TPE:4968) share price has soared 396% over five years. And this is just one example of the epic gains achieved by some long term investors. It's also good to see the share price up 57% over the last quarter.

Check out our latest analysis for RichWave Technology

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

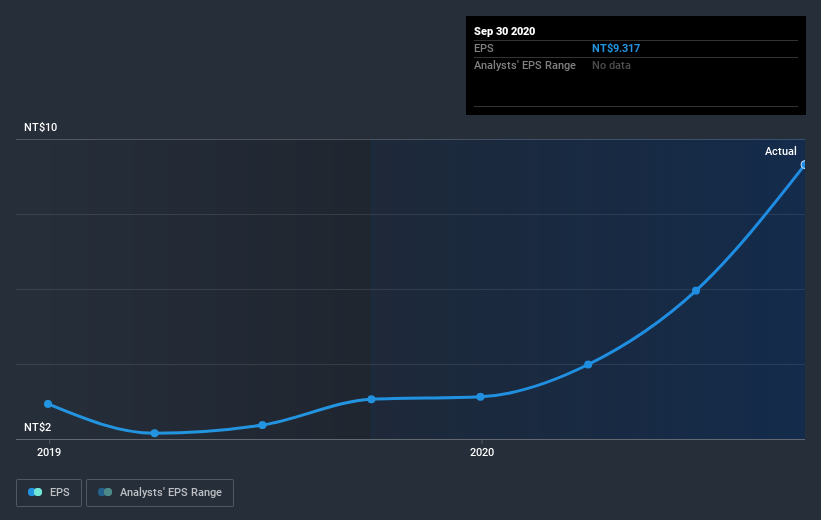

During five years of share price growth, RichWave Technology achieved compound earnings per share (EPS) growth of 28% per year. This EPS growth is lower than the 38% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into RichWave Technology's key metrics by checking this interactive graph of RichWave Technology's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for RichWave Technology the TSR over the last 5 years was 424%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that RichWave Technology shareholders have received a total shareholder return of 103% over one year. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 39% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand RichWave Technology better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for RichWave Technology (of which 1 doesn't sit too well with us!) you should know about.

But note: RichWave Technology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade RichWave Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:4968

RichWave Technology

Designs, develops, and sells radio frequency (RF) integrated circuits in Taiwan, China, Korea, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026