- Japan

- /

- Semiconductors

- /

- TSE:6941

Highlighting January 2025's Leading Dividend Stocks

Reviewed by Simply Wall St

As global markets experience a boost from cooling inflation and strong bank earnings, major U.S. stock indexes have rebounded, with value stocks outperforming growth shares amid rising oil prices and profit-taking in large-cap technology stocks. In this dynamic environment, dividend stocks stand out as attractive options for investors seeking steady income streams; their appeal is further enhanced by the current economic backdrop of easing inflationary pressures and robust corporate earnings.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.58% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.67% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.07% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.16% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.52% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.62% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

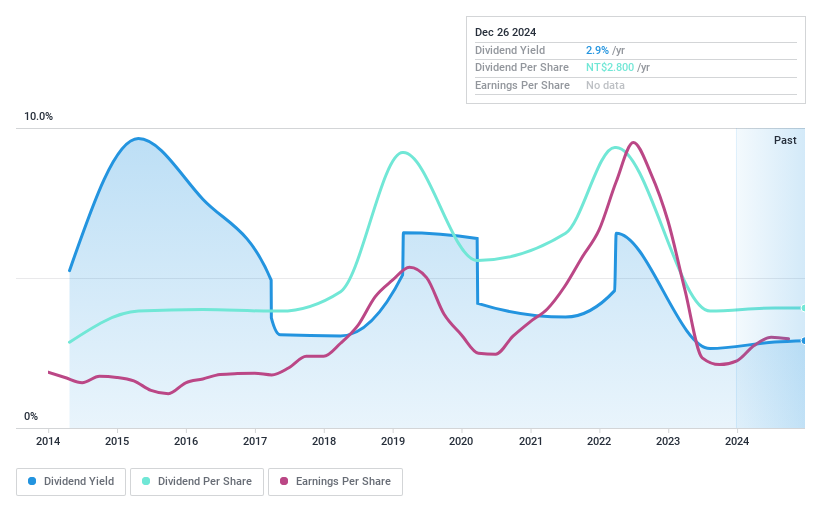

Sinopower Semiconductor (TPEX:6435)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sinopower Semiconductor, Inc. is involved in the research, design, manufacture, and sale of power semiconductor components and related modules both in Taiwan and internationally, with a market cap of NT$3.43 billion.

Operations: Sinopower Semiconductor, Inc. generates revenue primarily from its Semiconductors segment, which accounts for NT$2.72 billion.

Dividend Yield: 2.9%

Sinopower Semiconductor's dividend payments have grown over the past decade but remain volatile, with annual drops exceeding 20%. The dividends are well-covered by earnings and cash flows, with payout ratios of 52.3% and 32%, respectively. Despite trading significantly below its estimated fair value, its dividend yield of 2.89% is lower than Taiwan's top-tier payers. Recent earnings show growth in net income for the first nine months of 2024, potentially supporting future dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Sinopower Semiconductor.

- Insights from our recent valuation report point to the potential undervaluation of Sinopower Semiconductor shares in the market.

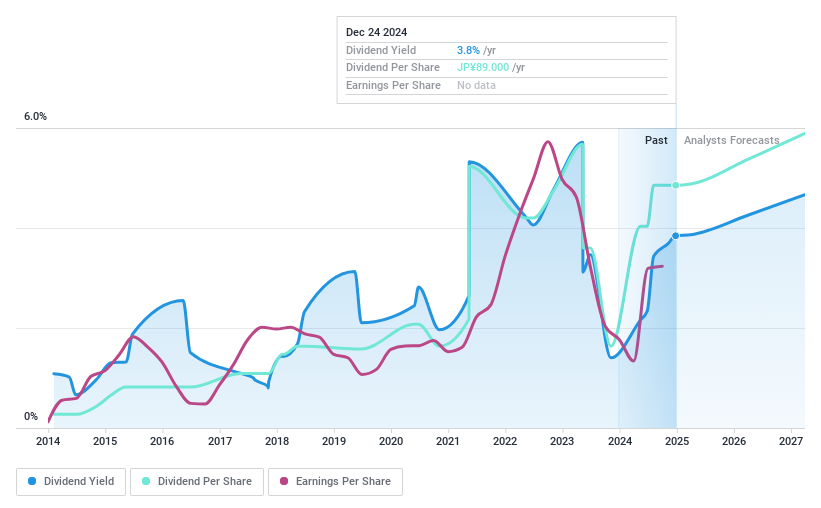

Yamaichi ElectronicsLtd (TSE:6941)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yamaichi Electronics Co., Ltd. manufactures and sells test, connector, and optical-related products both in Japan and internationally, with a market cap of ¥48.50 billion.

Operations: Yamaichi Electronics Co., Ltd. generates revenue through its Test Solutions Business, which accounts for ¥25.02 billion, the Connector Solutions Business contributing ¥19.18 billion, and the Optical Related Business adding ¥1.20 billion.

Dividend Yield: 3.5%

Yamaichi Electronics Ltd.'s dividend payments, while having increased over the past decade, are volatile with annual declines exceeding 20%. Despite this instability, dividends are well-covered by earnings and cash flows, with payout ratios of 19.8% and 39.9%, respectively. The stock trades at a significant discount to its estimated fair value but offers a lower dividend yield of 3.54% compared to Japan's top-tier payers. Recent share buybacks may enhance shareholder value further.

- Get an in-depth perspective on Yamaichi ElectronicsLtd's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Yamaichi ElectronicsLtd is priced lower than what may be justified by its financials.

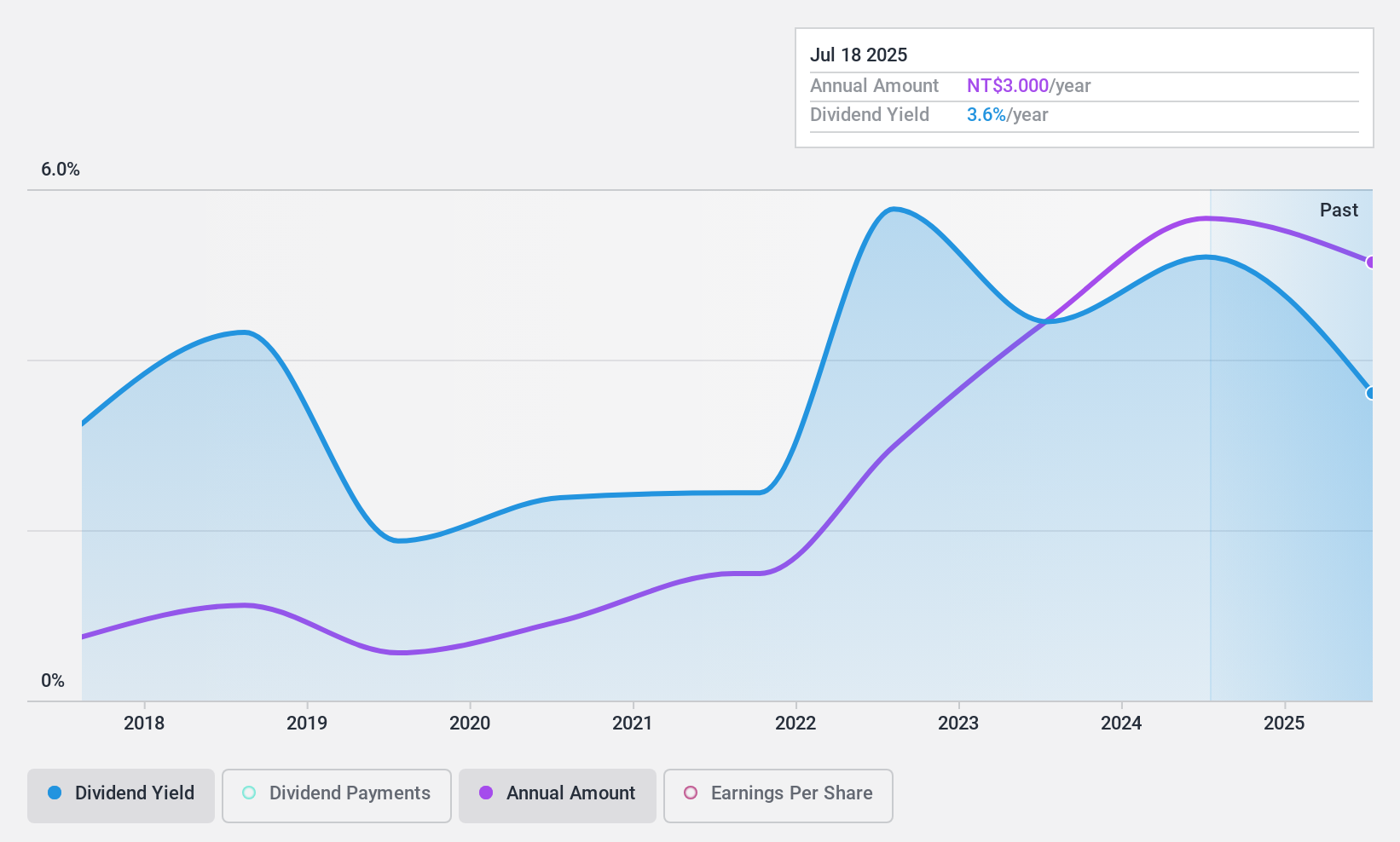

Global Brands Manufacture (TWSE:6191)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Global Brands Manufacture Ltd. operates in Taiwan, focusing on the production of printed circuit boards and electronic manufacturing services, with a market capitalization of NT$29.88 billion.

Operations: Global Brands Manufacture Ltd.'s revenue is primarily derived from its Printed Circuit Board (PCB) segment, which generated NT$14.10 billion, and its Electronic Manufacturing Service (EMS) segment, contributing NT$7.68 billion.

Dividend Yield: 5%

Global Brands Manufacture's dividend yield is among the top 25% in its market, supported by earnings and cash flow coverage with payout ratios of 51% and 71.5%, respectively. However, dividends have been inconsistent over the past eight years. The stock trades below estimated fair value, presenting a potential opportunity despite recent earnings declines. A share repurchase program worth TWD 163.27 million may positively impact shareholder value amid a volatile share price environment.

- Dive into the specifics of Global Brands Manufacture here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Global Brands Manufacture is trading behind its estimated value.

Turning Ideas Into Actions

- Unlock our comprehensive list of 1983 Top Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6941

Yamaichi ElectronicsLtd

Manufactures and sells test, connector, and optical-related products in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.