As global markets respond to easing inflation and robust bank earnings, major U.S. stock indexes have seen a notable rebound, with value stocks outperforming growth shares. In this environment of cautious optimism, dividend stocks stand out as attractive options for investors seeking steady income streams amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.34% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.50% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.18% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.59% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.02% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Tomoe Engineering (TSE:6309)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Tomoe Engineering Co., Ltd. operates in the chemical and machinery and equipment sectors across Japan, Asia, and internationally, with a market cap of ¥37.47 billion.

Operations: Tomoe Engineering Co., Ltd. generates revenue from its Chemical Industry Products Sale segment amounting to ¥39.12 billion and its Machine Manufacturing and Sales segment totaling ¥13 billion.

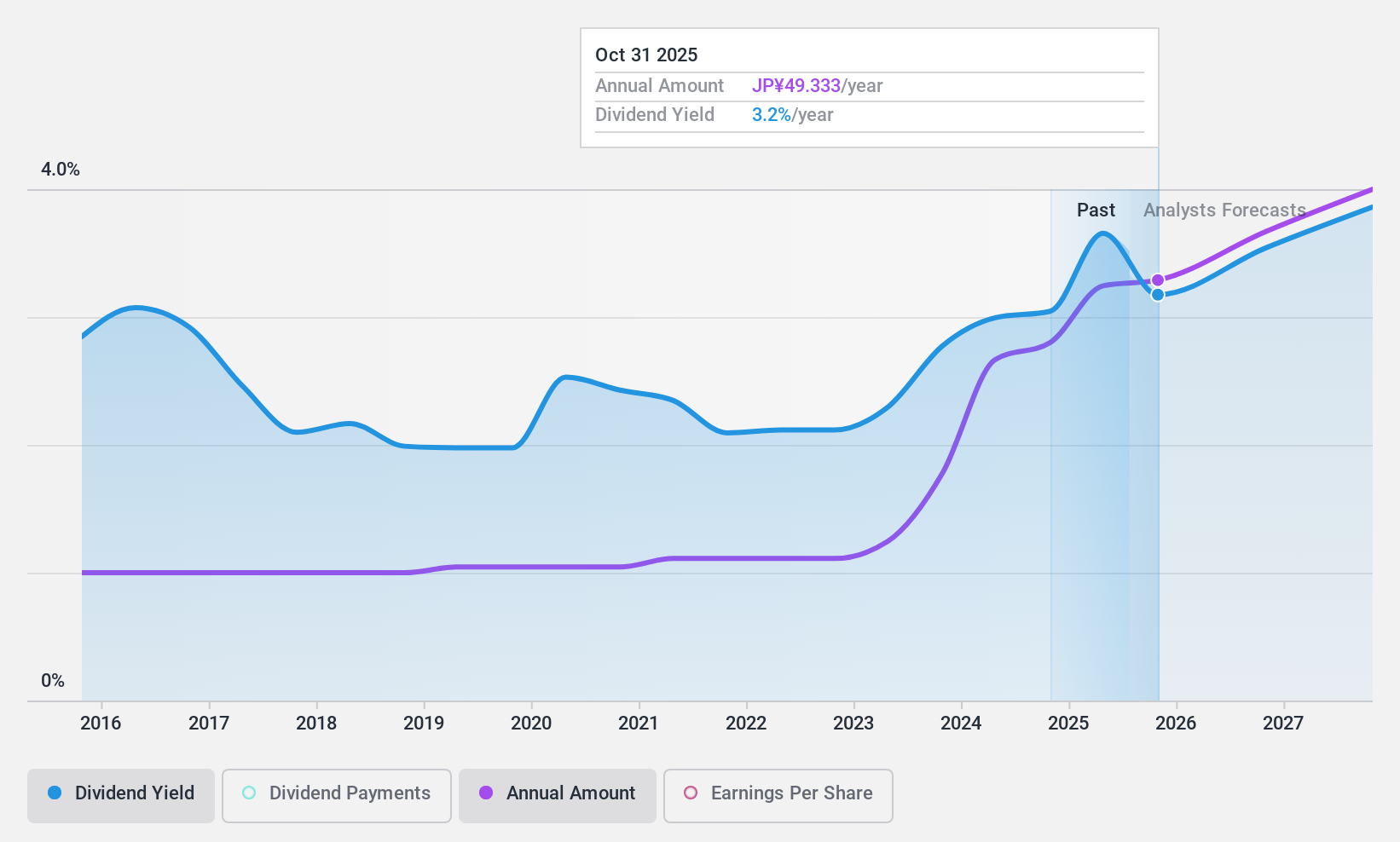

Dividend Yield: 3.9%

Tomoe Engineering's dividend strategy is supported by a healthy cash payout ratio of 51.7% and an earnings payout ratio of 40%, ensuring sustainability. Despite stable dividends over the past decade, recent guidance indicates a decrease in year-end dividends to ¥73 per share from ¥82 previously, though there was an increase for the second quarter. The stock trades at a discount to its estimated fair value and offers an attractive dividend yield of 3.89%, ranking in Japan's top quartile.

- Click here to discover the nuances of Tomoe Engineering with our detailed analytical dividend report.

- According our valuation report, there's an indication that Tomoe Engineering's share price might be on the cheaper side.

Mars Group Holdings (TSE:6419)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Mars Group Holdings Corporation, with a market cap of ¥60.78 billion, operates in Japan through its subsidiaries in the amusement, automatic recognition system, and hotel and restaurant sectors.

Operations: Mars Group Holdings Corporation generates revenue from its amusement segment (¥37.59 billion), smart solution related business (¥5.34 billion), and hotel/restaurant related business (¥2.48 billion).

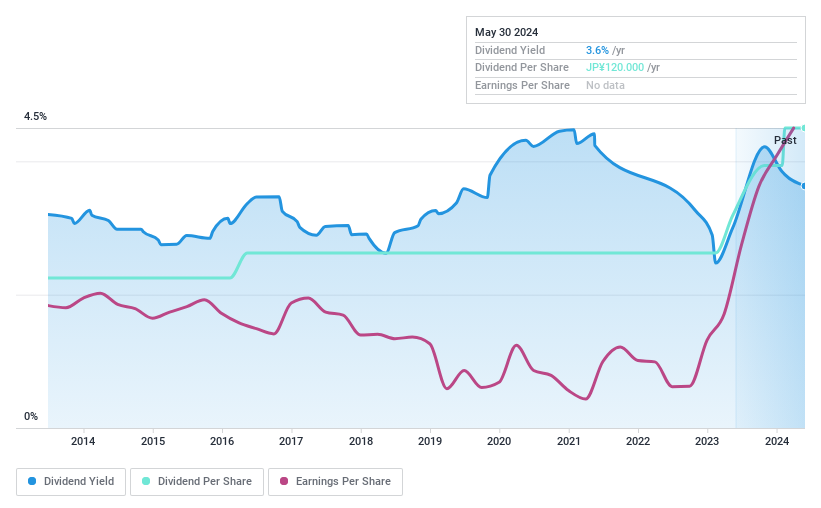

Dividend Yield: 5.9%

Mars Group Holdings offers an attractive dividend yield of 5.92%, placing it in Japan's top quartile for dividend payers. The company has consistently increased its dividends over the past decade, with a recent doubling to ¥120 per share. Dividends are well-covered, with a payout ratio of 40.2% and cash payout ratio of 47.3%. Trading significantly below its estimated fair value, Mars Group presents a compelling option for income-focused investors seeking stability and growth potential.

- Unlock comprehensive insights into our analysis of Mars Group Holdings stock in this dividend report.

- The valuation report we've compiled suggests that Mars Group Holdings' current price could be quite moderate.

Okinawa Financial Group (TSE:7350)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Okinawa Financial Group, Inc. offers a range of financial services and has a market cap of ¥54.04 billion.

Operations: Okinawa Financial Group, Inc. generates revenue through its Banking Segment with ¥37.17 billion and the Leasing Industry with ¥11.27 billion.

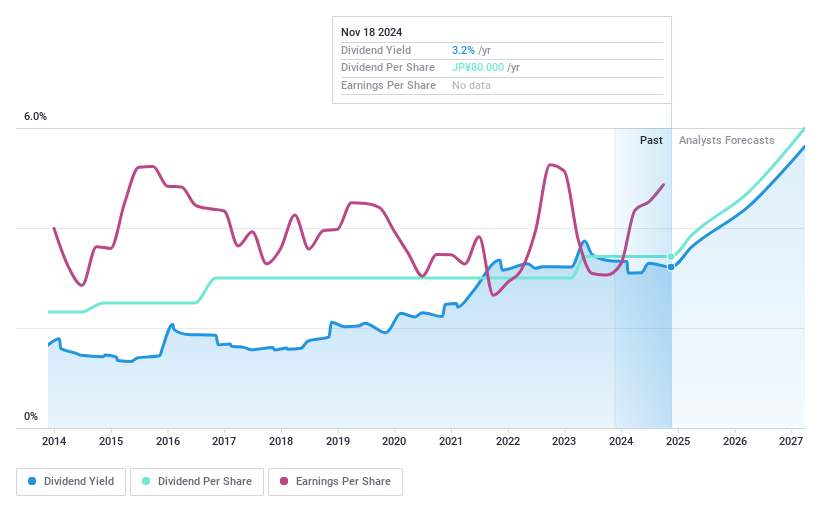

Dividend Yield: 3.6%

Okinawa Financial Group's dividend payments have been reliable and growing over the past decade, supported by a low payout ratio of 26.2%. However, its dividend yield of 3.56% is below the top quartile in Japan. The stock trades at a significant discount to its estimated fair value and offers good relative value compared to peers. Despite robust earnings growth last year, the allowance for bad loans remains low at 46%, which could be a concern for investors.

- Click here and access our complete dividend analysis report to understand the dynamics of Okinawa Financial Group.

- Insights from our recent valuation report point to the potential undervaluation of Okinawa Financial Group shares in the market.

Next Steps

- Click through to start exploring the rest of the 1980 Top Dividend Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Okinawa Financial Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7350

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives