- Japan

- /

- Marine and Shipping

- /

- TSE:9107

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by AI competition fears and fluctuating corporate earnings, investors are keenly observing the Federal Reserve's steady interest rate policy amid persistent inflation. With the Dow Jones Industrial Average showing resilience despite broader market volatility, dividend stocks present an appealing option for those seeking stability and income in uncertain times. A good dividend stock typically offers consistent payouts and financial health, attributes that can provide a buffer against market turbulence highlighted by recent economic developments.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.97% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.85% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.29% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

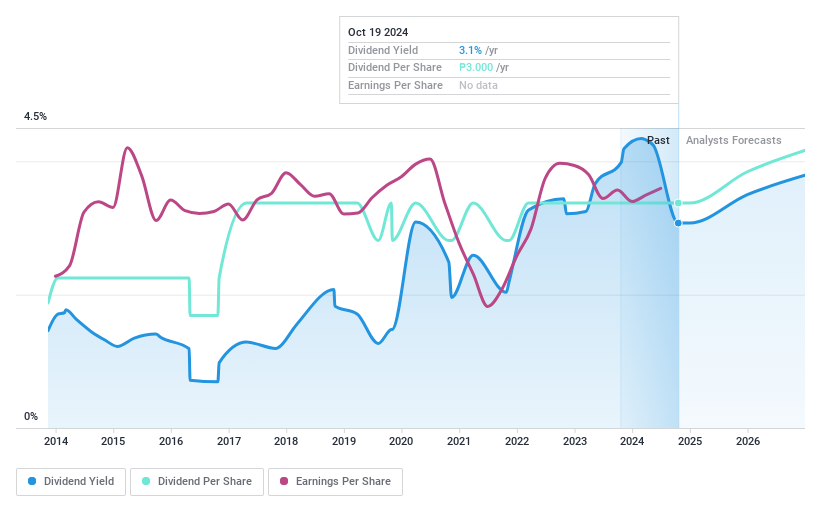

Security Bank (PSE:SECB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Security Bank Corporation, with a market cap of ₱56.14 billion, offers a range of banking and financial products and services to both wholesale and retail clients in the Philippines.

Operations: Security Bank's revenue segments include Retail Banking at ₱2.86 billion, Business Banking at ₱1.56 billion, and Wholesale Banking at ₱7.61 billion, while Financial Markets reported a negative contribution of -₱0.53 billion.

Dividend Yield: 3.9%

Security Bank's dividend yield of 3.89% is below the top tier in the PH market, and its dividend payments have been volatile over the past decade. Despite this, dividends are well covered by earnings with a low payout ratio of 22.6%, forecasted to improve further. While earnings have shown modest growth, concerns include a high level of bad loans at 3.4% and recent executive changes that may impact strategic direction.

- Unlock comprehensive insights into our analysis of Security Bank stock in this dividend report.

- Our valuation report unveils the possibility Security Bank's shares may be trading at a discount.

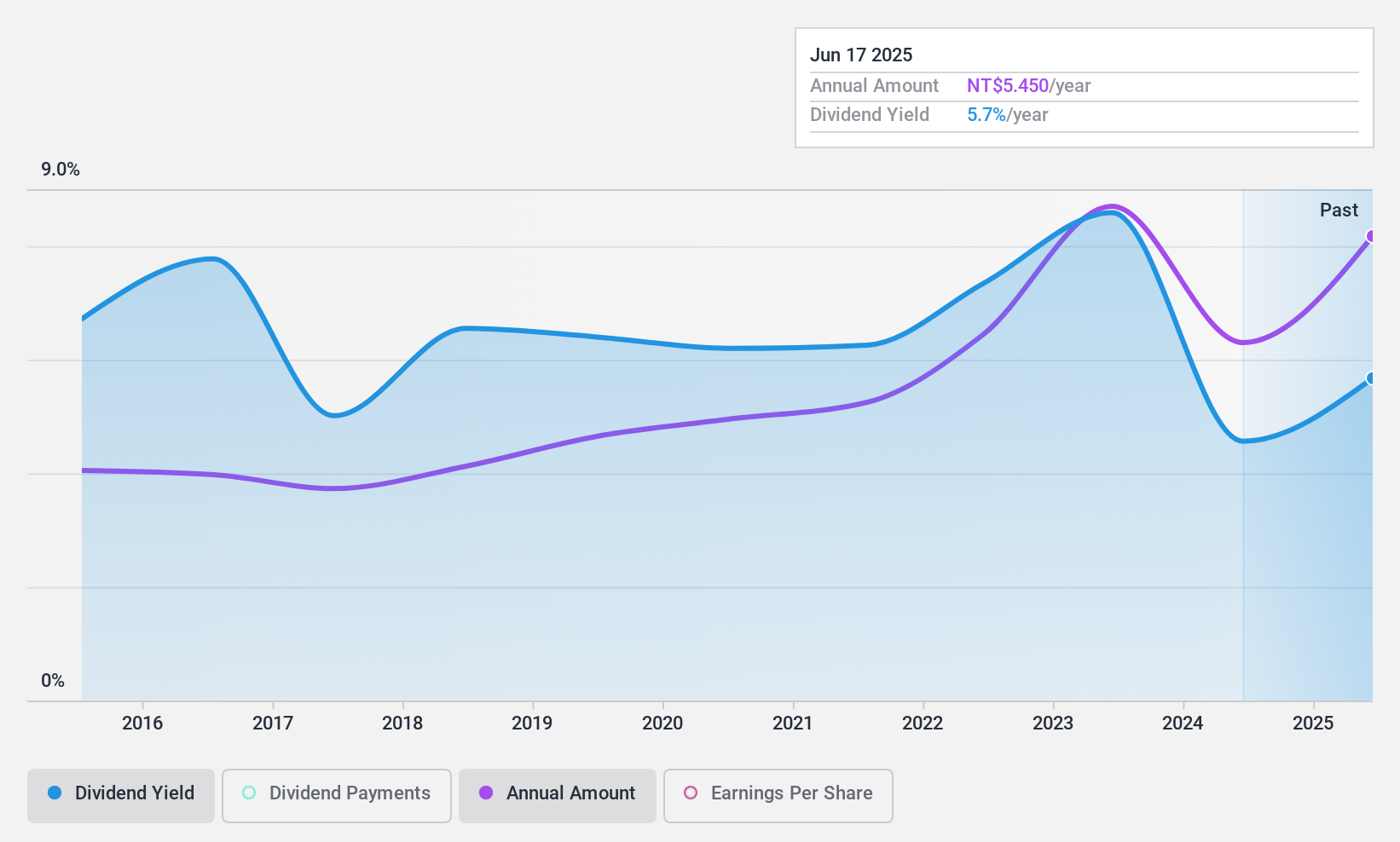

Asia Tech Image (TPEX:4974)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Asia Tech Image Inc. designs, develops, and manufactures customized contact image sensor modules in Taiwan, China, and Myanmar with a market cap of NT$7.69 billion.

Operations: Asia Tech Image's revenue segments include NT$5.44 billion from Asia and NT$3.86 billion from Domestic markets.

Dividend Yield: 3.6%

Asia Tech Image's dividend yield of 3.61% is lower than the top tier in the TW market. While dividends are covered by earnings with a payout ratio of 67.8% and cash flows at 51.4%, they have been volatile over the past decade, raising concerns about reliability. Despite trading below its estimated fair value, recent financials show growth with Q3 sales at TWD 1.34 billion and net income at TWD 137.43 million, indicating potential for future stability.

- Click here to discover the nuances of Asia Tech Image with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Asia Tech Image's share price might be too pessimistic.

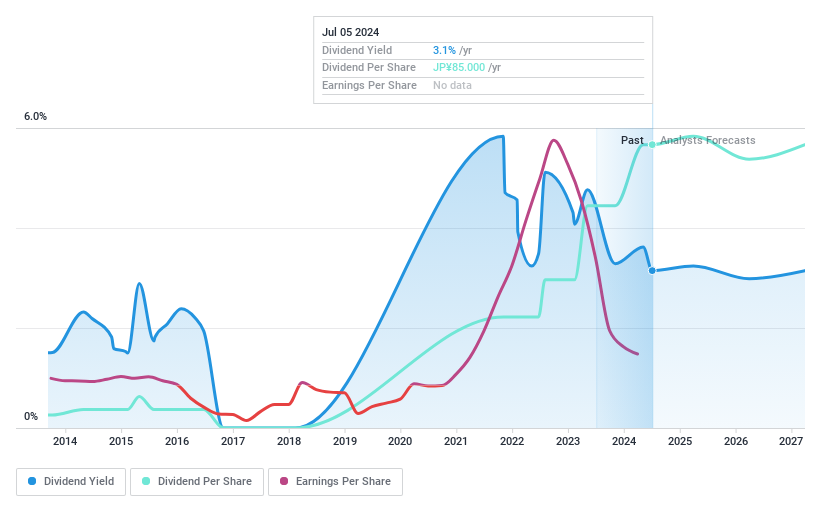

Kawasaki Kisen Kaisha (TSE:9107)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kawasaki Kisen Kaisha, Ltd. offers marine, land, and air transportation services across Japan, the United States, Europe, Asia, and globally with a market cap of ¥1.26 trillion.

Operations: Kawasaki Kisen Kaisha's revenue is primarily derived from its Product Logistics segment at ¥600.11 billion, followed by Dry Bulk at ¥329.04 billion and Resource transportation services at ¥106.31 billion.

Dividend Yield: 4.9%

Kawasaki Kisen Kaisha's dividend yield of 4.87% ranks in the top 25% in Japan, offering a compelling return despite its volatile history over the past decade. The dividends are well-covered by earnings with a payout ratio of 30.9% and supported by cash flows at 65.4%. Recent governance changes aim to enable flexible capital and dividend policies, potentially enhancing shareholder returns. However, earnings are projected to decline significantly in the coming years, which may impact future payouts.

- Navigate through the intricacies of Kawasaki Kisen Kaisha with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Kawasaki Kisen Kaisha is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Click this link to deep-dive into the 1959 companies within our Top Dividend Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kawasaki Kisen Kaisha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9107

Kawasaki Kisen Kaisha

Provides marine, land, and air transportation services in Japan, the United States, Europe, Asia, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives