Undiscovered Gems Three Promising Stocks With Strong Potential

Reviewed by Simply Wall St

In the current market landscape, U.S. small-cap stocks have joined their larger peers in reaching record highs, driven by a mix of geopolitical developments and robust consumer spending despite ongoing manufacturing challenges. As investors navigate these dynamic conditions, identifying promising stocks often involves looking for companies with strong fundamentals and growth potential that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.72% | -3.47% | -13.16% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Boai NKY Medical Holdings (SZSE:300109)

Simply Wall St Value Rating: ★★★★★★

Overview: Boai NKY Medical Holdings Ltd. operates in the fine chemical and medical care sectors both within China and internationally, with a market cap of CN¥7.17 billion.

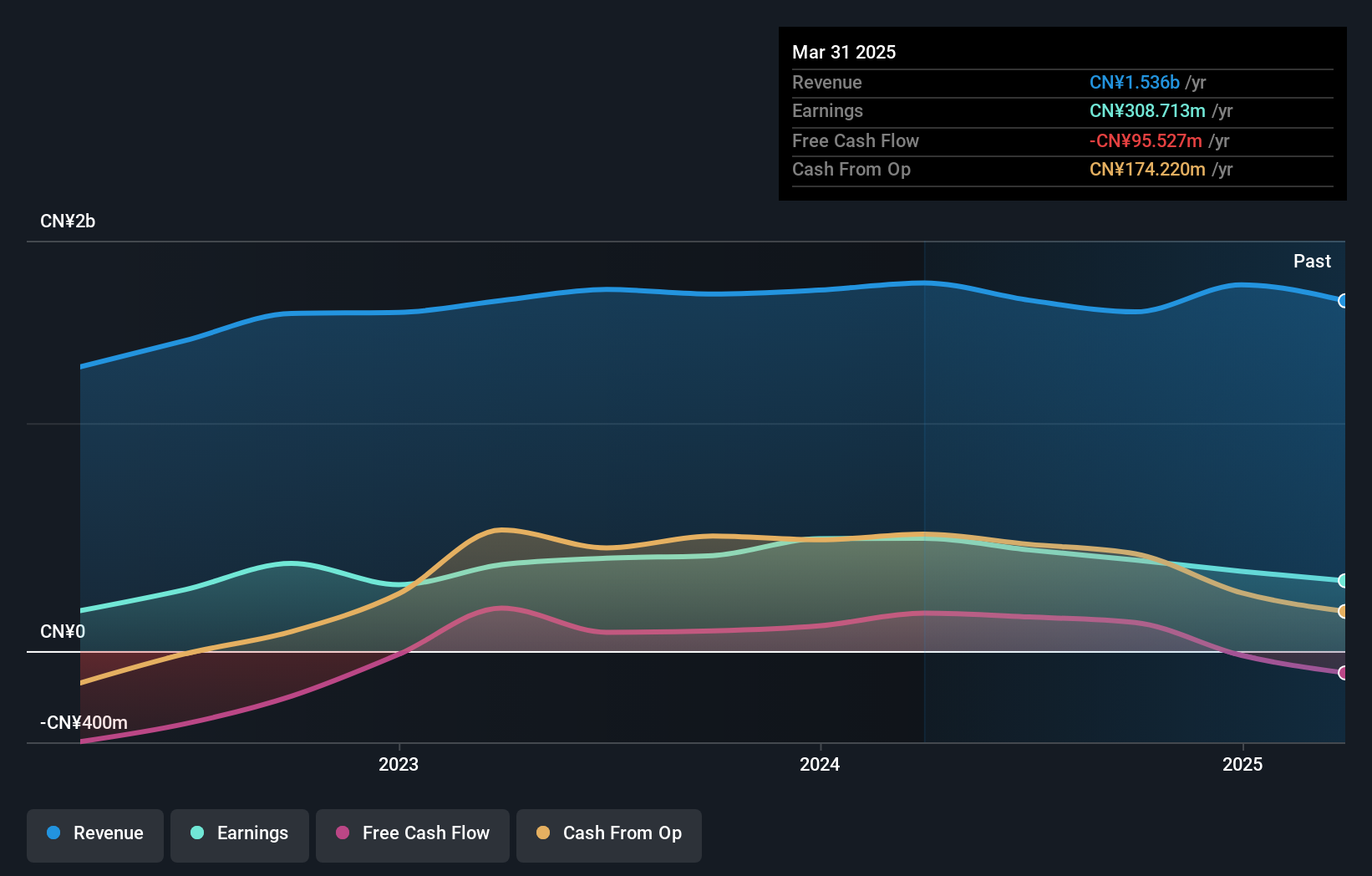

Operations: Boai NKY generates revenue primarily from its fine chemical and medical care segments. The company's net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and cost management.

Boai NKY Medical Holdings, a smaller player in the medical sector, has seen its debt to equity ratio improve significantly from 27.4% to 11.6% over five years, indicating prudent financial management. Despite a dip in net income from CNY 404.92 million to CNY 311.24 million for the nine months ending September 2024, the company's price-to-earnings ratio of 21.5x remains attractive compared to the broader CN market at 36.7x. Earnings per share have decreased slightly but remain robust with basic EPS at CNY 0.66 and diluted EPS at CNY 0.65, suggesting resilience amidst challenging conditions.

Xintec (TPEX:3374)

Simply Wall St Value Rating: ★★★★★★

Overview: Xintec Inc. is a wafer level chip scale packaging company with operations in Asia, the United States, and Europe, and it has a market cap of NT$53.05 billion.

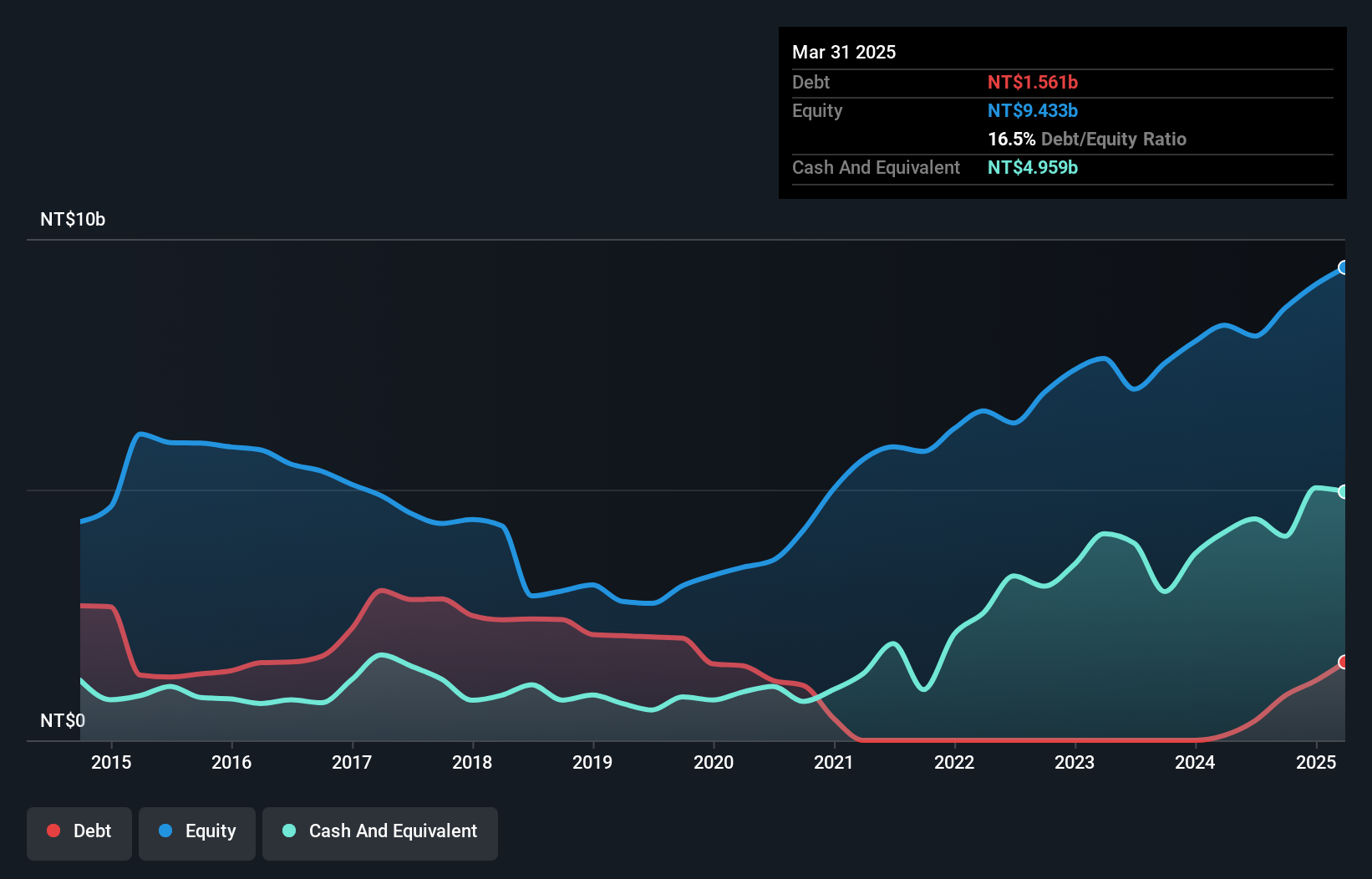

Operations: Xintec generates revenue primarily from its semiconductor equipment and services segment, amounting to NT$7.03 billion.

Xintec, a player in the semiconductor field, showcases robust financial health with high-quality earnings and a solid debt-to-equity ratio improvement from 66% to 10.3% over five years. Recent earnings reports highlight growth, with Q3 sales at TWD 2.17 billion and net income reaching TWD 561.78 million, both up from last year. Basic EPS rose to TWD 2.07 from TWD 1.89 previously, reflecting strong performance despite market volatility. The company also outpaced industry growth rates with an impressive annual earnings increase of 18.1%, suggesting promising prospects amidst its current challenges in share price stability.

- Delve into the full analysis health report here for a deeper understanding of Xintec.

Evaluate Xintec's historical performance by accessing our past performance report.

Advanced Echem Materials (TPEX:4749)

Simply Wall St Value Rating: ★★★★★☆

Overview: Advanced Echem Materials Company Limited specializes in developing and manufacturing special chemical materials for semiconductor and display applications in Taiwan, with a market cap of NT$57.85 billion.

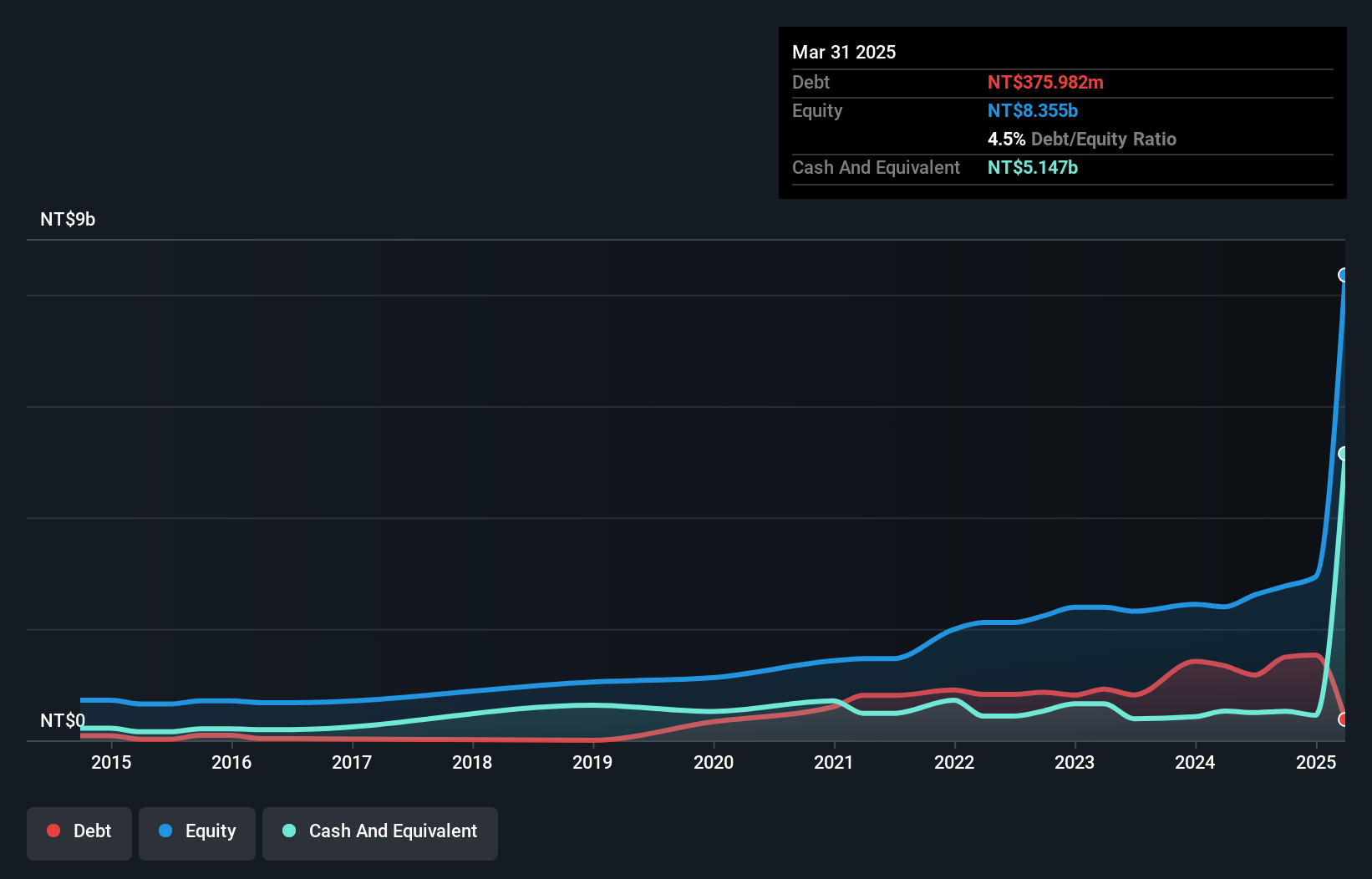

Operations: Advanced Echem Materials generates revenue primarily from the sale of special chemical materials for semiconductor and display applications. The company has a market capitalization of NT$57.85 billion, reflecting its significant presence in Taiwan's chemical manufacturing sector.

Advanced Echem Materials, a smaller player in the semiconductor sector, has shown promising growth with earnings surging by 63.2% over the past year, outpacing industry averages. The company's recent third-quarter results highlight sales of TWD 856.82 million and net income of TWD 155.72 million, both significantly higher than last year’s figures. Despite not being free cash flow positive, its debt management appears satisfactory with a net debt to equity ratio at 35.1%. Moreover, interest payments are comfortably covered by EBIT at a multiple of 68x, suggesting financial stability amidst its expansion efforts.

- Click here and access our complete health analysis report to understand the dynamics of Advanced Echem Materials.

Learn about Advanced Echem Materials' historical performance.

Turning Ideas Into Actions

- Investigate our full lineup of 4642 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boai NKY Medical Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300109

Boai NKY Medical Holdings

Engages in the fine chemical and medical care businesses in China and internationally.

Flawless balance sheet average dividend payer.