Discover Xinhua Winshare Publishing and Media And 2 Additional Dividend Stocks

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and shifting trade policies, U.S. stock indexes are climbing toward record highs, with growth stocks leading the way. In this dynamic environment, dividend stocks can offer investors a blend of income and potential stability, making them an attractive consideration amidst economic uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.00% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.94% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.90% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.55% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.37% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.29% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1986 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

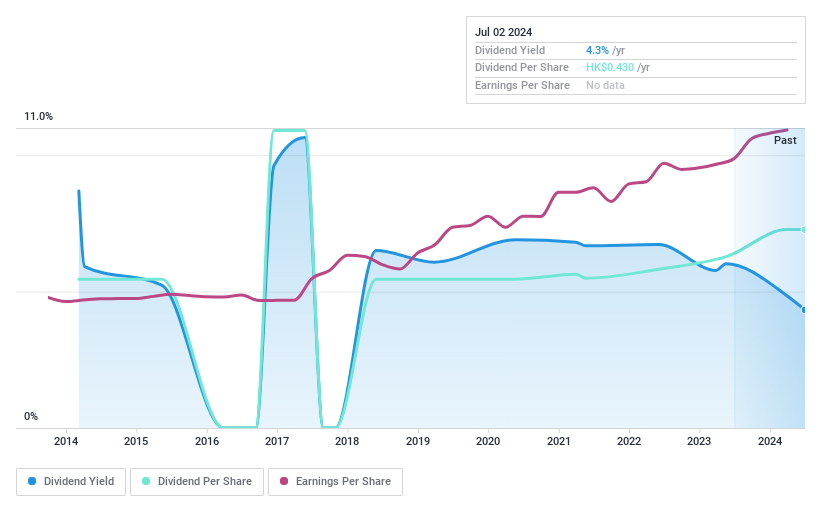

Xinhua Winshare Publishing and Media (SEHK:811)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinhua Winshare Publishing and Media Co., Ltd. (SEHK:811) is engaged in the publishing and media industry, with a market cap of approximately HK$16.97 billion.

Operations: Xinhua Winshare Publishing and Media Co., Ltd. generates revenue primarily from its publishing and media operations, with segments contributing significantly to its financial performance.

Dividend Yield: 3.8%

Xinhua Winshare Publishing and Media's dividend payments, although volatile over the past decade, are well covered by both earnings (payout ratio: 47.6%) and cash flows (cash payout ratio: 26%). Despite trading at a significant discount to its estimated fair value, its dividend yield of 3.78% is low compared to top-tier payers in Hong Kong. Recent board changes include Ms. Yang Miao becoming the sole company secretary as of January 2025.

- Click to explore a detailed breakdown of our findings in Xinhua Winshare Publishing and Media's dividend report.

- Our valuation report here indicates Xinhua Winshare Publishing and Media may be undervalued.

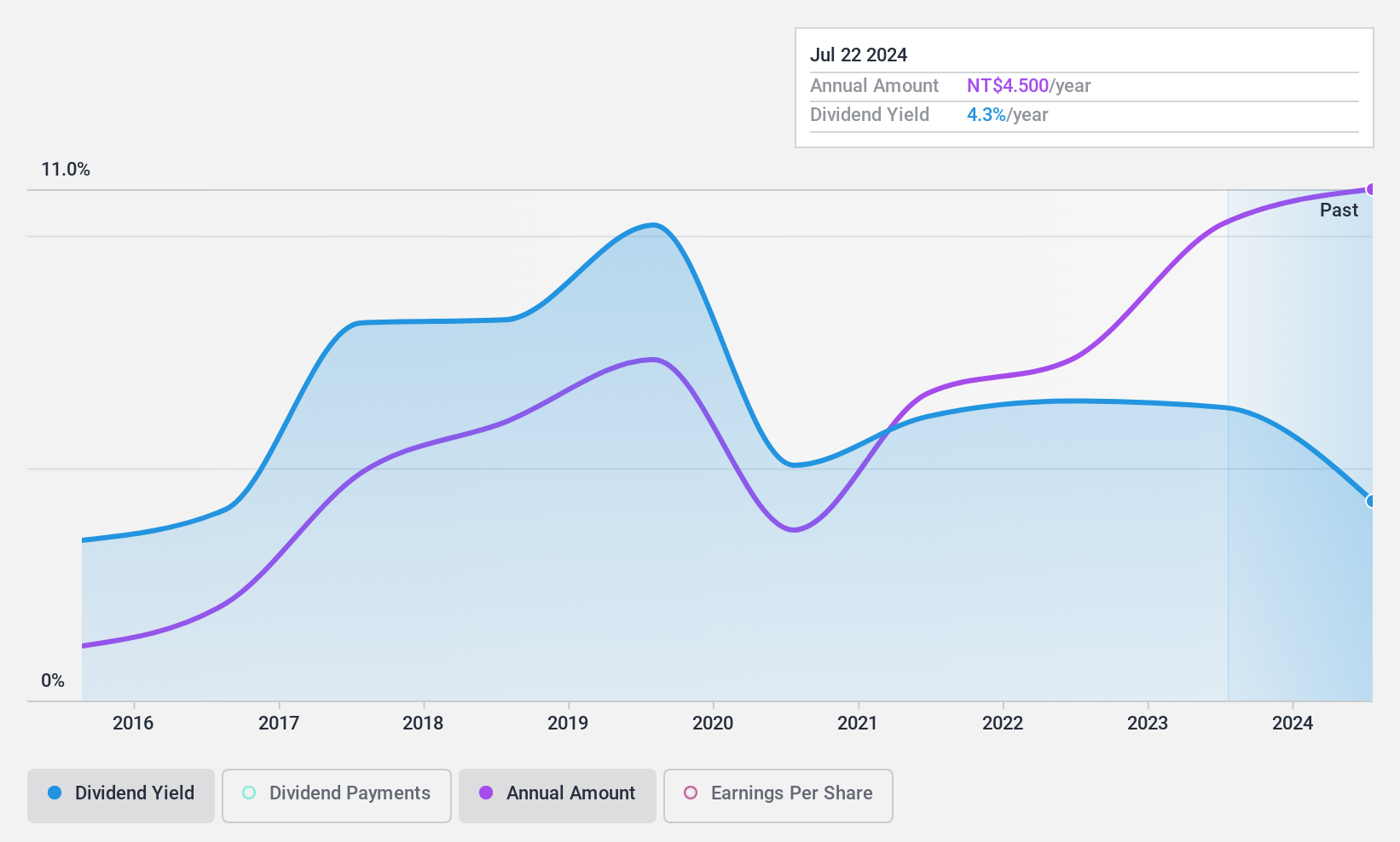

Wholetech System Hitech (TPEX:3402)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wholetech System Hitech Limited offers system integration services across Taiwan, China, and Singapore, with a market capitalization of NT$7.56 billion.

Operations: Wholetech System Hitech Limited generates revenue through its Equipment segment, contributing NT$723.40 million, and its Construction segment, which brings in NT$4.77 billion.

Dividend Yield: 4.3%

Wholetech System Hitech's dividend payments have grown over the past decade but remain unreliable due to volatility. The current yield of 4.33% is slightly below Taiwan's top-tier payers. Dividends are well covered by earnings (payout ratio: 69.1%) and cash flows (cash payout ratio: 35%), indicating sustainability despite the unstable track record. Trading at a discount, Wholetech offers potential value while maintaining reasonable dividend coverage from profits and free cash flow.

- Click here and access our complete dividend analysis report to understand the dynamics of Wholetech System Hitech.

- Our expertly prepared valuation report Wholetech System Hitech implies its share price may be lower than expected.

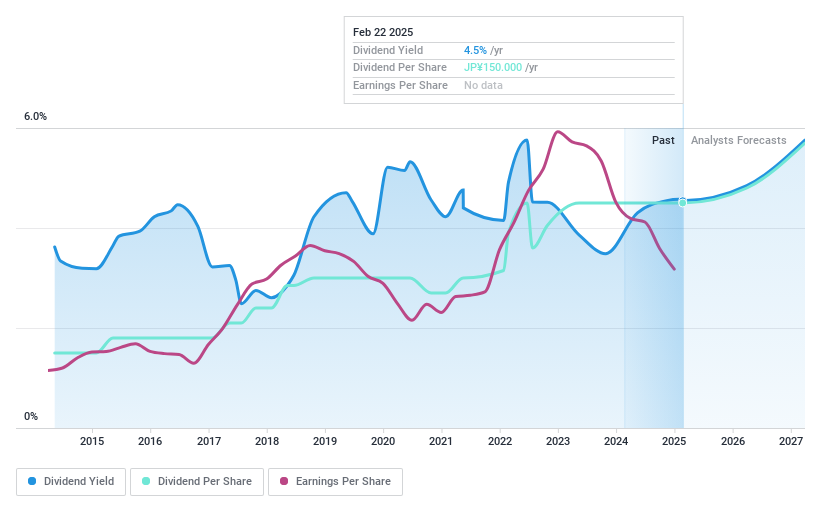

Valqua (TSE:7995)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Valqua, Ltd. is engaged in the design, manufacturing, processing, and sale of fiber, fluorocarbon resin, rubber, and other materials both in Japan and internationally with a market cap of ¥57.80 billion.

Operations: Valqua, Ltd.'s revenue is primarily generated from its Seal Products Business at ¥39.34 billion, followed by the Functional Resin Products Business at ¥18.07 billion and the Silicon Wafer Recycling Business, Etc. contributing ¥3.09 billion.

Dividend Yield: 4.5%

Valqua's dividend yield of 4.54% is among the top 25% in Japan, but its reliability is questionable due to past volatility and lack of free cash flow coverage. While dividends have grown over the last decade, they are not well-supported by cash flows despite a manageable payout ratio of 70.8%. Trading at a discount to estimated fair value, Valqua presents potential value but with caution regarding dividend sustainability and stability.

- Click here to discover the nuances of Valqua with our detailed analytical dividend report.

- Our valuation report here indicates Valqua may be overvalued.

Summing It All Up

- Click this link to deep-dive into the 1986 companies within our Top Dividend Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:811

Xinhua Winshare Publishing and Media

Xinhua Winshare Publishing and Media Co., Ltd.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives