- Japan

- /

- Electronic Equipment and Components

- /

- TSE:7420

3 Top Dividend Stocks With Yields Reaching Up To 7.2%

Reviewed by Simply Wall St

In a week marked by cautious Federal Reserve commentary and looming political uncertainties, global markets have experienced notable fluctuations, with U.S. stocks seeing broad-based declines despite a late-week rally. Amidst this volatility, investors are increasingly turning their attention to dividend stocks as a potential source of steady income in an unpredictable economic landscape. A good dividend stock typically offers a reliable yield and demonstrates strong financial health, making it attractive for those seeking stability amidst market turbulence.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.85% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.45% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.96% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.71% | ★★★★★★ |

Click here to see the full list of 1928 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

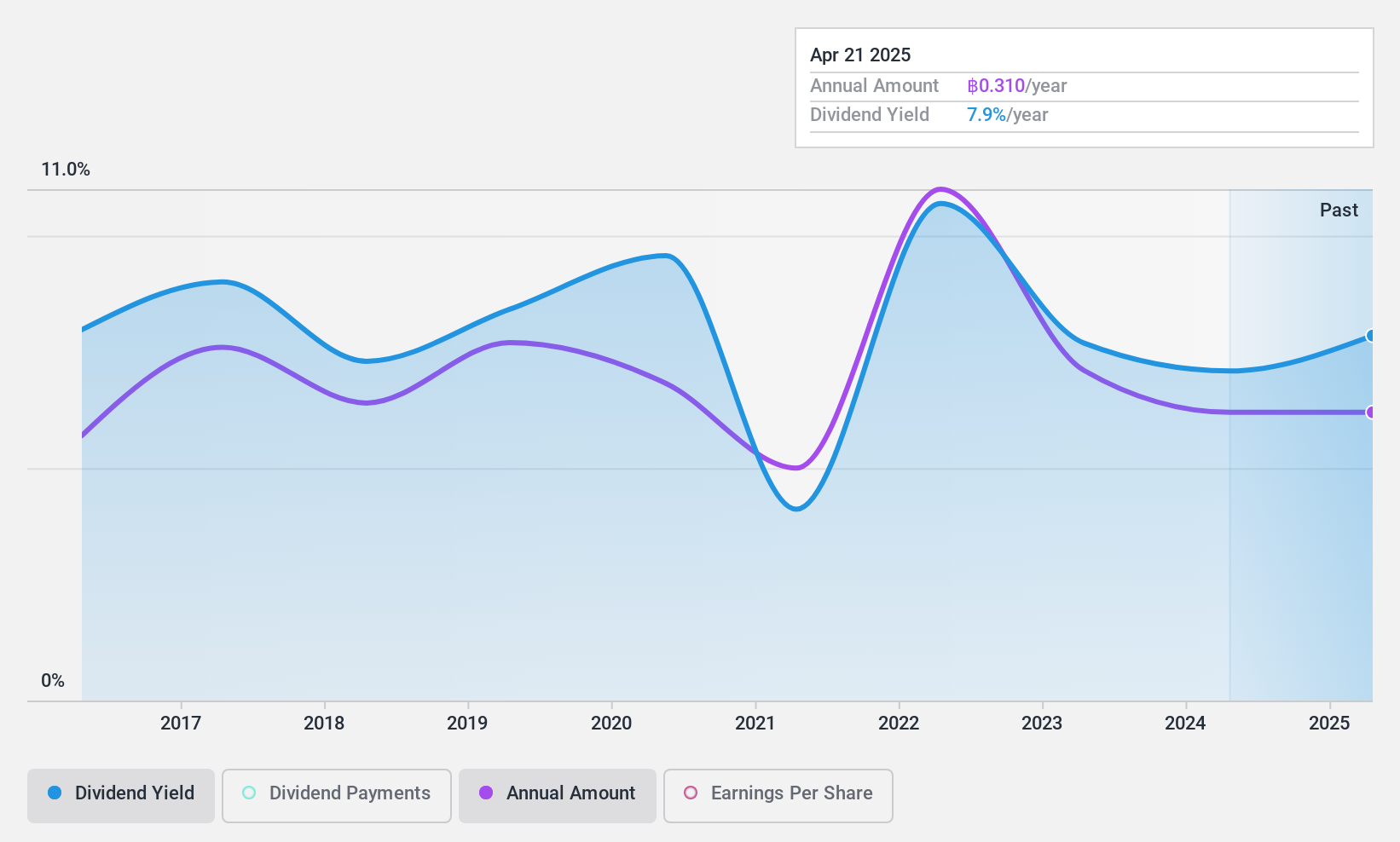

KGI Securities (Thailand) (SET:KGI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KGI Securities (Thailand) Public Company Limited, along with its subsidiaries, operates in the securities and derivatives sector in Thailand, with a market cap of THB8.48 billion.

Operations: KGI Securities (Thailand) Public Company Limited generates revenue from various segments, including Asset Management (THB1.22 billion), Security Trading (THB1.17 billion), Investment Banking (THB65 million), and Securities and Derivatives Brokerage (THB923 million).

Dividend Yield: 7.3%

KGI Securities (Thailand) offers a dividend yield of 7.28%, placing it in the top 25% of Thai market dividend payers. However, its dividends have been volatile and unreliable over the past decade, with payments not consistently growing. Despite this instability, KGI's dividends are well covered by both earnings (payout ratio: 82.6%) and free cash flows (cash payout ratio: 40.5%). The stock currently trades at a discount to its estimated fair value.

- Take a closer look at KGI Securities (Thailand)'s potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of KGI Securities (Thailand) shares in the market.

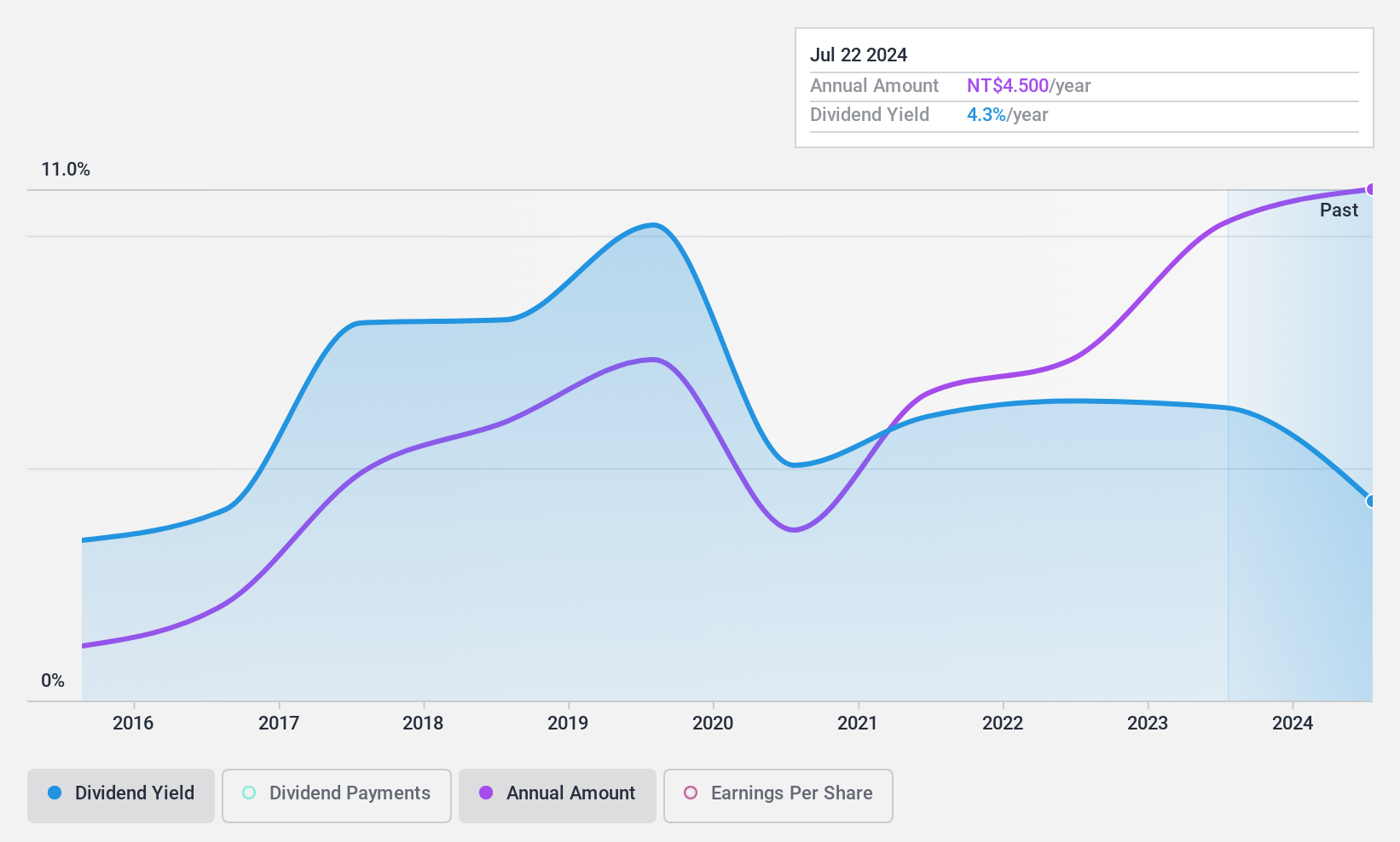

Wholetech System Hitech (TPEX:3402)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wholetech System Hitech Limited offers system integration services across Taiwan, China, and Singapore, with a market capitalization of NT$7.60 billion.

Operations: Wholetech System Hitech Limited generates revenue through its Equipment segment, contributing NT$723.40 million, and its Construction segment, which accounts for NT$4.77 billion.

Dividend Yield: 4.3%

Wholetech System Hitech's dividend yield of 4.33% is slightly below the top tier of Taiwan's market, and its dividends have been volatile over the past decade. Despite this, dividends are well covered by earnings (payout ratio: 69.1%) and cash flows (cash payout ratio: 35%). Recent earnings growth, with a net income increase to TWD 128.79 million in Q3, supports dividend sustainability. The stock trades at a discount to its estimated fair value.

- Delve into the full analysis dividend report here for a deeper understanding of Wholetech System Hitech.

- Our expertly prepared valuation report Wholetech System Hitech implies its share price may be lower than expected.

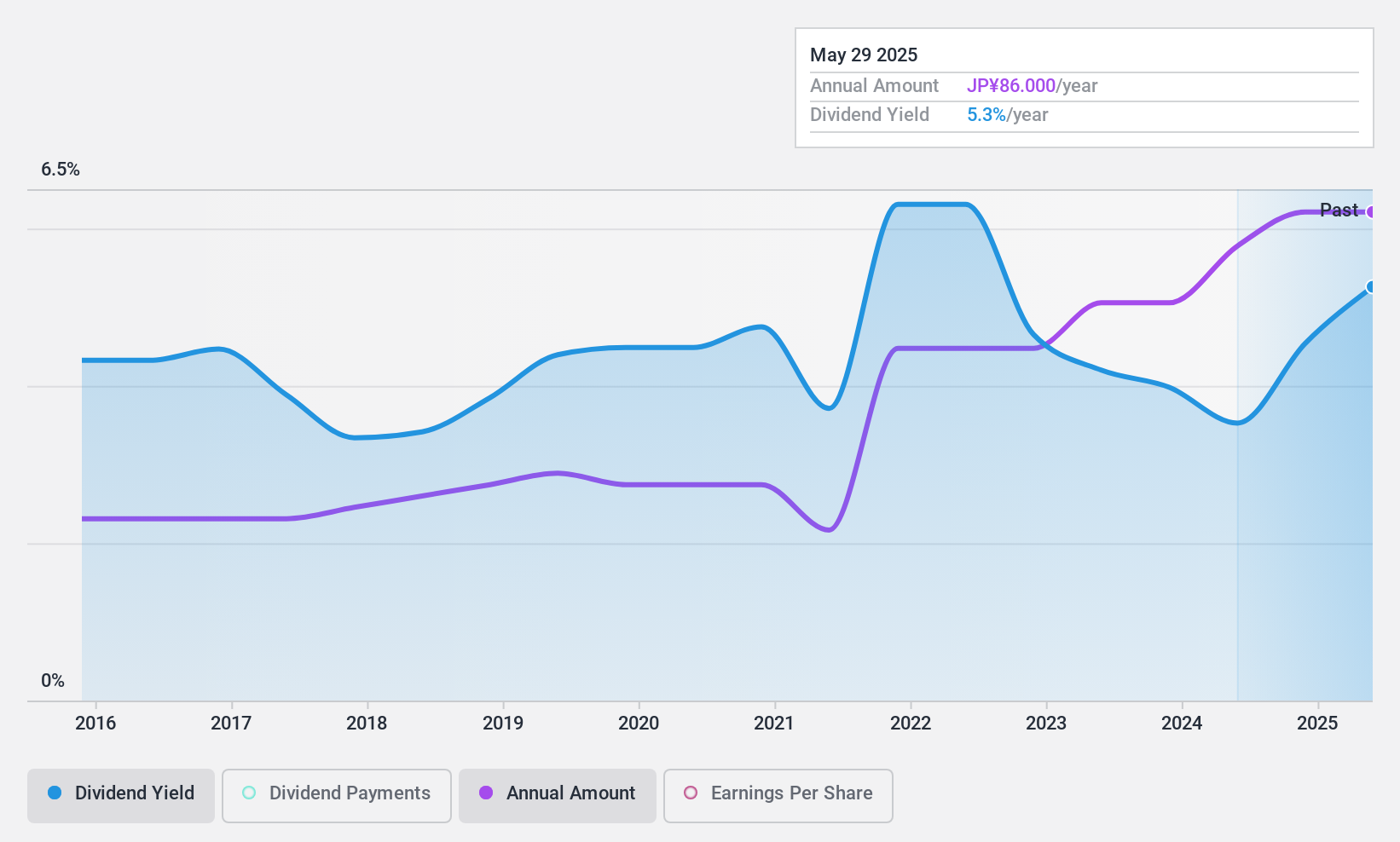

Satori Electric (TSE:7420)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Satori Electric Co., Ltd. and its subsidiaries distribute electronic parts and equipment both in Japan and internationally, with a market cap of ¥25.25 billion.

Operations: Satori Electric Co., Ltd.'s revenue is derived from its Global Business segment at ¥45.99 billion, Mobility Business at ¥35.33 billion, Enterprise Business at ¥47.63 billion, and Industrial Infrastructure Business at ¥29.57 billion.

Dividend Yield: 4.9%

Satori Electric's dividend yield of 4.88% ranks in the top 25% among Japanese dividend payers, though its dividends have been volatile over the past decade. Despite this instability, dividends are well covered by earnings (payout ratio: 53.2%) and cash flows (cash payout ratio: 23.9%). Recent board meetings indicate a focus on shareholder returns, discussing an interim dividend from retained earnings and strategic investments to enhance growth potential. The stock trades significantly below its estimated fair value.

- Dive into the specifics of Satori Electric here with our thorough dividend report.

- According our valuation report, there's an indication that Satori Electric's share price might be on the cheaper side.

Where To Now?

- Click here to access our complete index of 1928 Top Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7420

Satori Electric

Distributes electronic parts and equipment in Japan, China, India, Thailand, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion