As global markets navigate a landscape marked by fluctuating interest rates and economic uncertainties, investors are increasingly looking towards Asia for opportunities. In this context, dividend stocks can offer a compelling blend of income and potential stability, making them an attractive consideration for those seeking to enhance their portfolios amidst evolving market dynamics.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.00% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.76% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.93% | ★★★★★★ |

| NCD (TSE:4783) | 4.48% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.86% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.13% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| Daicel (TSE:4202) | 4.30% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

Click here to see the full list of 1024 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

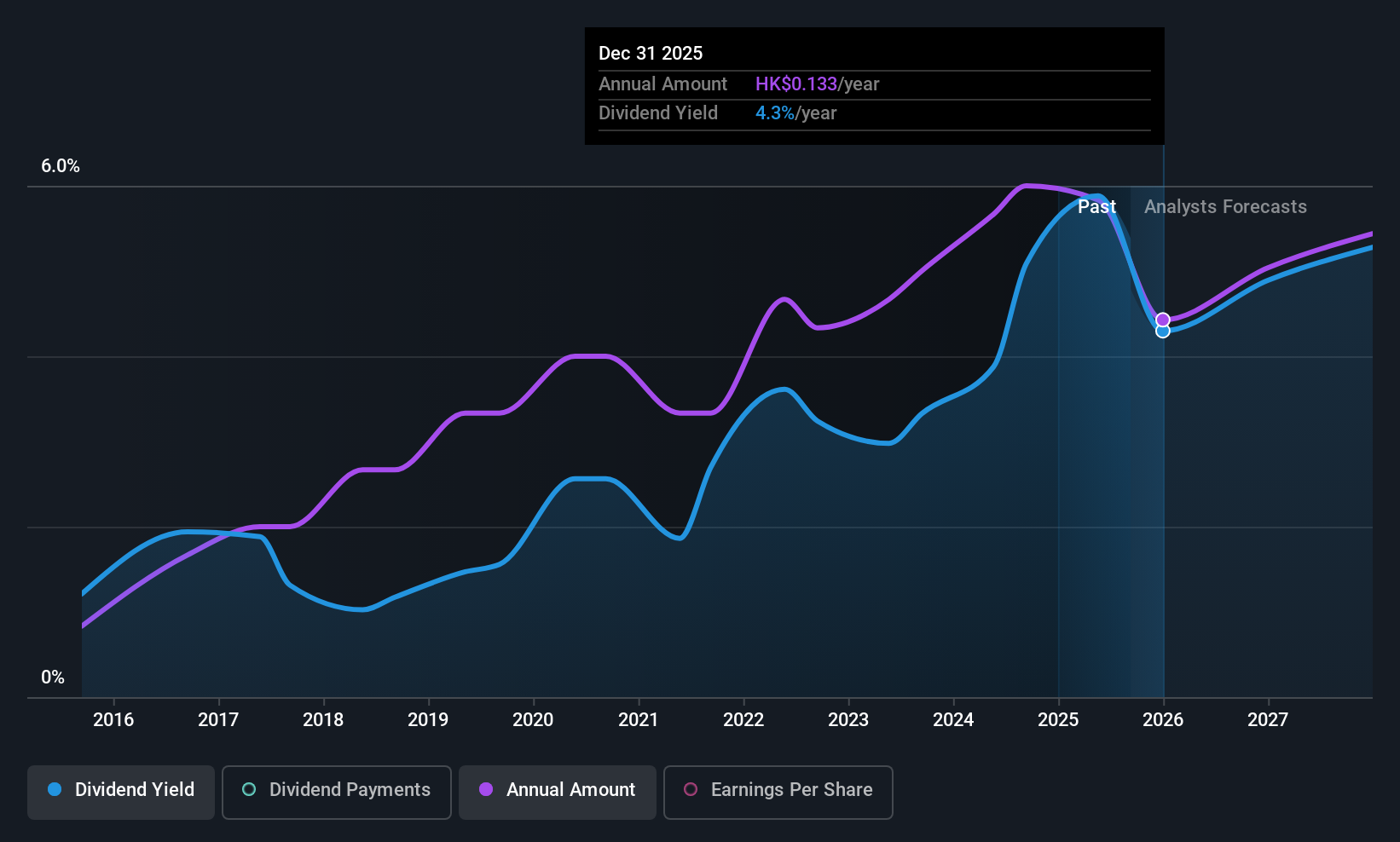

SSY Group (SEHK:2005)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SSY Group Limited is an investment holding company that engages in the research, development, manufacturing, trading, and sale of pharmaceutical products to hospitals and distributors both in China and internationally, with a market cap of HK$9.56 billion.

Operations: SSY Group Limited generates revenue primarily from its Intravenous Infusion Solution and Others segment, contributing HK$4.39 billion, alongside HK$375.23 million from Medical Materials.

Dividend Yield: 5.4%

SSY Group's recent dividend decrease to HK$0.05 per share reflects its current financial challenges, as evidenced by a significant drop in both sales and net income for the first half of 2025. Despite a stable dividend history over the past decade, this reduction raises concerns about sustainability given the lack of free cash flow coverage. Recent regulatory approvals for new drugs could potentially enhance future revenue streams, but immediate impacts on dividends remain uncertain amidst declining profit margins and earnings.

- Unlock comprehensive insights into our analysis of SSY Group stock in this dividend report.

- According our valuation report, there's an indication that SSY Group's share price might be on the expensive side.

AP (Thailand) (SET:AP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: AP (Thailand) Public Company Limited, with a market cap of THB25.80 billion, operates in the real estate development sector in Thailand through its subsidiaries.

Operations: AP (Thailand) Public Company Limited generates revenue primarily from its Low-Rise Segment, which accounts for THB33.94 billion, and its High-Rise Segment, contributing THB1.45 billion.

Dividend Yield: 7.3%

AP (Thailand) has maintained reliable and growing dividends over the past decade, supported by a sustainable payout ratio of 40.9% and reasonable cash flow coverage. Despite recent decreases in net income to THB 1.87 billion for the first half of 2025, dividend payments remain stable with a yield of 7.32%. The company's price-to-earnings ratio is attractive at 5.6x compared to the Thai market average, indicating good relative value for investors focused on dividends.

- Get an in-depth perspective on AP (Thailand)'s performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of AP (Thailand) shares in the market.

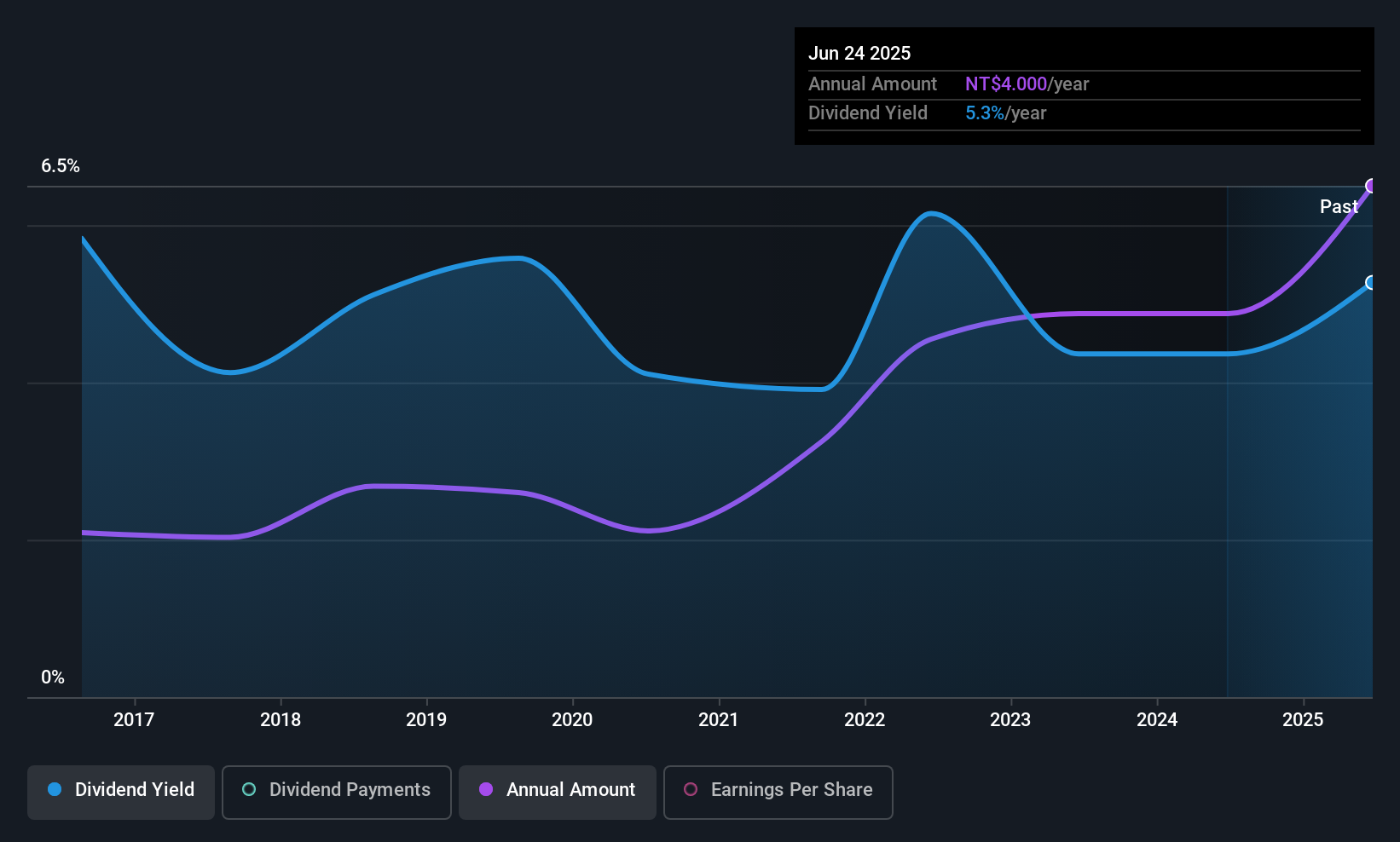

Ardentec (TPEX:3264)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ardentec Corporation offers semiconductor testing solutions for memory, logic, and mixed-signal ICs to various clients globally, with a market cap of NT$38.25 billion.

Operations: Ardentec Corporation generates revenue primarily from its semiconductor testing solutions, with NT$8.11 billion attributed to Ardentec Corporation and NT$4.27 billion from Quanzhi Technology (Shares) Company.

Dividend Yield: 5%

Ardentec's dividend yield of 4.96% is slightly below the top quartile in Taiwan, with a payout ratio of 87.3%, indicating coverage by earnings and cash flows. Despite a history of volatility, dividends have grown over the past decade. Recent earnings show modest growth, with net income rising to TWD 563.3 million for Q2 2025. The stock trades at a favorable price-to-earnings ratio of 17.6x compared to the market average, suggesting good value relative to peers.

- Dive into the specifics of Ardentec here with our thorough dividend report.

- Our expertly prepared valuation report Ardentec implies its share price may be lower than expected.

Next Steps

- Access the full spectrum of 1024 Top Asian Dividend Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2005

SSY Group

An investment holding company, researches, develops, manufactures, trades in, and sells various pharmaceutical products to hospitals and distributors in the People’s Republic of China and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives