- Taiwan

- /

- Semiconductors

- /

- TPEX:5443

How Well Is Gallant Precision Machining (GTSM:5443) Allocating Its Capital?

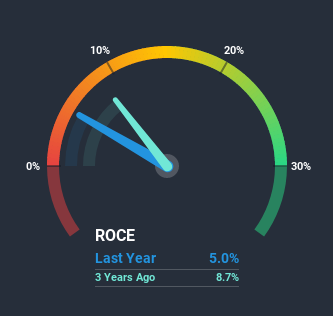

What underlying fundamental trends can indicate that a company might be in decline? More often than not, we'll see a declining return on capital employed (ROCE) and a declining amount of capital employed. Ultimately this means that the company is earning less per dollar invested and on top of that, it's shrinking its base of capital employed. So after we looked into Gallant Precision Machining (GTSM:5443), the trends above didn't look too great.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Gallant Precision Machining, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.05 = NT$170m ÷ (NT$5.7b - NT$2.3b) (Based on the trailing twelve months to September 2020).

Thus, Gallant Precision Machining has an ROCE of 5.0%. Ultimately, that's a low return and it under-performs the Semiconductor industry average of 10%.

Check out our latest analysis for Gallant Precision Machining

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Gallant Precision Machining has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

The Trend Of ROCE

We are a bit worried about the trend of returns on capital at Gallant Precision Machining. Unfortunately the returns on capital have diminished from the 8.2% that they were earning five years ago. Meanwhile, capital employed in the business has stayed roughly the flat over the period. Since returns are falling and the business has the same amount of assets employed, this can suggest it's a mature business that hasn't had much growth in the last five years. If these trends continue, we wouldn't expect Gallant Precision Machining to turn into a multi-bagger.

On a separate but related note, it's important to know that Gallant Precision Machining has a current liabilities to total assets ratio of 40%, which we'd consider pretty high. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.The Key Takeaway

All in all, the lower returns from the same amount of capital employed aren't exactly signs of a compounding machine. Yet despite these poor fundamentals, the stock has gained a huge 358% over the last five years, so investors appear very optimistic. Regardless, we don't feel too comfortable with the fundamentals so we'd be steering clear of this stock for now.

Gallant Precision Machining does come with some risks though, we found 6 warning signs in our investment analysis, and 1 of those can't be ignored...

While Gallant Precision Machining isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

When trading Gallant Precision Machining or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:5443

Gallant Precision Machining

Engages in the research and development, production, manufacture, and sale of flat panel display testing, semiconductor assembly, and intelligent automation equipment in Taiwan, China, and internationally.

Excellent balance sheet with questionable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026