- Taiwan

- /

- Semiconductors

- /

- TPEX:5274

Are Strong Financial Prospects The Force That Is Driving The Momentum In ASPEED Technology Inc.'s GTSM:5274) Stock?

Most readers would already be aware that ASPEED Technology's (GTSM:5274) stock increased significantly by 18% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. In this article, we decided to focus on ASPEED Technology's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for ASPEED Technology

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for ASPEED Technology is:

36% = NT$1.0b ÷ NT$2.8b (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.36 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

ASPEED Technology's Earnings Growth And 36% ROE

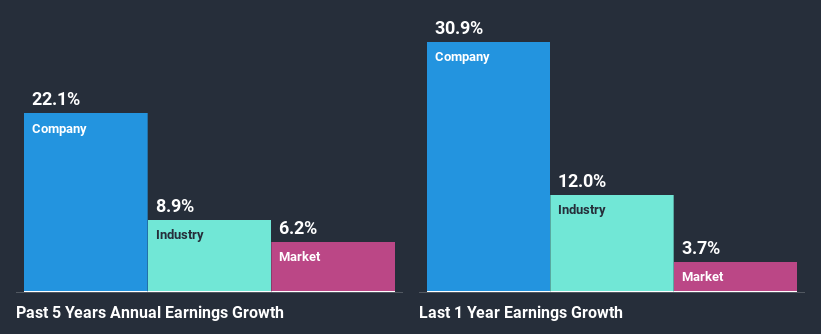

To begin with, ASPEED Technology has a pretty high ROE which is interesting. Additionally, the company's ROE is higher compared to the industry average of 11% which is quite remarkable. As a result, ASPEED Technology's exceptional 22% net income growth seen over the past five years, doesn't come as a surprise.

As a next step, we compared ASPEED Technology's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 8.9%.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. Is ASPEED Technology fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is ASPEED Technology Efficiently Re-investing Its Profits?

ASPEED Technology's significant three-year median payout ratio of 83% (where it is retaining only 17% of its income) suggests that the company has been able to achieve a high growth in earnings despite returning most of its income to shareholders.

Additionally, ASPEED Technology has paid dividends over a period of eight years which means that the company is pretty serious about sharing its profits with shareholders. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 84%. Regardless, the future ROE for ASPEED Technology is predicted to rise to 45% despite there being not much change expected in its payout ratio.

Conclusion

On the whole, we feel that ASPEED Technology's performance has been quite good. In particular, its high ROE is quite noteworthy and also the probable explanation behind its considerable earnings growth. Yet, the company is retaining a small portion of its profits. Which means that the company has been able to grow its earnings in spite of it, so that's not too bad. We also studied the latest analyst forecasts and found that the company's earnings growth is expected be similar to its current growth rate. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

If you decide to trade ASPEED Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:5274

ASPEED Technology

Operates as a fabless integrated circuit (IC) design company in Taiwan, China, the United States, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives