- Japan

- /

- Commercial Services

- /

- TSE:9308

Top Three Dividend Stocks To Consider In Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a period of volatility marked by AI competition fears and mixed earnings reports, investors are seeking stability amidst fluctuating indices. In such an environment, dividend stocks can offer a reliable income stream and potential for long-term growth, making them an appealing consideration for those looking to balance their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.84% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.05% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.70% | ★★★★★★ |

Click here to see the full list of 1961 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Mildef Crete (TPEX:3213)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mildef Crete Inc. and its subsidiaries engage in the research, design, planning, manufacturing, sales, importation, and exportation of computer software, hardware, and components across Taiwan and several international markets including Germany, the United Kingdom, Sweden, and the United States; it has a market cap of NT$4.95 billion.

Operations: Mildef Crete Inc. generates revenue primarily from its computer hardware segment, which accounts for NT$2.96 billion.

Dividend Yield: 6.4%

Mildef Crete's dividend yield of 6.4% ranks in the top 25% of Taiwan's market, yet its sustainability is questionable due to a high cash payout ratio (112.5%) and unreliable history over the past decade. Despite earnings growth of 41.7%, dividends remain volatile with coverage issues by free cash flow, though they are covered by earnings with a payout ratio of 56.3%. Recent earnings show mixed results, impacting future dividend stability considerations.

- Take a closer look at Mildef Crete's potential here in our dividend report.

- The analysis detailed in our Mildef Crete valuation report hints at an deflated share price compared to its estimated value.

Inui Global Logistics (TSE:9308)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inui Global Logistics Co., Ltd. operates in shipping, warehousing, and realty sectors both in Japan and internationally, with a market cap of ¥42.05 billion.

Operations: Inui Global Logistics Co., Ltd. generates revenue from its Logistics - Ocean Voyage Business with ¥23.03 billion, the Logistics - Warehousing and Transportation Business contributing ¥3.83 billion, and the Real Estate Business adding ¥4.41 billion.

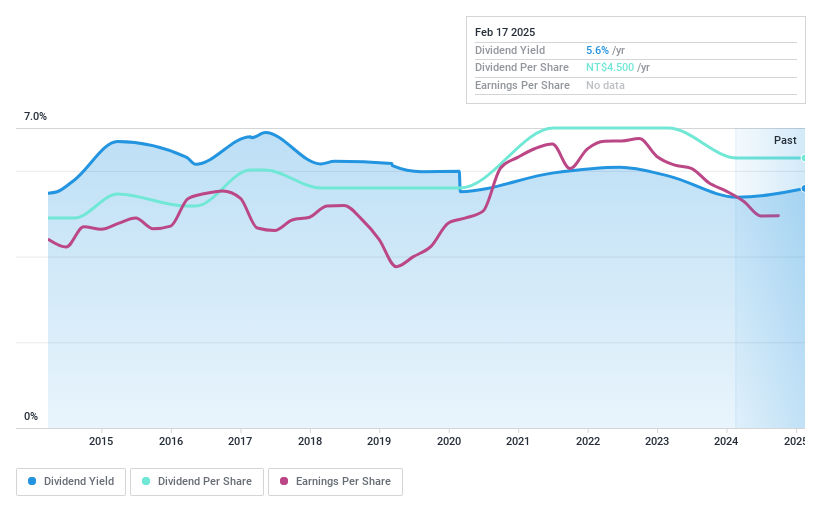

Dividend Yield: 6.7%

Inui Global Logistics offers a high dividend yield of 6.69%, placing it among the top 25% in Japan. However, its sustainability is challenged by a high cash payout ratio (135.2%) and unreliable dividend history over the past decade, despite earnings coverage with a low payout ratio of 10.4%. Earnings grew significantly by 66.4% last year, yet dividends remain volatile and not well-supported by free cash flows due to large one-off items impacting results.

- Get an in-depth perspective on Inui Global Logistics' performance by reading our dividend report here.

- According our valuation report, there's an indication that Inui Global Logistics' share price might be on the expensive side.

E-Life (TWSE:6281)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: E-Life Corporation operates as a retailer of home appliances, computers, and mobile devices in Taiwan with a market capitalization of NT$7.92 billion.

Operations: E-Life Corporation's revenue from its Channel Sales Business of 3C Home Appliances amounts to NT$19.82 billion.

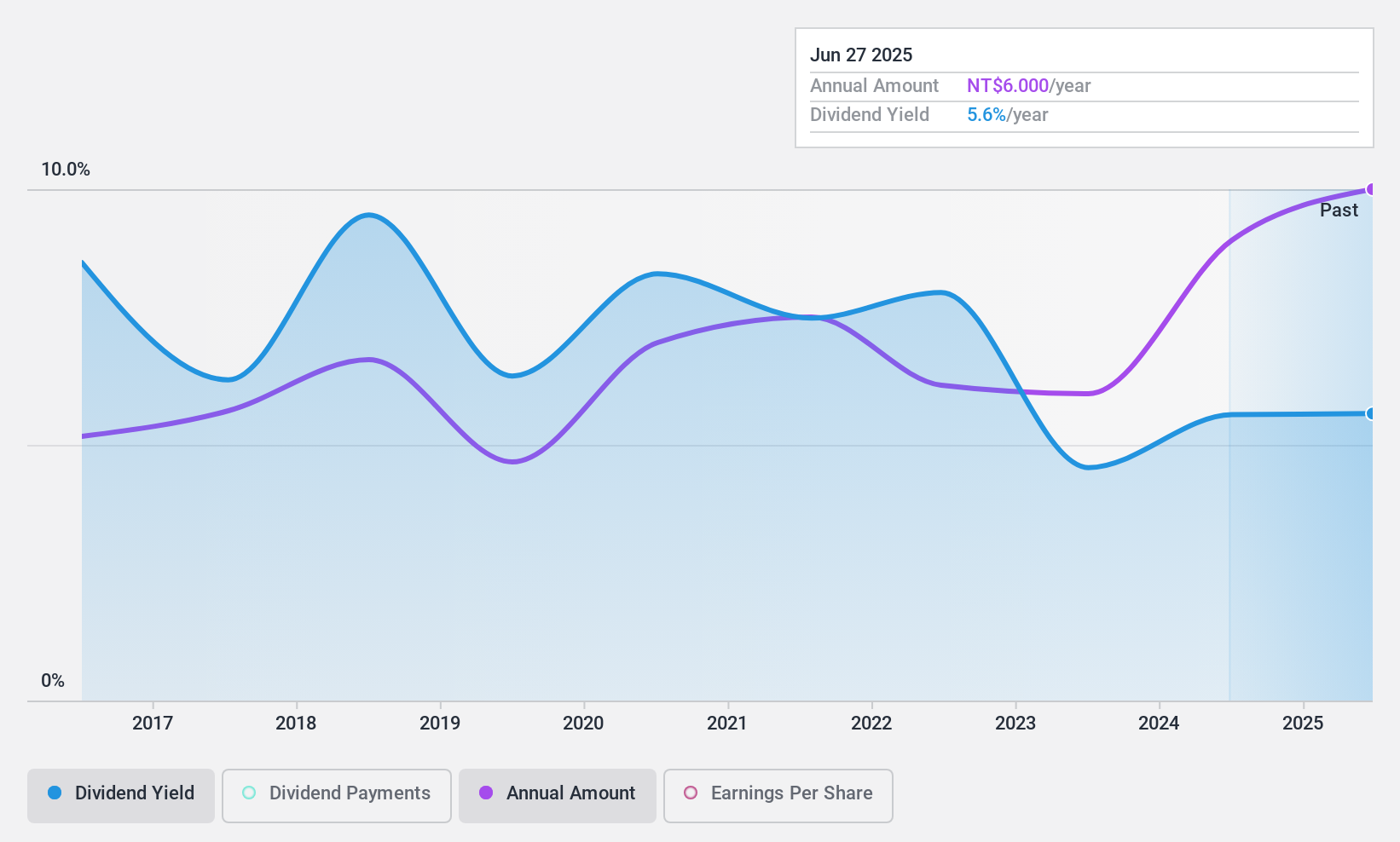

Dividend Yield: 5.6%

E-Life's dividend yield of 5.63% ranks in the top 25% of Taiwan's market, but its sustainability is questionable with a high payout ratio (97.9%) not covered by earnings. However, dividends are stable and have grown over the past decade, supported by a low cash payout ratio (27.5%). Despite trading at 78.9% below estimated fair value, reliance on cash flow rather than earnings for dividends raises concerns about long-term viability.

- Delve into the full analysis dividend report here for a deeper understanding of E-Life.

- In light of our recent valuation report, it seems possible that E-Life is trading behind its estimated value.

Summing It All Up

- Dive into all 1961 of the Top Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9308

Inui Global Logistics

Engages in shipping, warehousing, and realty businesses in Japan and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives