- Taiwan

- /

- Specialty Stores

- /

- TWSE:2911

Reflecting on Les Enphants' (TPE:2911) Share Price Returns Over The Last Five Years

While it may not be enough for some shareholders, we think it is good to see the Les Enphants Co., Ltd. (TPE:2911) share price up 24% in a single quarter. But that doesn't change the fact that the returns over the last five years have been less than pleasing. In fact, the share price is down 51%, which falls well short of the return you could get by buying an index fund.

View our latest analysis for Les Enphants

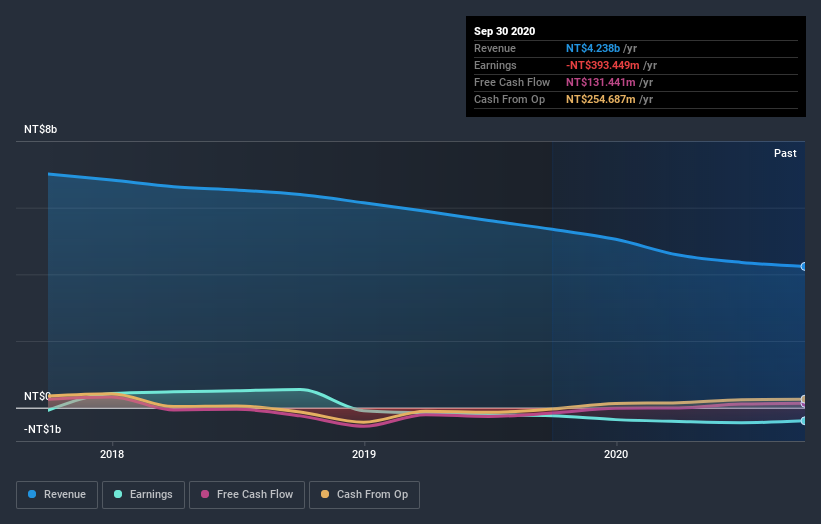

Because Les Enphants made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade Les Enphants reduced its trailing twelve month revenue by 15% for each year. That puts it in an unattractive cohort, to put it mildly. It seems appropriate, then, that the share price slid about 9% annually during that time. It's fair to say most investors don't like to invest in loss making companies with falling revenue. You'd want to research this company pretty thoroughly before buying, it looks a bit too risky for us.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Les Enphants' total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Les Enphants' TSR of was a loss of 49% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Les Enphants shareholders gained a total return of 7.5% during the year. But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 8% endured over half a decade. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Les Enphants better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Les Enphants (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

Of course Les Enphants may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade Les Enphants, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2911

Les Enphants

Manufactures and sells clothes, toys, and supplies for children and infants.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives