- Taiwan

- /

- Real Estate

- /

- TWSE:2501

We Think Cathay Real Estate DevelopmentLtd (TPE:2501) Is Taking Some Risk With Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Cathay Real Estate Development Co.,Ltd. (TPE:2501) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Cathay Real Estate DevelopmentLtd

What Is Cathay Real Estate DevelopmentLtd's Net Debt?

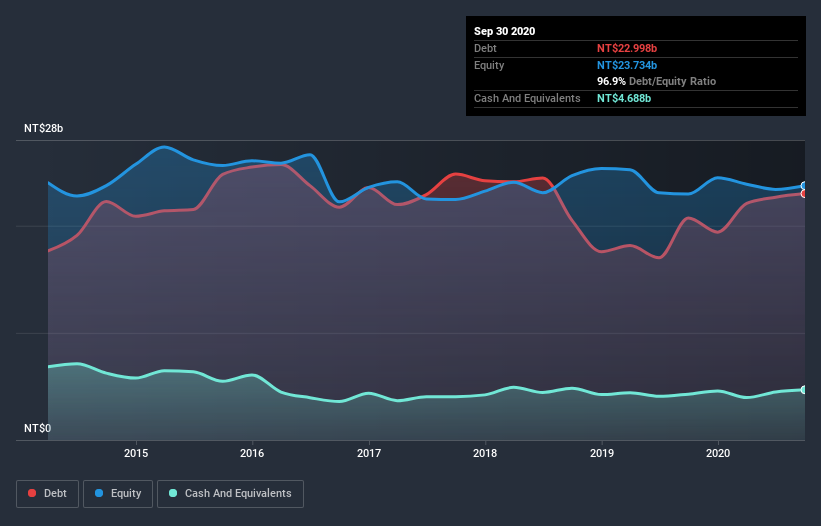

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Cathay Real Estate DevelopmentLtd had NT$23.0b of debt, an increase on NT$20.7b, over one year. On the flip side, it has NT$4.69b in cash leading to net debt of about NT$18.3b.

A Look At Cathay Real Estate DevelopmentLtd's Liabilities

Zooming in on the latest balance sheet data, we can see that Cathay Real Estate DevelopmentLtd had liabilities of NT$24.5b due within 12 months and liabilities of NT$11.2b due beyond that. Offsetting these obligations, it had cash of NT$4.69b as well as receivables valued at NT$520.4m due within 12 months. So it has liabilities totalling NT$30.4b more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's NT$22.1b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

As it happens Cathay Real Estate DevelopmentLtd has a fairly concerning net debt to EBITDA ratio of 11.0 but very strong interest coverage of 29.9. This means that unless the company has access to very cheap debt, that interest expense will likely grow in the future. Unfortunately, Cathay Real Estate DevelopmentLtd's EBIT flopped 11% over the last four quarters. If earnings continue to decline at that rate then handling the debt will be more difficult than taking three children under 5 to a fancy pants restaurant. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Cathay Real Estate DevelopmentLtd's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Cathay Real Estate DevelopmentLtd's free cash flow amounted to 42% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

On the face of it, Cathay Real Estate DevelopmentLtd's level of total liabilities left us tentative about the stock, and its net debt to EBITDA was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. Overall, it seems to us that Cathay Real Estate DevelopmentLtd's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for Cathay Real Estate DevelopmentLtd you should be aware of, and 2 of them are a bit concerning.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Cathay Real Estate DevelopmentLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2501

Cathay Real Estate DevelopmentLtd

Engages in the construction of residential and commercial buildings for leasing or selling in Taiwan.

Mediocre balance sheet second-rate dividend payer.