As global markets continue to navigate the complexities of rising inflation and interest rate expectations, U.S. stock indexes are climbing toward record highs, buoyed by growth stocks outperforming value shares. In this environment, dividend stocks can offer a compelling option for investors seeking stability and income, as they tend to provide regular payouts that can help cushion against market volatility while potentially benefiting from capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.41% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.92% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.01% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.42% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.27% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.33% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1998 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Essex Bio-Technology (SEHK:1061)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Essex Bio-Technology Limited is an investment holding company that develops, manufactures, distributes, and sells biopharmaceutical products in the People's Republic of China, Hong Kong, and internationally with a market cap of HK$1.55 billion.

Operations: Essex Bio-Technology's revenue is primarily derived from its Surgical segment, which generated HK$871.44 million, and its Ophthalmology segment, with HK$747.39 million in revenue.

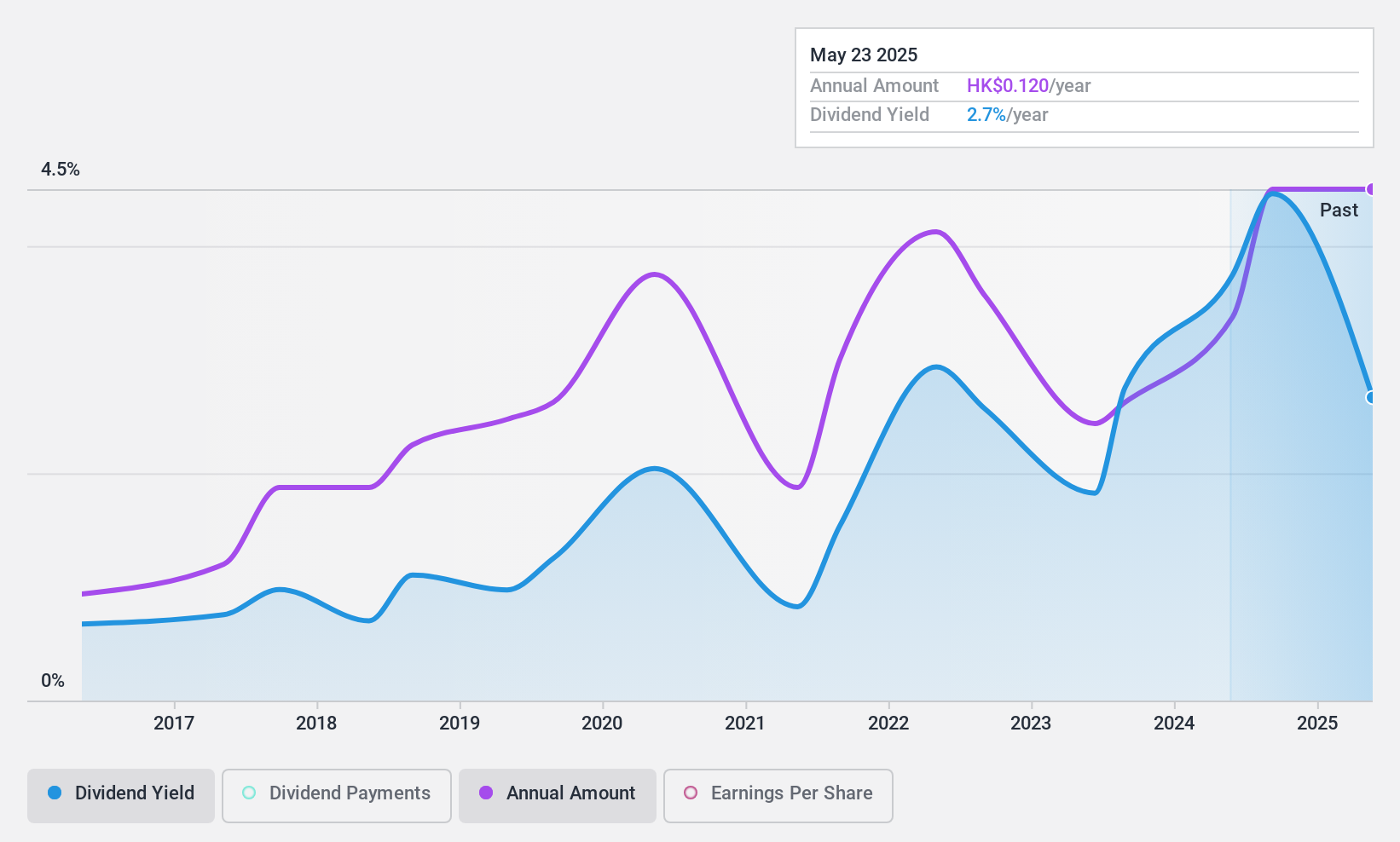

Dividend Yield: 4.4%

Essex Bio-Technology's dividend payments are well-covered by earnings and cash flows, with a payout ratio of 22.7% and a cash payout ratio of 32.2%. Despite this coverage, the dividends have been volatile over the past decade and yield lower than top-tier payers in Hong Kong. The stock trades at a good value with a price-to-earnings ratio of 5.9x, below the market average, but its unstable dividend history may concern some investors.

- Click here and access our complete dividend analysis report to understand the dynamics of Essex Bio-Technology.

- Our comprehensive valuation report raises the possibility that Essex Bio-Technology is priced lower than what may be justified by its financials.

Golden Long Teng Development (TPEX:3188)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Golden Long Teng Development Co., Ltd. focuses on the development, sale, and lease of residential and commercial buildings with a market cap of NT$5.68 billion.

Operations: Golden Long Teng Development Co., Ltd.'s revenue primarily comes from its Construction and Development segment, which generated NT$3.05 billion.

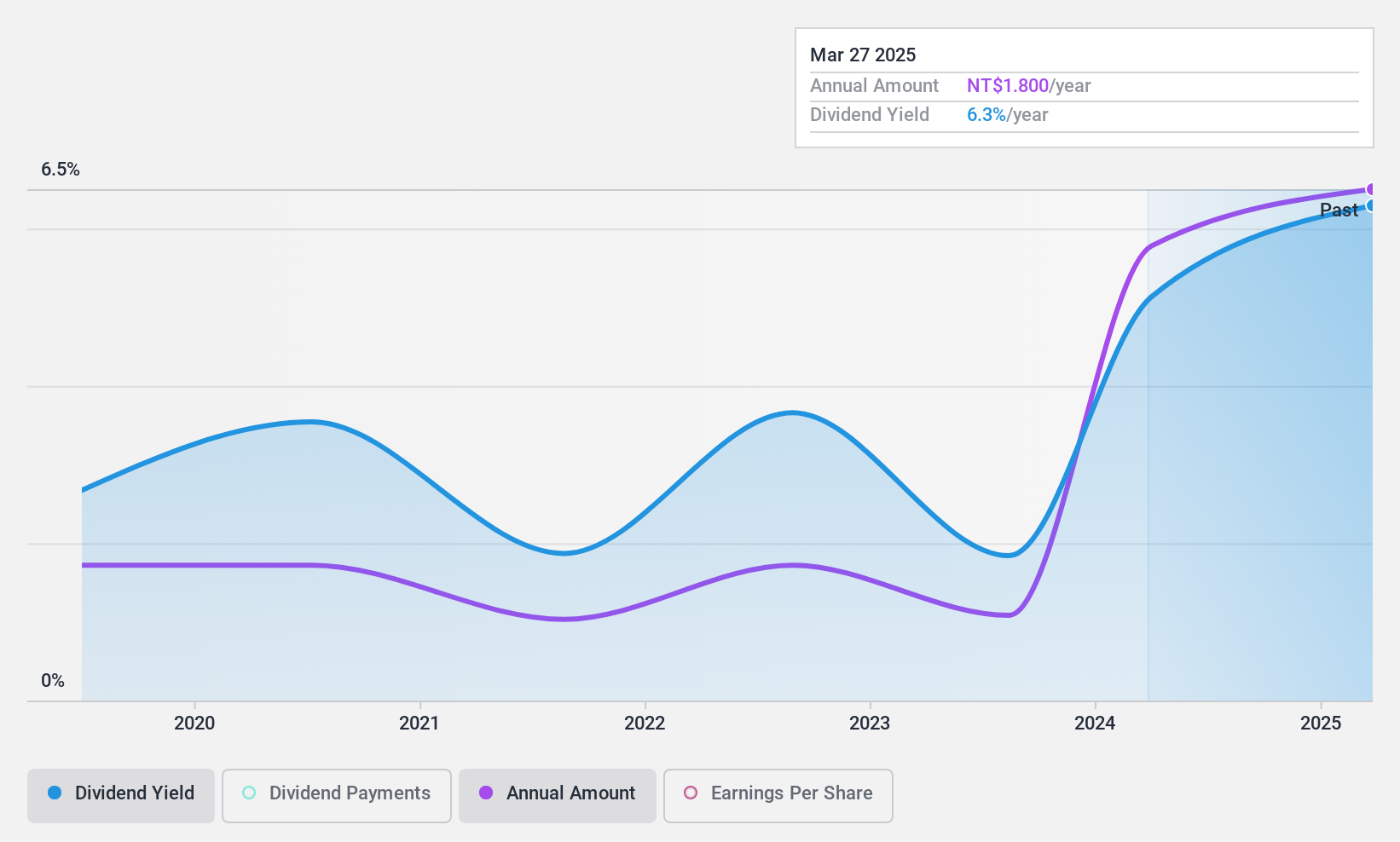

Dividend Yield: 5.2%

Golden Long Teng Development's dividends are covered by earnings and cash flows, with payout ratios of 41.2% and 69% respectively. However, the dividend history has been volatile over the past six years. Despite this, the dividend yield is in Taiwan's top quartile at 5.25%. The company recently expanded by acquiring land and buildings in Kaohsiung City for TWD 701.91 million, potentially impacting future financial stability and dividend reliability.

- Click to explore a detailed breakdown of our findings in Golden Long Teng Development's dividend report.

- The analysis detailed in our Golden Long Teng Development valuation report hints at an deflated share price compared to its estimated value.

Da-Li DevelopmentLtd (TWSE:6177)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Da-Li Development Co., Ltd., along with its subsidiaries, engages in the construction business in Taiwan and the United States, with a market cap of NT$19.83 billion.

Operations: Da-Li Development Co., Ltd. generates revenue primarily from its Construction Segment, which accounts for NT$4.36 billion, and its Construction Department, contributing NT$14.61 billion.

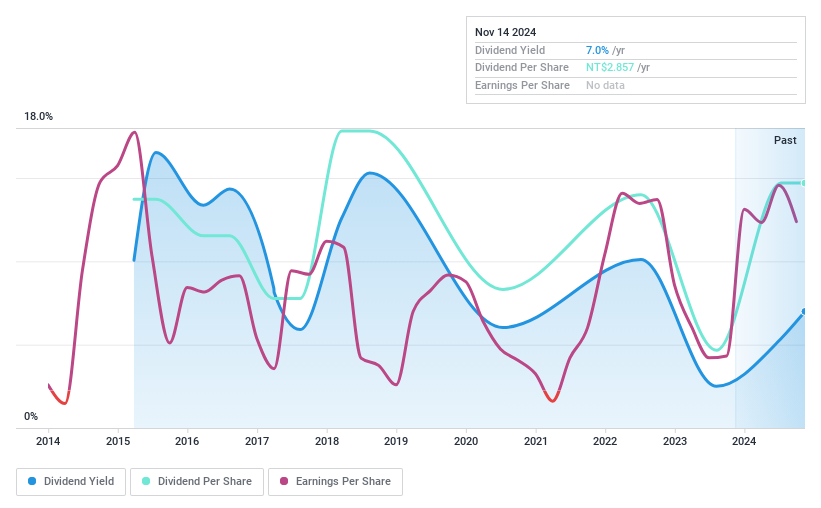

Dividend Yield: 6.2%

Da-Li Development Ltd.'s dividends are covered by earnings and cash flows, with a payout ratio of 63.5% and a low cash payout ratio of 21.8%. Despite being among the top dividend payers in Taiwan, its dividend history is volatile and unreliable over the past decade. Recent acquisitions in New Taipei City for TWD 500 million and an equity offering may affect future financial stability, potentially impacting dividend sustainability despite recent earnings growth.

- Click here to discover the nuances of Da-Li DevelopmentLtd with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Da-Li DevelopmentLtd is trading behind its estimated value.

Where To Now?

- Gain an insight into the universe of 1998 Top Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Essex Bio-Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1061

Essex Bio-Technology

An investment holding company, develops, manufactures, and sells biologic drugs in China, Hong Kong, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)