- Taiwan

- /

- Real Estate

- /

- TWSE:6177

3 Global Dividend Stocks With Yields Up To 9.8%

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by steady U.S. inflation, mixed economic signals from Europe, and vigorous activity in Chinese stock exchanges, investors are increasingly seeking stable income sources amid the volatility. In this environment, dividend stocks stand out as attractive options for those looking to balance risk with regular income streams, especially when yields can reach as high as 9.8%.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.05% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.32% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.78% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.92% | ★★★★★★ |

| NCD (TSE:4783) | 4.52% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.18% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| Daicel (TSE:4202) | 4.37% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.35% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.74% | ★★★★★★ |

Click here to see the full list of 1323 stocks from our Top Global Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

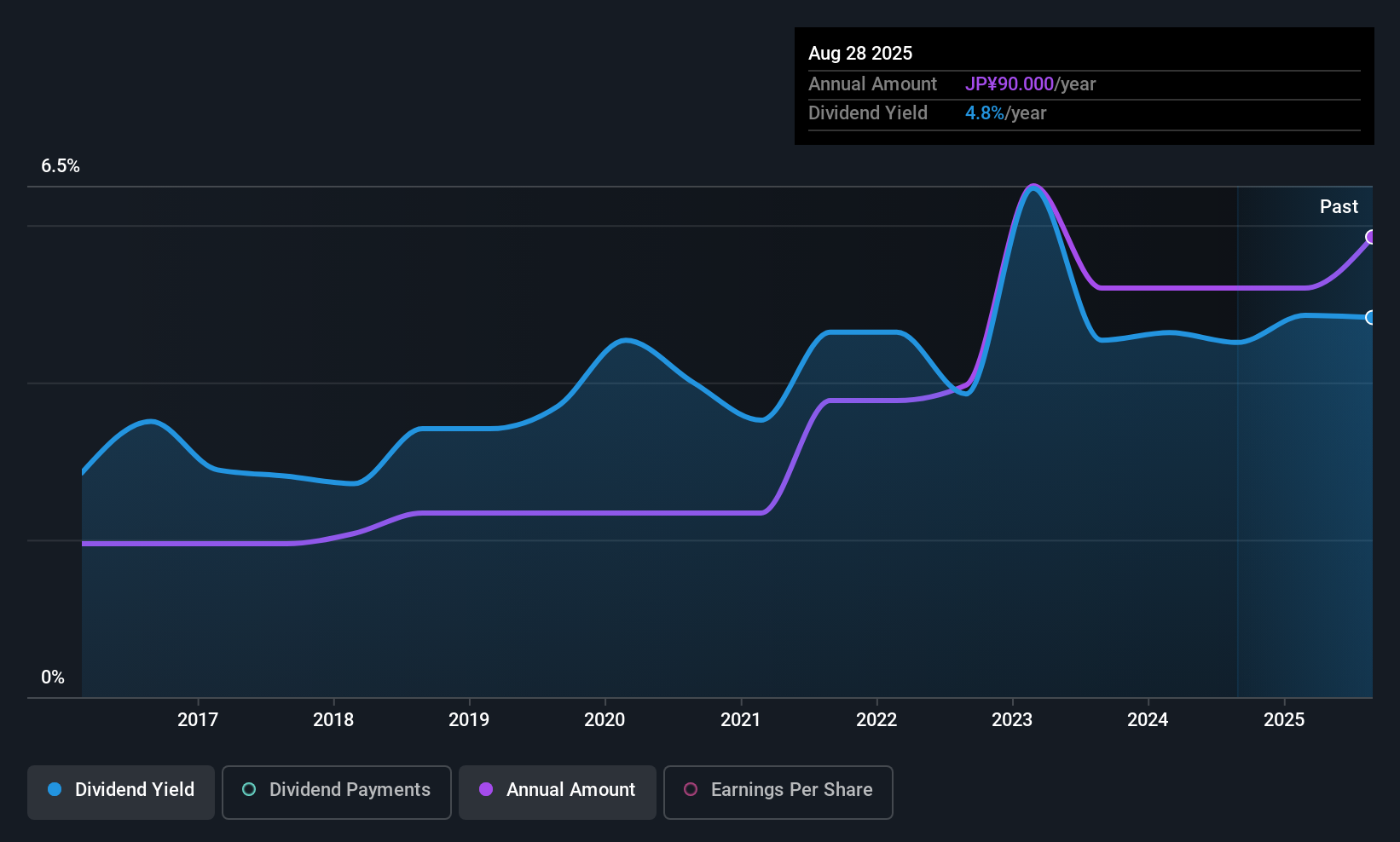

AIT (TSE:9381)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: AIT Corporation operates as a comprehensive logistics company primarily in China and Southeast Asia, with a market cap of ¥48.66 billion.

Operations: AIT Corporation generates revenue through its comprehensive logistics operations primarily in China and Southeast Asia.

Dividend Yield: 4.3%

AIT is trading at 30.8% below its estimated fair value, offering potential value for investors. Its dividends are covered by earnings and cash flows, with payout ratios of 59.6% and 67.4%, respectively, suggesting sustainability. However, the dividend history has been volatile over the past decade despite recent growth in payouts and a competitive yield of 4.31%. The next ex-dividend date was June 16, with a ¥45 cash dividend scheduled for August 28, 2025.

- Get an in-depth perspective on AIT's performance by reading our dividend report here.

- According our valuation report, there's an indication that AIT's share price might be on the cheaper side.

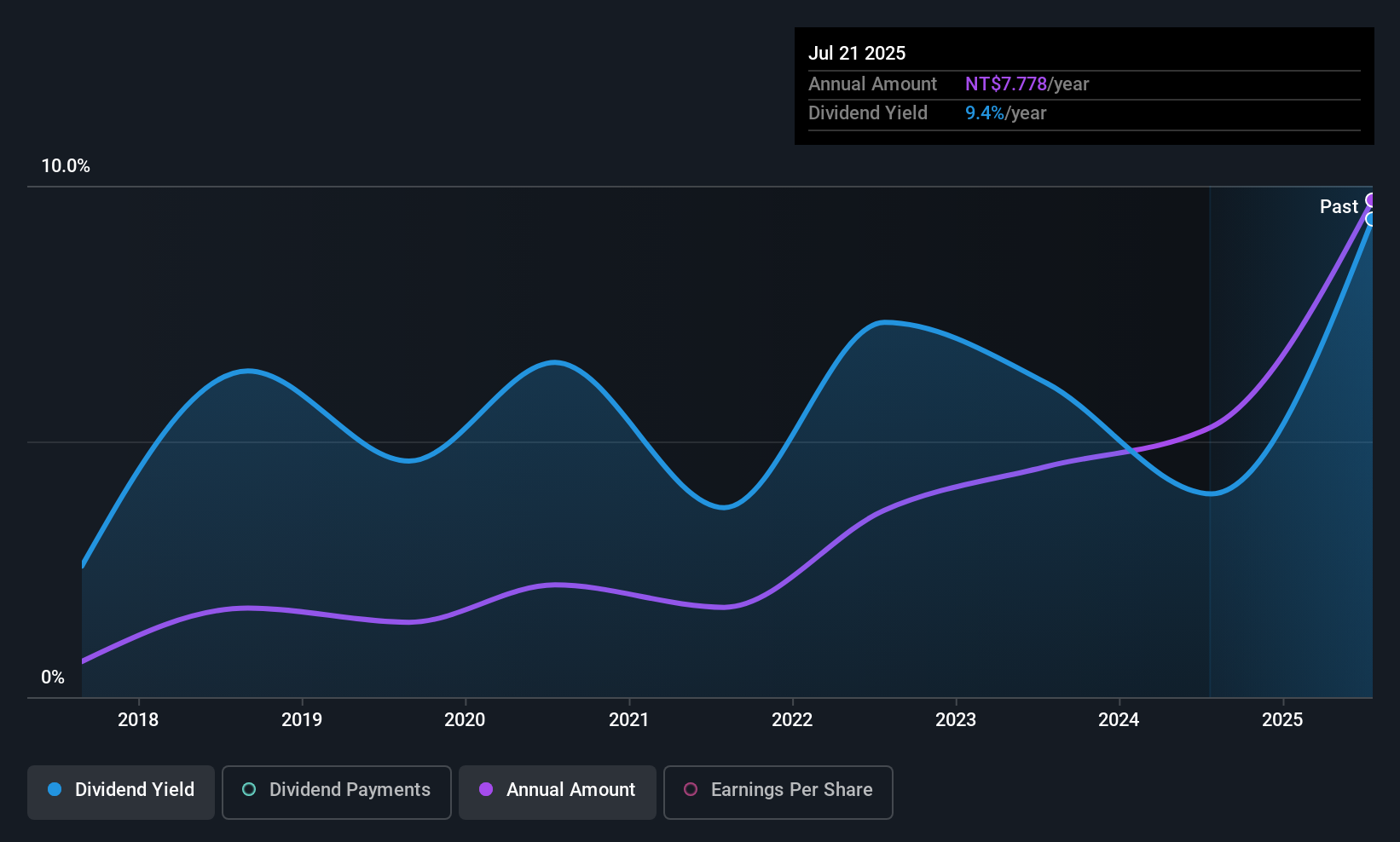

Hua Yu Lien Development (TWSE:1436)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hua Yu Lien Development Co., Ltd. operates in the real estate sector in Taiwan with a market capitalization of approximately NT$12.28 billion.

Operations: Hua Yu Lien Development Co., Ltd. generates its revenue primarily from the Construction Sector, contributing NT$6.57 billion, and the Engineering Department, adding NT$651.19 million.

Dividend Yield: 9.9%

Hua Yu Lien Development recently announced a cash dividend of TWD 1.3 billion, equating to TWD 10.12 per share, despite reporting declining earnings with second-quarter net income down to TWD 374.07 million from the previous year's TWD 644.21 million. While the dividend yield is high at 9.9%, it isn't supported by free cash flows and has been historically volatile, raising concerns about sustainability despite a reasonable payout ratio of 57.9%.

- Unlock comprehensive insights into our analysis of Hua Yu Lien Development stock in this dividend report.

- Our valuation report here indicates Hua Yu Lien Development may be undervalued.

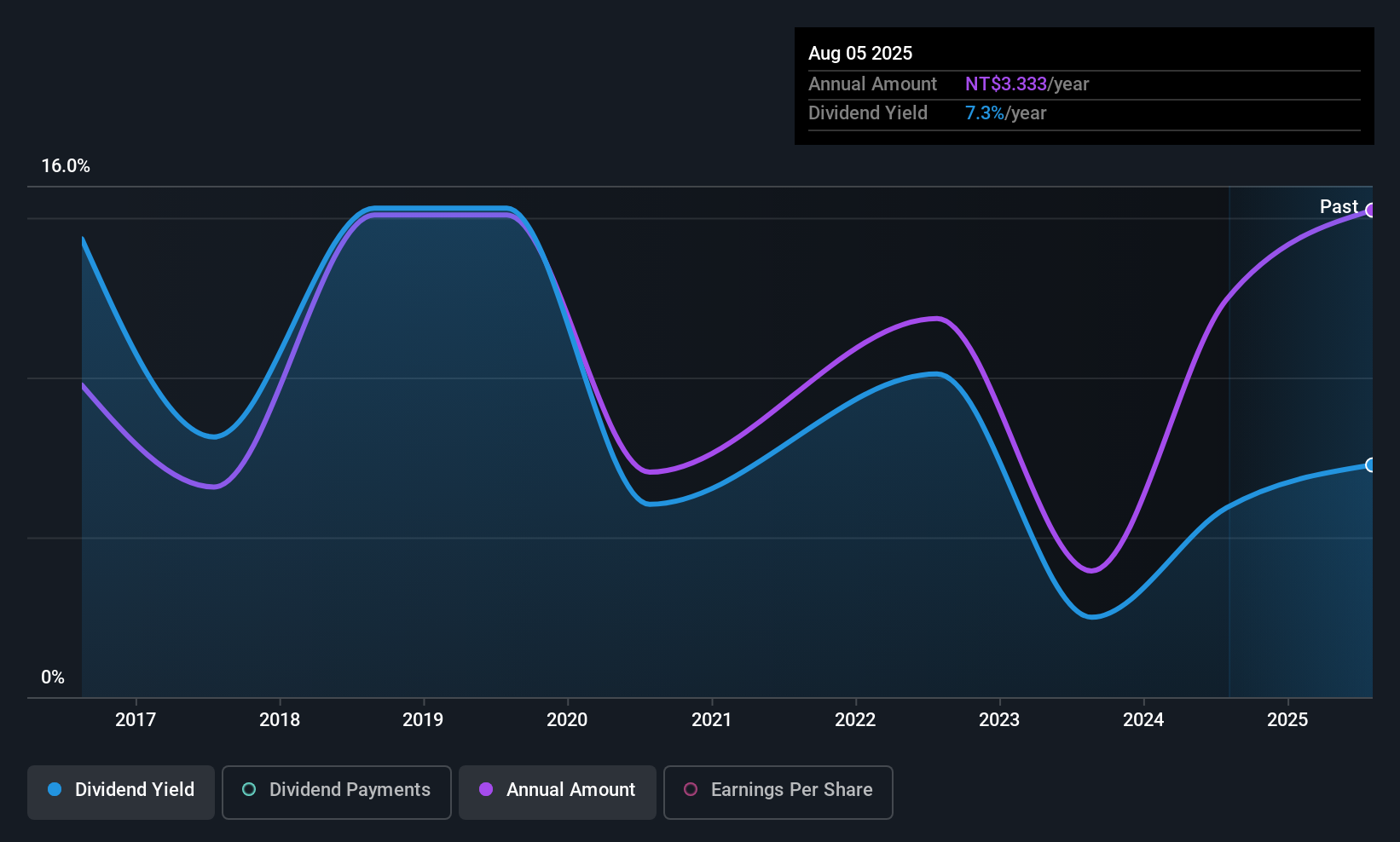

Da-Li DevelopmentLtd (TWSE:6177)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Da-Li Development Co., Ltd., along with its subsidiaries, operates in the construction industry in Taiwan and the United States, with a market capitalization of approximately NT$20.71 billion.

Operations: Da-Li Development Co., Ltd.'s revenue is primarily derived from its Development segment, which accounts for NT$7.20 billion, and its Construction segment, contributing NT$5.51 billion.

Dividend Yield: 5.6%

Da-Li Development's dividend yield of 5.63% is among the top 25% in Taiwan, but its sustainability is questionable due to a lack of free cash flows and volatile historical payments. Despite a reasonable payout ratio of 62%, recent financials show significant declines, with second-quarter sales dropping to TWD 494.88 million from TWD 4.39 billion year-on-year and a net loss reported, impacting dividend reliability and coverage by earnings or cash flows.

- Click to explore a detailed breakdown of our findings in Da-Li DevelopmentLtd's dividend report.

- The analysis detailed in our Da-Li DevelopmentLtd valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Investigate our full lineup of 1323 Top Global Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6177

Da-Li DevelopmentLtd

Engages in the construction business in Taiwan and the United States.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)