- Taiwan

- /

- Real Estate

- /

- TWSE:2923

Even though Sino Horizon Holdings (TWSE:2923) has lost NT$2.3b market cap in last 7 days, shareholders are still up 18% over 1 year

Sino Horizon Holdings Limited (TWSE:2923) shareholders might be concerned after seeing the share price drop 11% in the last month. But at least the stock is up over the last year. However, its return of 17% does fall short of the market return of, 38%.

In light of the stock dropping 4.4% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

View our latest analysis for Sino Horizon Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

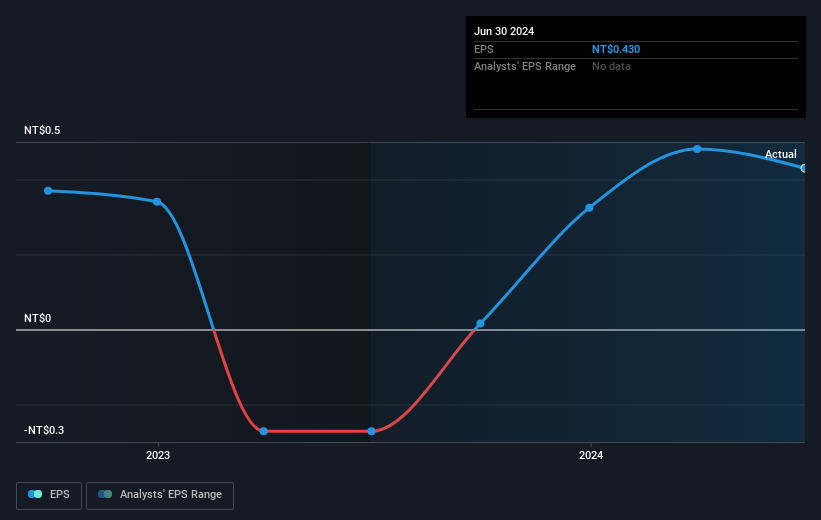

During the last year Sino Horizon Holdings grew its earnings per share, moving from a loss to a profit.

The company was close to break-even last year, so earnings per share of NT$0.43 isn't particularly stand out. But judging by the share price, the market is happy with the maiden profit. Some investors scan for companies that have just become profitable, since that's an important business development milestone.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Sino Horizon Holdings' key metrics by checking this interactive graph of Sino Horizon Holdings's earnings, revenue and cash flow.

A Different Perspective

Sino Horizon Holdings shareholders are up 18% for the year (even including dividends). But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 6% over half a decade It is possible that returns will improve along with the business fundamentals. It's always interesting to track share price performance over the longer term. But to understand Sino Horizon Holdings better, we need to consider many other factors. For instance, we've identified 3 warning signs for Sino Horizon Holdings that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2923

Sino Horizon Holdings

Engages in the development, sale, and leasing of real estate properties in mainland China and Taiwan.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives