- Japan

- /

- Interactive Media and Services

- /

- TSE:4449

Uncovering Undiscovered Gems on None in November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, key indices like the S&P 600 for small-cap stocks have shown mixed performance amid fluctuating sector returns and economic indicators. In this complex environment, identifying promising investment opportunities often involves looking beyond headline-grabbing giants to uncover smaller companies with strong fundamentals and potential for growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Brillian Network & Automation Integrated System | 8.39% | 20.15% | 19.93% | ★★★★★★ |

| Gallant Precision Machining | 29.51% | -2.07% | 4.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shin Ruenn development (TPEX:6186)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shin Ruenn Development Co., LTD engages in the development, trading, leasing, and sale of real estate properties in Taiwan with a market cap of NT$10.68 billion.

Operations: Shin Ruenn generates revenue primarily through the development, trading, leasing, and sale of real estate properties in Taiwan. The company has a market capitalization of NT$10.68 billion.

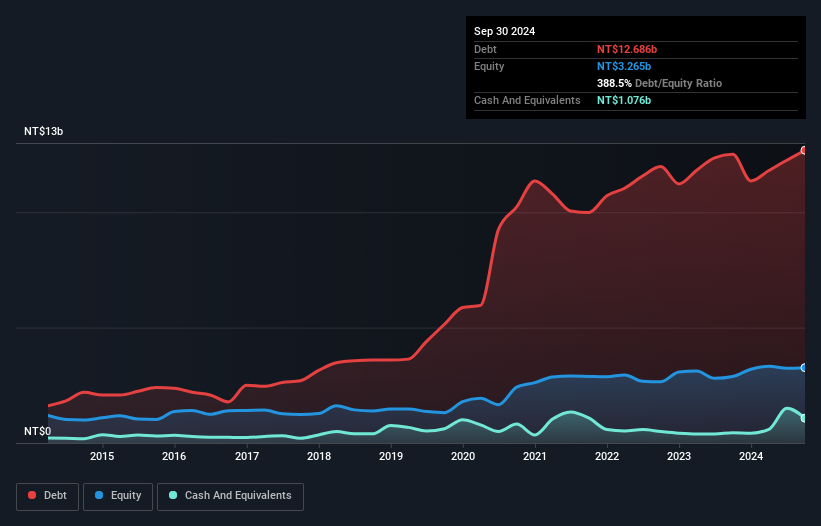

Shin Ruenn Development, a smaller entity in the real estate sector, has shown mixed financial results recently. Despite a significant increase in sales to TWD 1.31 billion for Q3 2024 from TWD 511.85 million last year, net income saw a downturn to TWD 29.13 million from TWD 78.78 million previously. The company's net profit margin dropped from last year's 15.9% to the current 9.4%, indicating pressure on profitability despite revenue growth of earnings by an average of 5% annually over five years and recent project expansions like the TWD 420 million contract with Weirun Construction Co., Ltd., which reflects ongoing strategic development efforts amidst high volatility in share price movements.

- Unlock comprehensive insights into our analysis of Shin Ruenn development stock in this health report.

Learn about Shin Ruenn development's historical performance.

giftee (TSE:4449)

Simply Wall St Value Rating: ★★★★☆☆

Overview: giftee Inc. operates in the Internet service sector in Japan with a market capitalization of ¥38.81 billion.

Operations: Revenue streams for TSE:4449 are not specified in detail. The company has a market capitalization of ¥38.81 billion, indicating its valuation in the market. Specific financial data regarding revenue segments or cost breakdowns is not provided, limiting further analysis of its business operations and profitability trends.

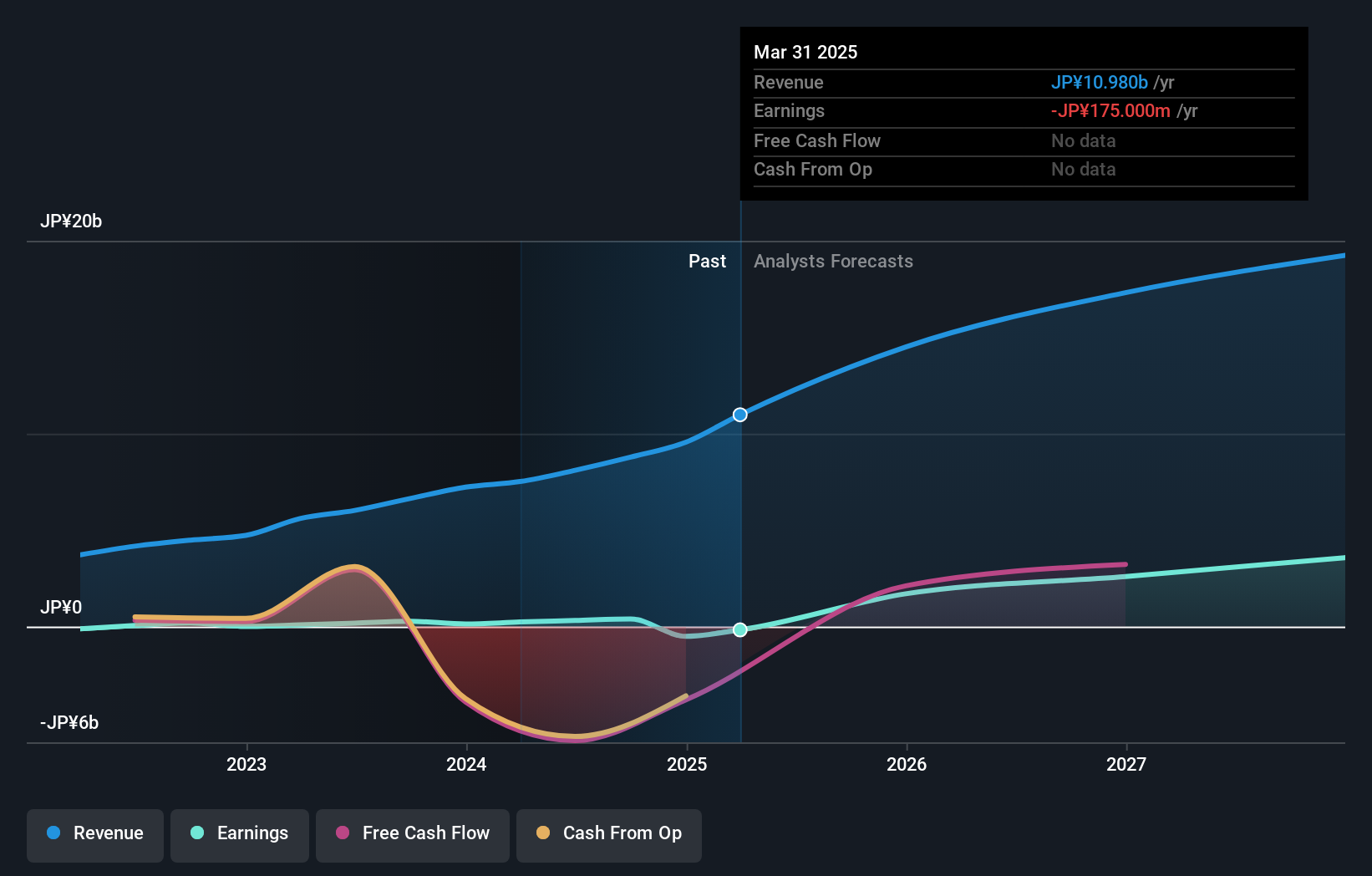

Giftee, a small player in the market, has shown impressive earnings growth of 77% over the past year, outpacing its industry peers. Despite this growth, the company faces challenges with free cash flow being negative recently. Its debt-to-equity ratio has surged from 0.2 to 98.7 over five years but remains satisfactory at a net level of 24.9%. Recent board discussions on stock acquisition rights and confirmed guidance for fiscal year-end sales and operating profit suggest strategic moves towards future expansion. The anticipated dividend of JPY 10 per share reflects confidence in ongoing profitability amidst volatility concerns.

- Click to explore a detailed breakdown of our findings in giftee's health report.

Gain insights into giftee's historical performance by reviewing our past performance report.

SEIKOH GIKEN (TSE:6834)

Simply Wall St Value Rating: ★★★★★★

Overview: SEIKOH GIKEN Co., Ltd. designs, manufactures, and sells optical components, lenses, and radio over fiber products both in Japan and internationally with a market capitalization of ¥39.87 billion.

Operations: SEIKOH GIKEN generates revenue primarily from its Optical Products Related segment, contributing ¥8.23 billion, and Precision Machine Related segment, adding ¥8.78 billion.

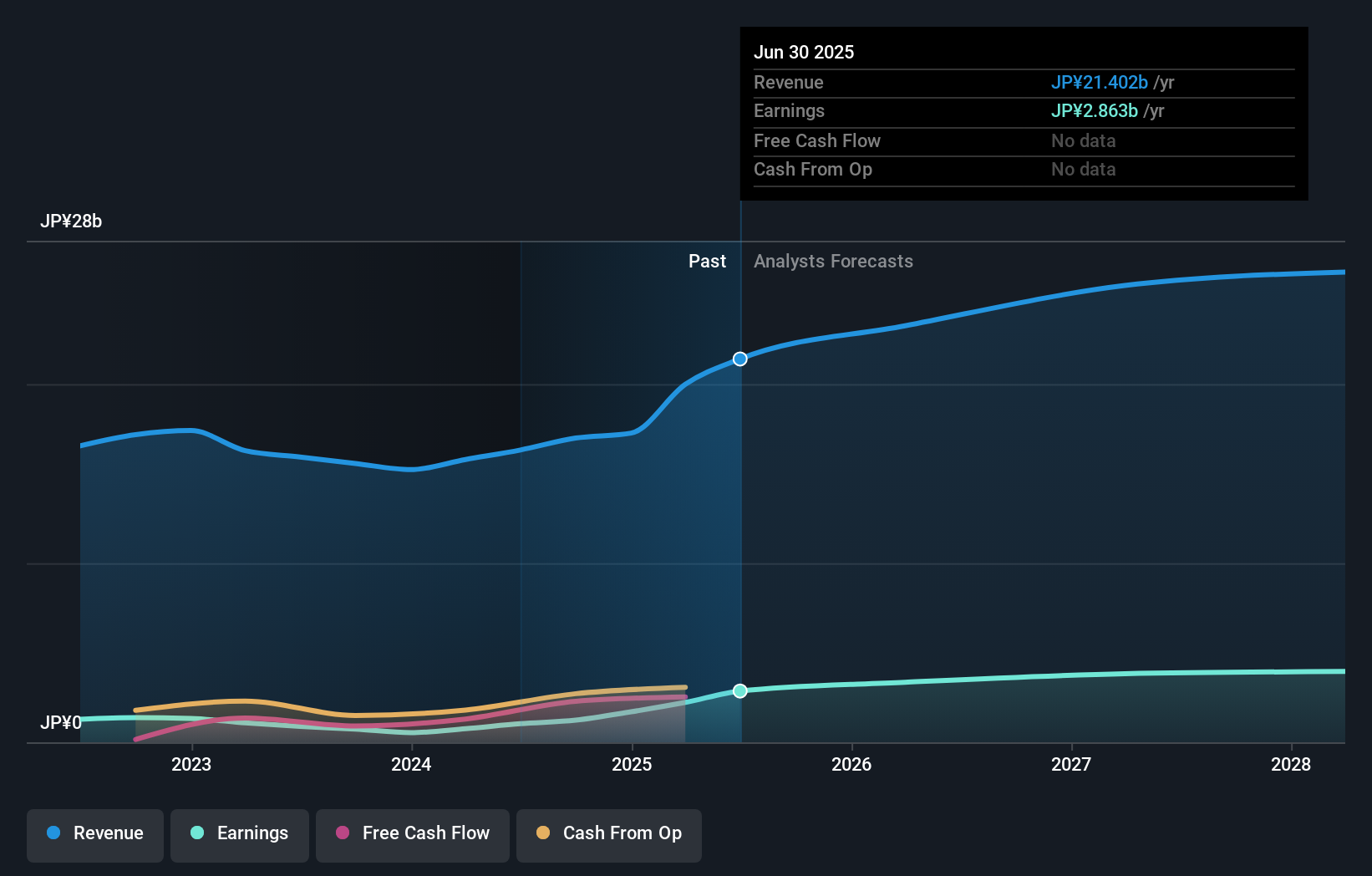

Seikoh Giken, a small player in the electronics industry, has shown impressive earnings growth of 67.8% over the past year, significantly outpacing its industry peers who faced a -3.2% downturn. The company operates debt-free for five years, highlighting strong financial health and eliminating concerns over interest payments. Trading at 47.1% below estimated fair value suggests potential undervaluation in the market's eyes. Despite recent share price volatility, Seikoh Giken's high-quality earnings and positive free cash flow position it well for future growth projections of 18.66% annually, making it an intriguing prospect within its sector.

- Take a closer look at SEIKOH GIKEN's potential here in our health report.

Review our historical performance report to gain insights into SEIKOH GIKEN's's past performance.

Key Takeaways

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4626 more companies for you to explore.Click here to unveil our expertly curated list of 4629 Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4449

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives