As global markets grapple with inflation fluctuations and trade policy uncertainties, Asian tech stocks have emerged as a focal point for investors seeking growth opportunities amid broader market volatility. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate robust innovation and adaptability to shifting economic conditions, positioning them well within the dynamic landscape of Asia's technology sector.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 34.74% | 33.49% | ★★★★★★ |

| Zhongji Innolight | 28.47% | 28.81% | ★★★★★★ |

| Fositek | 31.39% | 36.95% | ★★★★★★ |

| Seojin SystemLtd | 31.08% | 34.32% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| PharmaResearch | 23.41% | 26.41% | ★★★★★★ |

| Bioneer | 26.13% | 104.84% | ★★★★★★ |

| Ascentage Pharma Group International | 23.29% | 60.86% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Kexing Biopharm (SHSE:688136)

Simply Wall St Growth Rating: ★★★★★☆

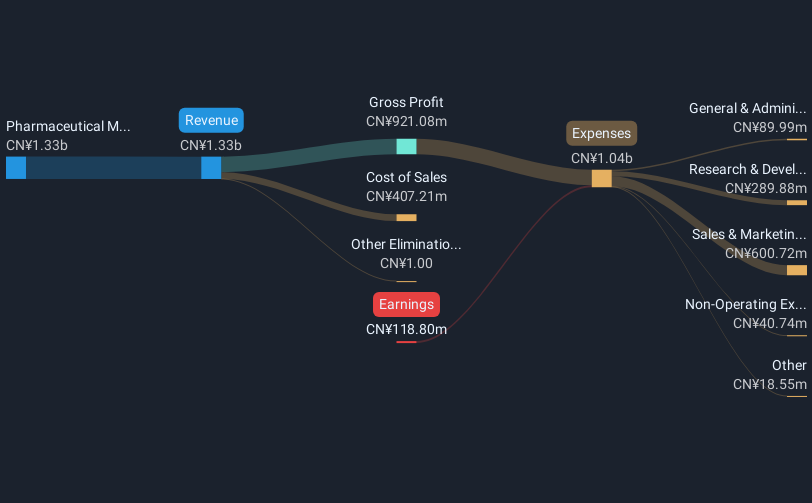

Overview: Kexing Biopharm Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs and microbial preparations both in China and internationally, with a market cap of CN¥4.95 billion.

Operations: Kexing Biopharm generates revenue primarily through pharmaceutical manufacturing, with a reported CN¥1.41 billion in this segment. The company is involved in the production and sale of recombinant protein drugs and microbial preparations, catering to both domestic and international markets.

Kexing Biopharm's recent FDA approval for clinical trials of its innovative pediatric RSV treatment, GB05, underscores its strategic focus on addressing critical viral infections with advanced biotechnology. This milestone follows a robust financial recovery in 2024, where sales surged to CNY 1.41 billion from CNY 1.26 billion the previous year and net income flipped from a significant loss to CNY 31.53 million in profits. The company's commitment to R&D is evident as it advances other promising projects like GB08 for long-term growth hormone therapy and GB18 for cancer cachexia, positioning it well in the competitive biotech landscape of Asia despite a highly volatile share price and a forecasted low Return on Equity (11.4%) over the next three years.

- Unlock comprehensive insights into our analysis of Kexing Biopharm stock in this health report.

Assess Kexing Biopharm's past performance with our detailed historical performance reports.

Trend Micro (TSE:4704)

Simply Wall St Growth Rating: ★★★★☆☆

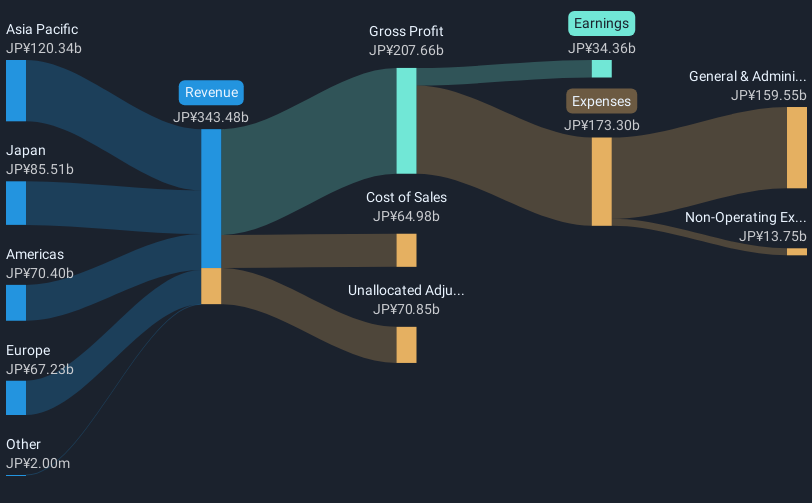

Overview: Trend Micro Incorporated is a company that specializes in developing and selling computer security software and related services globally, with a market capitalization of ¥1.33 trillion.

Operations: The company generates revenue primarily from the sale of security-related software and services, with significant contributions from the Asia Pacific region at ¥120.34 billion and Japan at ¥85.51 billion. The Americas and Europe also contribute to its revenue streams, bringing in ¥70.40 billion and ¥67.23 billion respectively.

Trend Micro's strategic innovations, particularly with the Trend Vision One™ platform and Trend Cybertron AI agent, underscore its robust position in cybersecurity. The company's R&D commitment is reflected in its recent launch of groundbreaking AI-driven solutions that enhance enterprise security capabilities. With a revenue growth forecast at 5.8% annually and earnings surge by 220.2% last year, Trend Micro is outpacing the Japanese market averages significantly. These advancements not only elevate their market stance but also solidify their role in shaping future cybersecurity trends amidst increasing digital threats globally.

- Take a closer look at Trend Micro's potential here in our health report.

Evaluate Trend Micro's historical performance by accessing our past performance report.

PharmaEssentia (TWSE:6446)

Simply Wall St Growth Rating: ★★★★★★

Overview: PharmaEssentia Corporation is a biopharmaceutical company focused on developing treatments for human diseases in Taiwan and internationally, with a market cap of NT$193.16 billion.

Operations: The company generates revenue primarily from the research and development of new drugs, amounting to NT$9.73 billion.

PharmaEssentia's recent strategic movements, including the Brazilian ANVISA's approval of BESREMi and an exclusive commercial license agreement across multiple Latin American countries, underscore its growing influence in the biotech sector. With a reported annual revenue surge from TWD 5.1 billion to TWD 9.7 billion and a swing to a net income of TWD 2.97 billion from a previous year's loss, the company is capitalizing on its innovative treatments for myeloproliferative neoplasms like Polycythemia Vera. These developments not only highlight PharmaEssentia’s robust market expansion strategy but also reflect its potential to impact significant patient demographics in emerging markets, promising continued growth in its sector.

- Delve into the full analysis health report here for a deeper understanding of PharmaEssentia.

Gain insights into PharmaEssentia's historical performance by reviewing our past performance report.

Where To Now?

- Click this link to deep-dive into the 510 companies within our Asian High Growth Tech and AI Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6446

PharmaEssentia

A biopharmaceutical company engages in treatment for human diseases in Taiwan and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives