- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2368

Exploring High Growth Tech Stocks In Asia With Promising Potential

Reviewed by Simply Wall St

The Asian tech market is garnering attention as global economic uncertainties and trade tensions have led to mixed performances across key indices, with some markets experiencing declines amid tariff threats and fiscal concerns. In this environment, identifying high-growth tech stocks requires a keen focus on companies with robust innovation capabilities and adaptability to shifting economic landscapes.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Eoptolink Technology | 30.78% | 30.77% | ★★★★★★ |

| Suzhou TFC Optical Communication | 29.68% | 30.37% | ★★★★★★ |

| Auras Technology | 21.79% | 25.47% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.40% | 23.42% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.98% | 29.01% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| PharmaResearch | 24.38% | 25.85% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Wuhan Guide Infrared (SZSE:002414)

Simply Wall St Growth Rating: ★★★★★☆

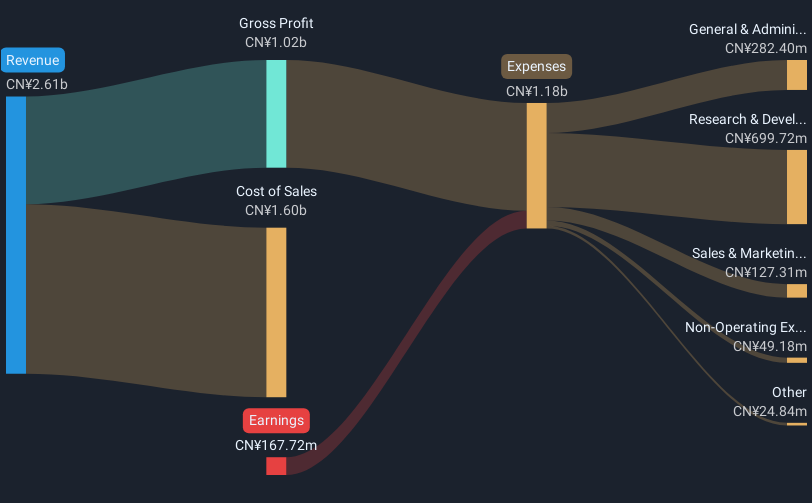

Overview: Wuhan Guide Infrared Co., Ltd. focuses on the research, development, production, and sale of infrared thermal imaging technology in Asia, with a market cap of CN¥37.50 billion.

Operations: Wuhan Guide Infrared Co., Ltd. generates revenue primarily through its infrared thermal imaging technology products and solutions. The company emphasizes innovation in research and development to enhance its product offerings across various sectors in Asia.

Wuhan Guide Infrared, amidst a challenging financial landscape, has shown remarkable resilience with its recent first-quarter earnings. The company's revenue soared to CNY 680.76 million from CNY 467.97 million year-over-year, accompanied by a substantial increase in net income to CNY 83.55 million from just CNY 8.38 million. This performance is underpinned by an aggressive annualized revenue growth rate of 27.7%, significantly outpacing the broader Chinese market's growth of 12.3%. Despite current unprofitability, Wuhan Guide Infrared is poised for profitability within three years, bolstered by expected earnings growth of 113% per annum and strategic R&D investments that align with its ambitious expansion plans in the high-tech sector.

Gold Circuit Electronics (TWSE:2368)

Simply Wall St Growth Rating: ★★★★★☆

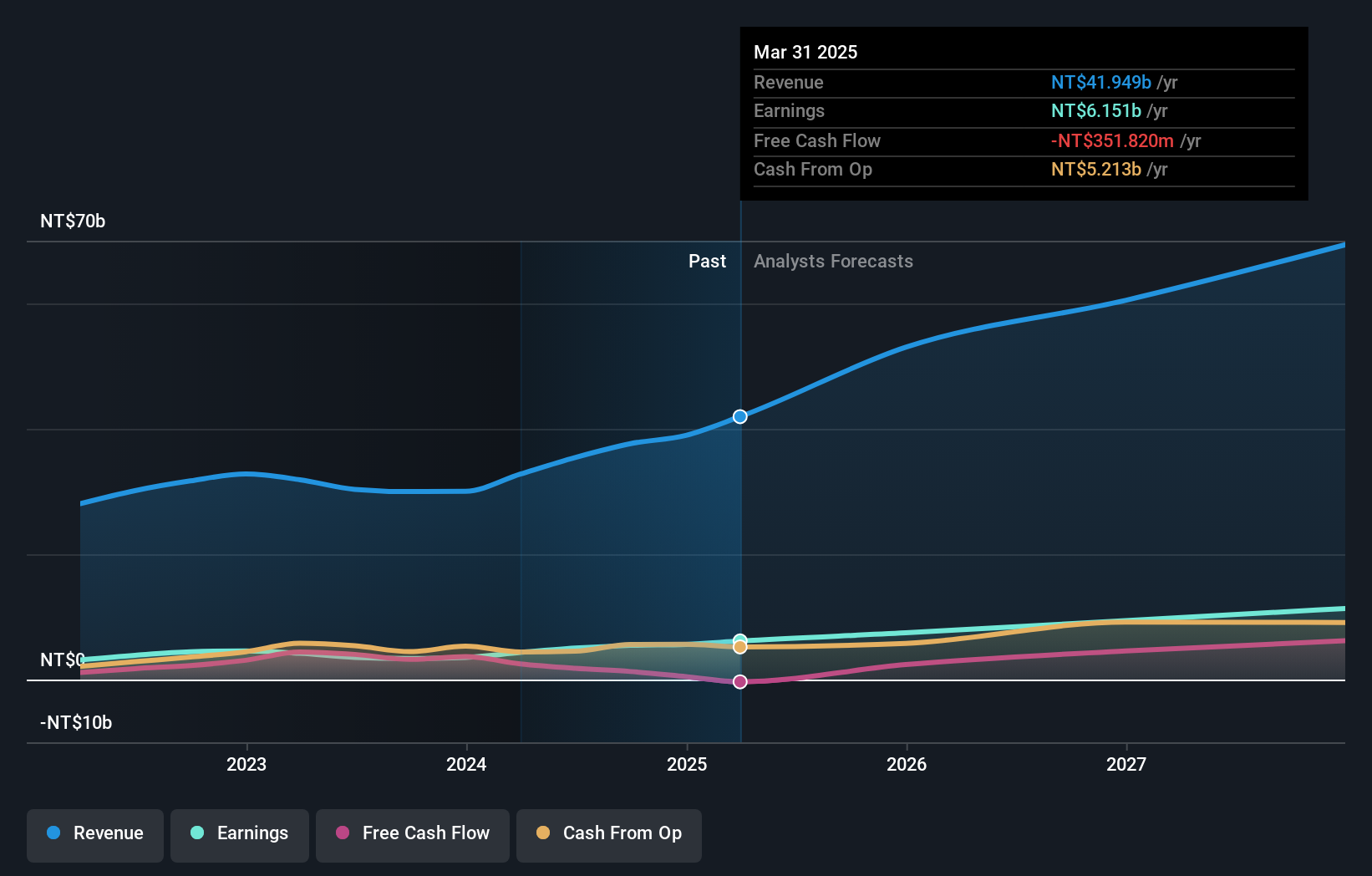

Overview: Gold Circuit Electronics Ltd. is a Taiwanese company specializing in the design, manufacture, processing, and distribution of printed circuit boards with a market capitalization of NT$118.51 billion.

Operations: Gold Circuit Electronics Ltd. focuses on the design, manufacture, processing, and distribution of printed circuit boards in Taiwan. The company operates with a market capitalization of NT$118.51 billion.

Gold Circuit Electronics has demonstrated robust performance with first-quarter sales surging to TWD 12.06 billion, up from TWD 9.07 billion last year, alongside a net income rise to TWD 1.75 billion from TWD 1.22 billion, reflecting a dynamic annualized earnings growth of 22%. At the forefront of technological advancements in Taiwan's bustling tech sector, the company's commitment is evident in its R&D spending trends which have consistently aligned with revenue growth—last year alone R&D expenses constituted approximately 5% of total revenues. This strategic focus on innovation not only fuels their market competitiveness but also positions them well for sustained growth amidst Asia's high-tech evolution.

PharmaEssentia (TWSE:6446)

Simply Wall St Growth Rating: ★★★★★★

Overview: PharmaEssentia Corporation is a biopharmaceutical company that focuses on developing treatments for human diseases both in Taiwan and globally, with a market capitalization of NT$171.02 billion.

Operations: The company specializes in the research and development of new drugs, generating revenue primarily from this segment, which totaled NT$11.34 billion.

PharmaEssentia has shown remarkable growth with a 31.4% annual increase in revenue and an even more impressive earnings surge of 57.7% per year, outpacing the broader Taiwanese market significantly. The company's dedication to innovation is underscored by its strategic allocation towards R&D, which not only supports its robust pipeline but also enhances its competitive edge in the biotech industry. Recent successful Phase I trials of P2203 highlight PharmaEssentia's potential to expand its therapeutic offerings, further solidifying its position in high-growth sectors within Asia’s tech landscape.

- Dive into the specifics of PharmaEssentia here with our thorough health report.

Explore historical data to track PharmaEssentia's performance over time in our Past section.

Seize The Opportunity

- Get an in-depth perspective on all 495 Asian High Growth Tech and AI Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2368

Gold Circuit Electronics

Designs, manufactures, processes, and distributes printed circuit boards in Taiwan.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives