Did You Miss Lotus Pharmaceutical's (TPE:1795) 64% Share Price Gain?

Lotus Pharmaceutical Co., Ltd. (TPE:1795) shareholders might be concerned after seeing the share price drop 20% in the last quarter. On the other hand the share price is higher than it was three years ago. In that time, it is up 64%, which isn't bad, but not amazing either.

Check out our latest analysis for Lotus Pharmaceutical

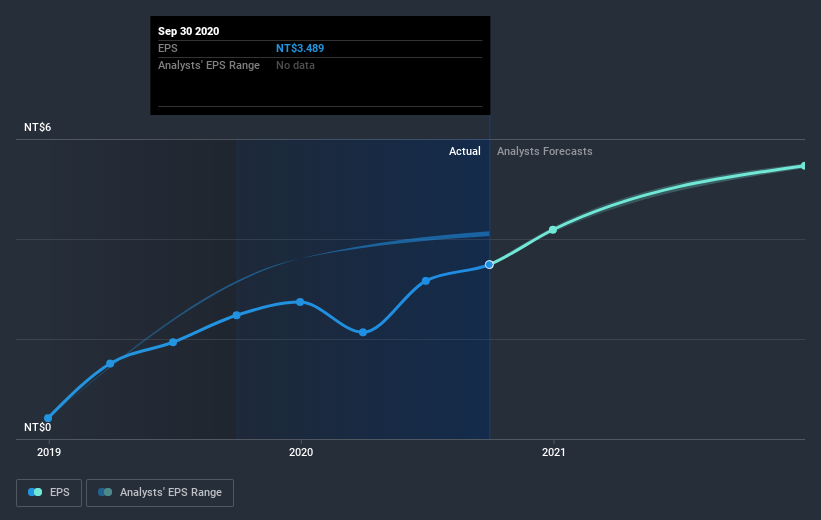

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Lotus Pharmaceutical became profitable within the last three years. So we would expect a higher share price over the period.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Lotus Pharmaceutical has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Lotus Pharmaceutical stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market gained around 38% in the last year, Lotus Pharmaceutical shareholders lost 26%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 0.1%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with Lotus Pharmaceutical .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade Lotus Pharmaceutical, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1795

Lotus Pharmaceutical

Engages in the research and development, manufacture, and sale of generic pharmaceutical products in Taiwan, South Korea, the United States, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives