Handa Pharmaceuticals'(GTSM:6620) Share Price Is Down 26% Over The Past Three Years.

Handa Pharmaceuticals, Inc. (GTSM:6620) shareholders should be happy to see the share price up 12% in the last month. But that doesn't change the fact that the returns over the last three years have been less than pleasing. Truth be told the share price declined 26% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

View our latest analysis for Handa Pharmaceuticals

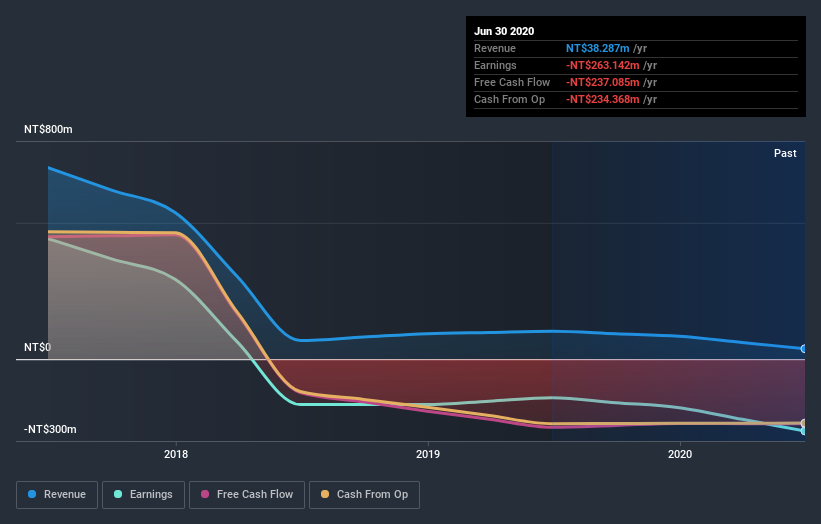

Handa Pharmaceuticals isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Handa Pharmaceuticals' revenue dropped 90% per year. That means its revenue trend is very weak compared to other loss making companies. With revenue in decline, the share price decline of 8% per year is hardly undeserved. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. The company will need to return to revenue growth as quickly as possible, if it wants to see some enthusiasm from investors.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Over the last year, Handa Pharmaceuticals shareholders took a loss of 2.1%. In contrast the market gained about 47%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 8% per annum loss investors have suffered over the last three years. We'd need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. It's always interesting to track share price performance over the longer term. But to understand Handa Pharmaceuticals better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Handa Pharmaceuticals you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade Handa Pharmaceuticals, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Handa Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6620

Handa Pharmaceuticals

A specialty pharmaceutical company, focuses on the development of drugs for various diseases in the United States and China.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives