Here's Why We're Not At All Concerned With GlycoNex Incorporation's (GTSM:4168) Cash Burn Situation

Just because a business does not make any money, does not mean that the stock will go down. Indeed, GlycoNex Incorporation (GTSM:4168) stock is up 163% in the last year, providing strong gains for shareholders. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So notwithstanding the buoyant share price, we think it's well worth asking whether GlycoNex Incorporation's cash burn is too risky. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for GlycoNex Incorporation

How Long Is GlycoNex Incorporation's Cash Runway?

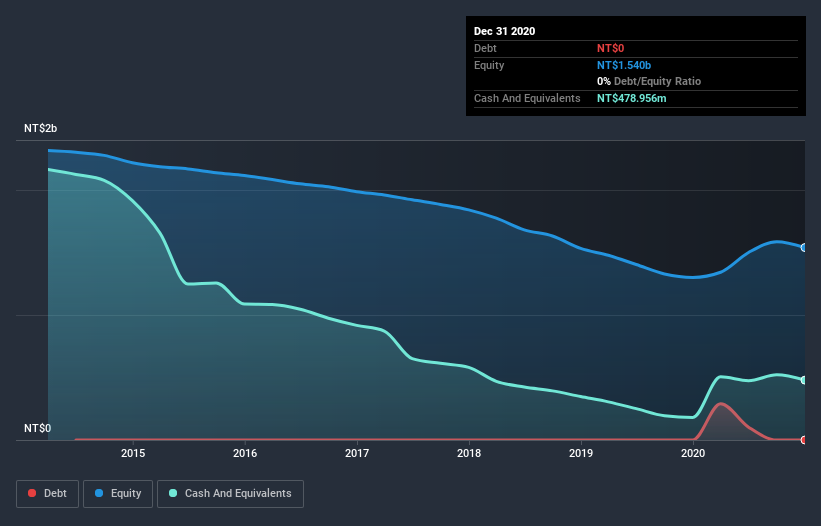

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at December 2020, GlycoNex Incorporation had cash of NT$479m and no debt. Importantly, its cash burn was NT$147m over the trailing twelve months. Therefore, from December 2020 it had 3.2 years of cash runway. There's no doubt that this is a reassuringly long runway. Depicted below, you can see how its cash holdings have changed over time.

How Is GlycoNex Incorporation's Cash Burn Changing Over Time?

In our view, GlycoNex Incorporation doesn't yet produce significant amounts of operating revenue, since it reported just NT$451k in the last twelve months. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. As it happens, the company's cash burn reduced by 19% over the last year, which suggests that management are maintaining a fairly steady rate of business development, albeit with a slight decrease in spending. Admittedly, we're a bit cautious of GlycoNex Incorporation due to its lack of significant operating revenues. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Hard Would It Be For GlycoNex Incorporation To Raise More Cash For Growth?

While GlycoNex Incorporation is showing a solid reduction in its cash burn, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of NT$2.9b, GlycoNex Incorporation's NT$147m in cash burn equates to about 5.1% of its market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

So, Should We Worry About GlycoNex Incorporation's Cash Burn?

As you can probably tell by now, we're not too worried about GlycoNex Incorporation's cash burn. For example, we think its cash runway suggests that the company is on a good path. Its weak point is its cash burn reduction, but even that wasn't too bad! Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. Separately, we looked at different risks affecting the company and spotted 3 warning signs for GlycoNex Incorporation (of which 2 are a bit concerning!) you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

When trading GlycoNex Incorporation or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:4168

GlycoNex Incorporation

Engages in the development of cancer drugs using glycosphingolipid antigen and human monoclonal antibody technologies in Taiwan.

Flawless balance sheet low.

Market Insights

Community Narratives