- Taiwan

- /

- Interactive Media and Services

- /

- TPEX:5287

3 High-Yield Dividend Stocks Paying Up To 6.1%

Reviewed by Simply Wall St

As global markets navigate a period of monetary policy adjustments, with rate cuts from the ECB and SNB and expectations for a Fed cut, investors are witnessing mixed performances across major indices. In this environment of economic recalibration and cautious optimism, dividend stocks can offer stability through regular income streams, making them an attractive option for those seeking to balance growth with income.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.25% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.80% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.63% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.21% | ★★★★★★ |

Click here to see the full list of 1972 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

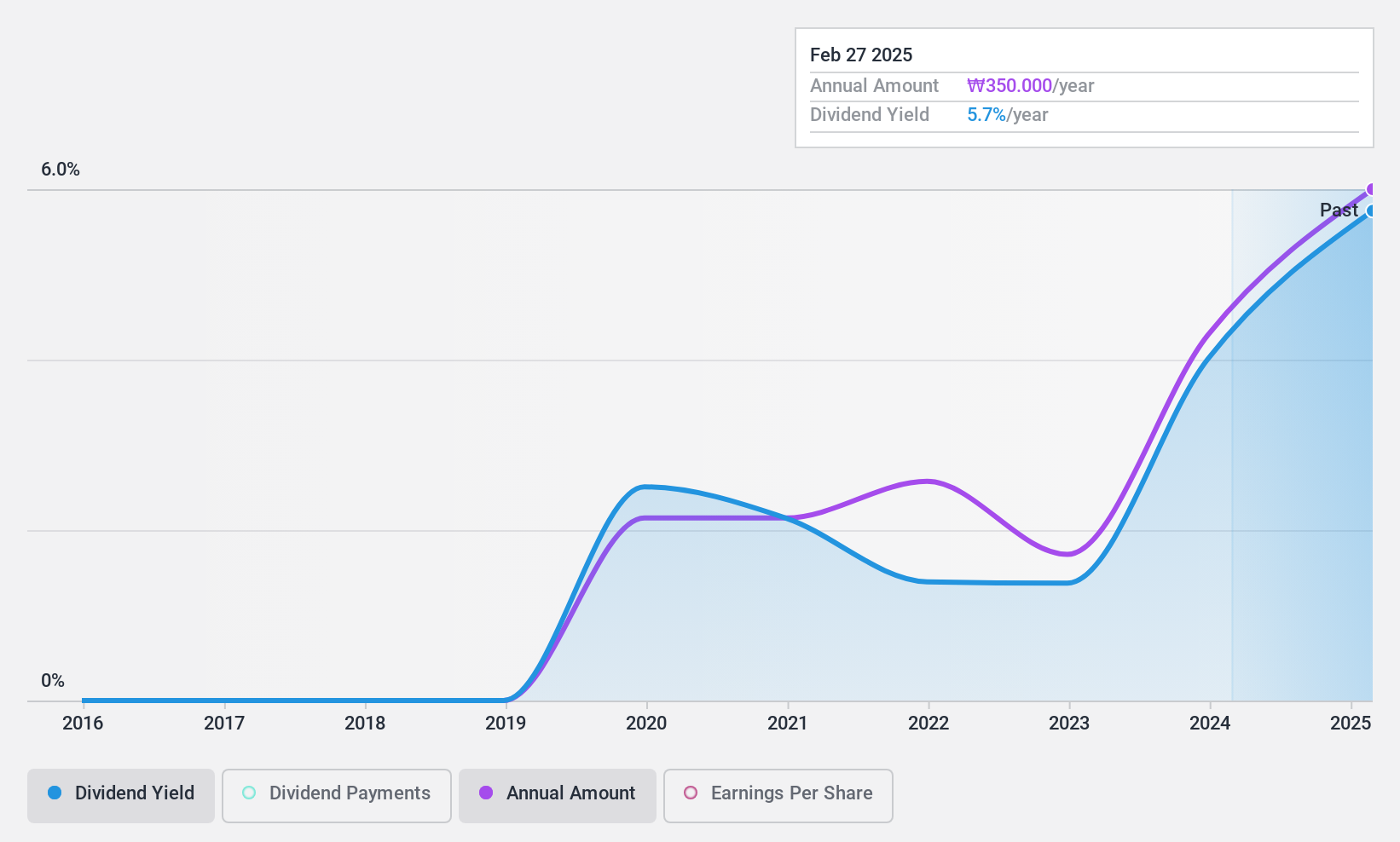

Samhwa Paints Industrial (KOSE:A000390)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samhwa Paints Industrial Co., Ltd. manufactures and sells various paints both in South Korea and internationally, with a market cap of ₩152.87 billion.

Operations: Samhwa Paints Industrial Co., Ltd.'s revenue primarily comes from its Paints and Chemicals segment, which generated ₩651.09 billion, supplemented by the IT segment at ₩8.22 billion.

Dividend Yield: 6.2%

Samhwa Paints Industrial's dividend yield of 6.17% ranks in the top 25% of the KR market, supported by a cash payout ratio of 32.6%, indicating strong coverage by cash flows. However, its dividend history is unstable with only five years of payments and volatility exceeding 20%. Despite trading below estimated fair value and earnings growth of 43.3%, recent earnings declines may impact future payouts, highlighting potential risks for investors seeking stable dividends.

- Dive into the specifics of Samhwa Paints Industrial here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Samhwa Paints Industrial is priced higher than what may be justified by its financials.

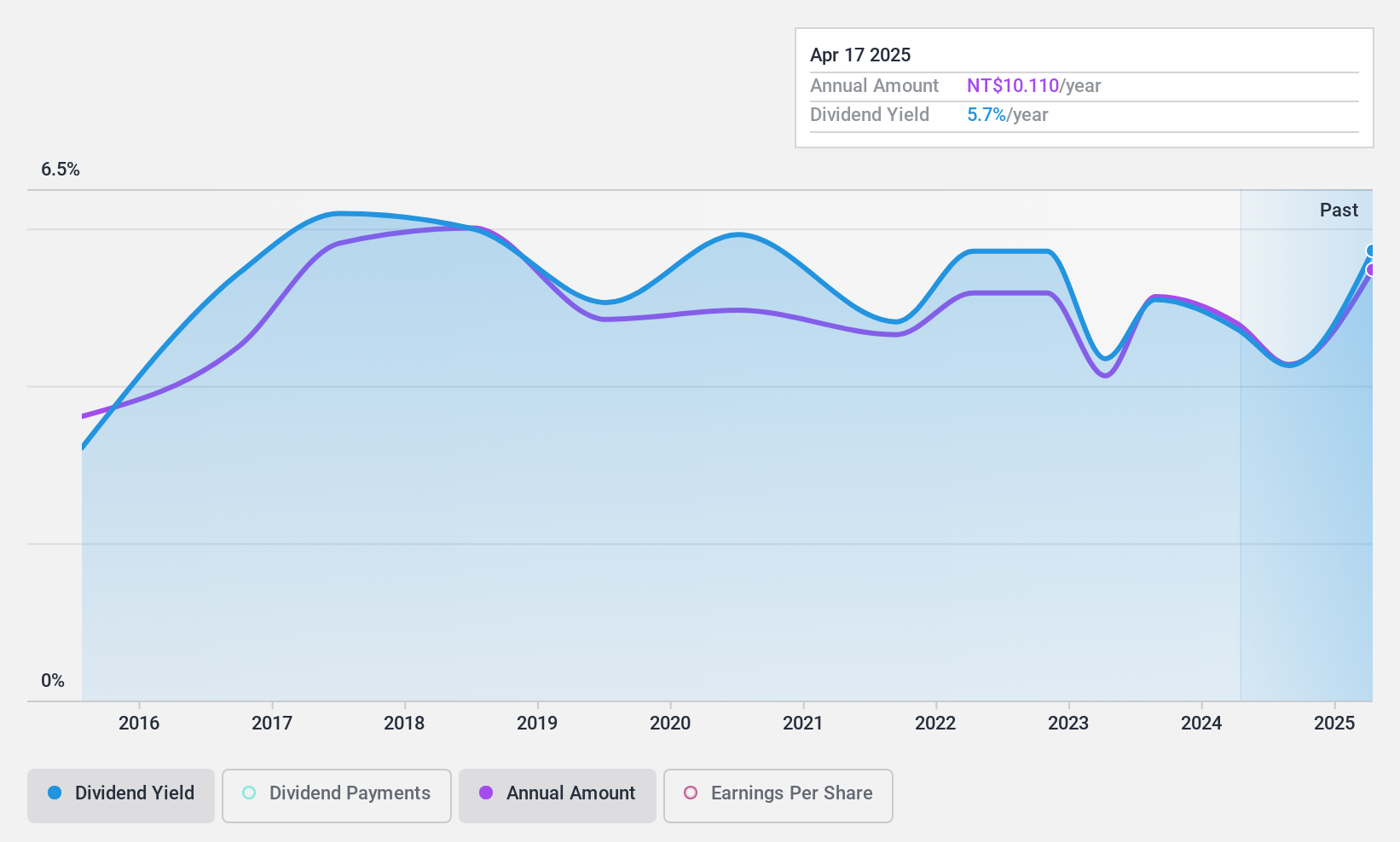

ADDCN Technology (TPEX:5287)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ADDCN Technology Co., Ltd operates online trading platforms in Taiwan and internationally, with a market cap of NT$11.19 billion.

Operations: ADDCN Technology Co., Ltd generates revenue primarily from its portal segment, amounting to NT$2.24 billion.

Dividend Yield: 4.2%

ADDCN Technology's dividend yield of 4.23% is below the top tier in the TW market, with a payout ratio of 73.5% indicating dividends are covered by earnings and cash flows. Despite trading at a good value, its dividend history is marked by volatility, though payments have increased over the past decade. Recent earnings growth supports sustainability but past instability may concern those prioritizing consistent income streams from dividends.

- Get an in-depth perspective on ADDCN Technology's performance by reading our dividend report here.

- Our valuation report unveils the possibility ADDCN Technology's shares may be trading at a discount.

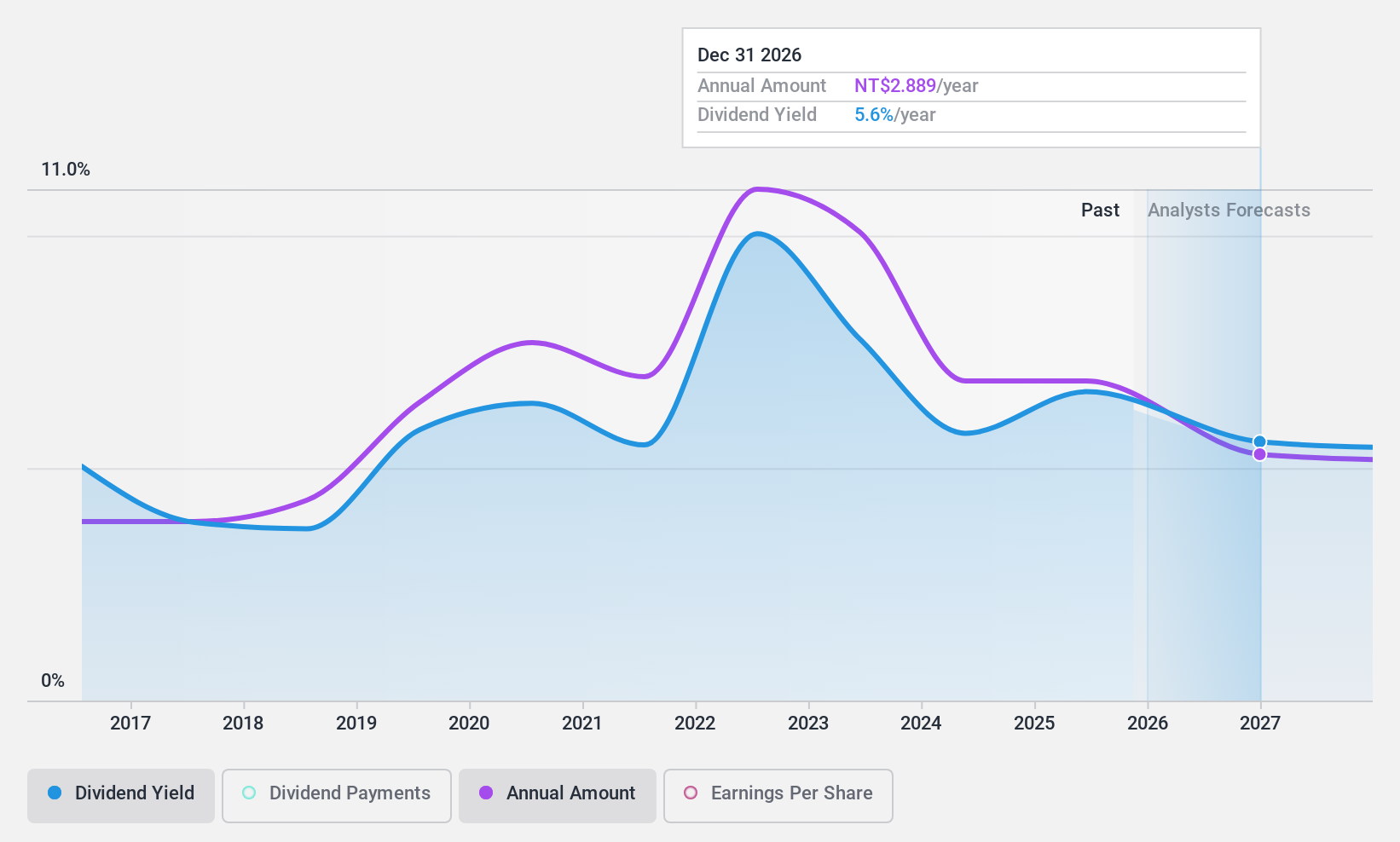

Chipbond Technology (TPEX:6147)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chipbond Technology Corporation, along with its subsidiaries, focuses on the research, development, manufacture, and sale of driver IC and non-driver IC packaging and testing services in Taiwan and Mainland China, with a market cap of NT$48.33 billion.

Operations: Chipbond Technology Corporation generates revenue primarily from its semiconductors segment, which accounted for NT$19.79 billion.

Dividend Yield: 5.8%

Chipbond Technology offers a dividend yield of 5.78%, placing it in the top 25% of TW market payers. Dividends are covered by both earnings and cash flows, with payout ratios at 70% and 78.1% respectively. However, its dividend history is volatile, showing instability over the past decade despite some growth. Recent earnings reports show decreased net income, which may impact future payouts but current valuation remains attractive compared to peers.

- Click to explore a detailed breakdown of our findings in Chipbond Technology's dividend report.

- Our expertly prepared valuation report Chipbond Technology implies its share price may be lower than expected.

Where To Now?

- Access the full spectrum of 1972 Top Dividend Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5287

ADDCN Technology

Operates online trading platforms in Taiwan and internationally.

Excellent balance sheet, good value and pays a dividend.