- Taiwan

- /

- Entertainment

- /

- TPEX:3293

International Games System Co., LTD (GTSM:3293) Analysts Just Slashed Next Year's Revenue Estimates By 11%

The latest analyst coverage could presage a bad day for International Games System Co., LTD (GTSM:3293), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Revenue estimates were cut sharply as the analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

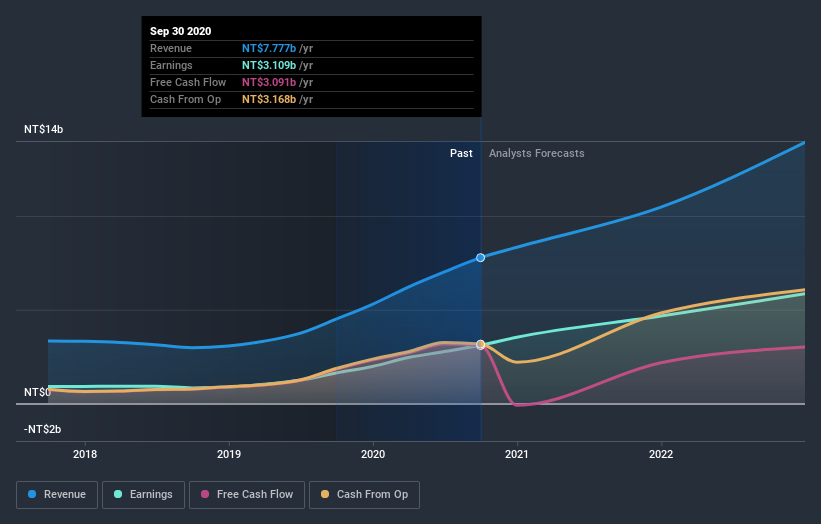

After the downgrade, the dual analysts covering International Games System are now predicting revenues of NT$10b in 2021. If met, this would reflect a major 35% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to bounce 88% to NT$83.01. Previously, the analysts had been modelling revenues of NT$12b and earnings per share (EPS) of NT$94.65 in 2021. It looks like analyst sentiment has declined substantially, with a measurable cut to revenue estimates and a real cut to earnings per share numbers as well.

See our latest analysis for International Games System

Despite the cuts to forecast earnings, there was no real change to the NT$964 price target, showing that the analysts don't think the changes have a meaningful impact on its intrinsic value. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic International Games System analyst has a price target of NT$990 per share, while the most pessimistic values it at NT$938. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or that the analysts have a clear view on its prospects.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We can infer from the latest estimates that forecasts expect a continuation of International Games System'shistorical trends, as the 27% annualised revenue growth to the end of 2021 is roughly in line with the 23% annual revenue growth over the past five years. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 14% annually. So although International Games System is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for International Games System. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. Overall, given the drastic downgrade to next year's forecasts, we'd be feeling a little more wary of International Games System going forwards.

Uncomfortably, our automated valuation tool also suggests that International Games System stock could be overvalued following the downgrade. Shareholders could be left disappointed if these estimates play out. Learn why, and examine the assumptions that underpin our valuation by visiting our free platform here to learn more about our valuation approach.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you decide to trade International Games System, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3293

International Games SystemLtd

Plans, designs, researches, develops, manufactures, markets, services, and licenses arcade, online, and mobile games in Taiwan, the United Kingdom, Curacao, and Malta.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives