- Taiwan

- /

- Metals and Mining

- /

- TWSE:9958

Risks Still Elevated At These Prices As Century Iron and Steel Industrial Co.,Ltd. (TWSE:9958) Shares Dive 26%

Century Iron and Steel Industrial Co.,Ltd. (TWSE:9958) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 77%, which is great even in a bull market.

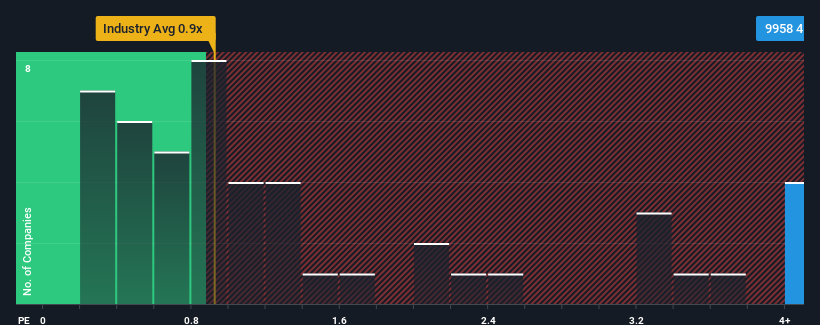

Although its price has dipped substantially, given around half the companies in Taiwan's Metals and Mining industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider Century Iron and Steel IndustrialLtd as a stock to avoid entirely with its 4.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Century Iron and Steel IndustrialLtd

How Has Century Iron and Steel IndustrialLtd Performed Recently?

Century Iron and Steel IndustrialLtd certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Century Iron and Steel IndustrialLtd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Century Iron and Steel IndustrialLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 55% last year. The strong recent performance means it was also able to grow revenue by 141% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 3.1% over the next year. Meanwhile, the rest of the industry is forecast to expand by 4.4%, which is not materially different.

With this information, we find it interesting that Century Iron and Steel IndustrialLtd is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does Century Iron and Steel IndustrialLtd's P/S Mean For Investors?

Century Iron and Steel IndustrialLtd's shares may have suffered, but its P/S remains high. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Century Iron and Steel IndustrialLtd currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Century Iron and Steel IndustrialLtd (2 can't be ignored!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:9958

Century Iron and Steel IndustrialLtd

Century Iron and Steel Industrial Co.,Ltd.

Exceptional growth potential with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives