- Taiwan

- /

- Metals and Mining

- /

- TWSE:9958

Market Participants Recognise Century Iron and Steel Industrial Co.,Ltd.'s (TWSE:9958) Revenues Pushing Shares 30% Higher

Century Iron and Steel Industrial Co.,Ltd. (TWSE:9958) shares have had a really impressive month, gaining 30% after a shaky period beforehand. The annual gain comes to 173% following the latest surge, making investors sit up and take notice.

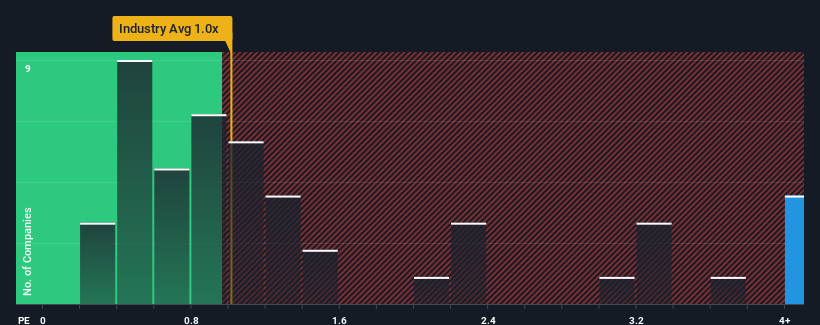

After such a large jump in price, given around half the companies in Taiwan's Metals and Mining industry have price-to-sales ratios (or "P/S") below 1x, you may consider Century Iron and Steel IndustrialLtd as a stock to avoid entirely with its 4.4x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Century Iron and Steel IndustrialLtd

How Century Iron and Steel IndustrialLtd Has Been Performing

With revenue growth that's exceedingly strong of late, Century Iron and Steel IndustrialLtd has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Century Iron and Steel IndustrialLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Century Iron and Steel IndustrialLtd would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 55% last year. The latest three year period has also seen an excellent 141% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 3.6% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in consideration, it's not hard to understand why Century Iron and Steel IndustrialLtd's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Century Iron and Steel IndustrialLtd's P/S

Century Iron and Steel IndustrialLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Century Iron and Steel IndustrialLtd maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Century Iron and Steel IndustrialLtd (2 make us uncomfortable!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:9958

Century Iron and Steel IndustrialLtd

Century Iron and Steel Industrial Co.,Ltd.

Exceptional growth potential with solid track record and pays a dividend.