As global markets react to the recent U.S. election results, with major indices reaching record highs on hopes of economic growth and tax reforms, investors are closely watching how these developments might influence future market dynamics. In this context, dividend stocks can offer a measure of stability and income potential amid fluctuating market conditions, making them an attractive consideration for those seeking to balance growth with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.03% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.10% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.98% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Innotech (TSE:9880) | 5.06% | ★★★★★★ |

Click here to see the full list of 1941 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

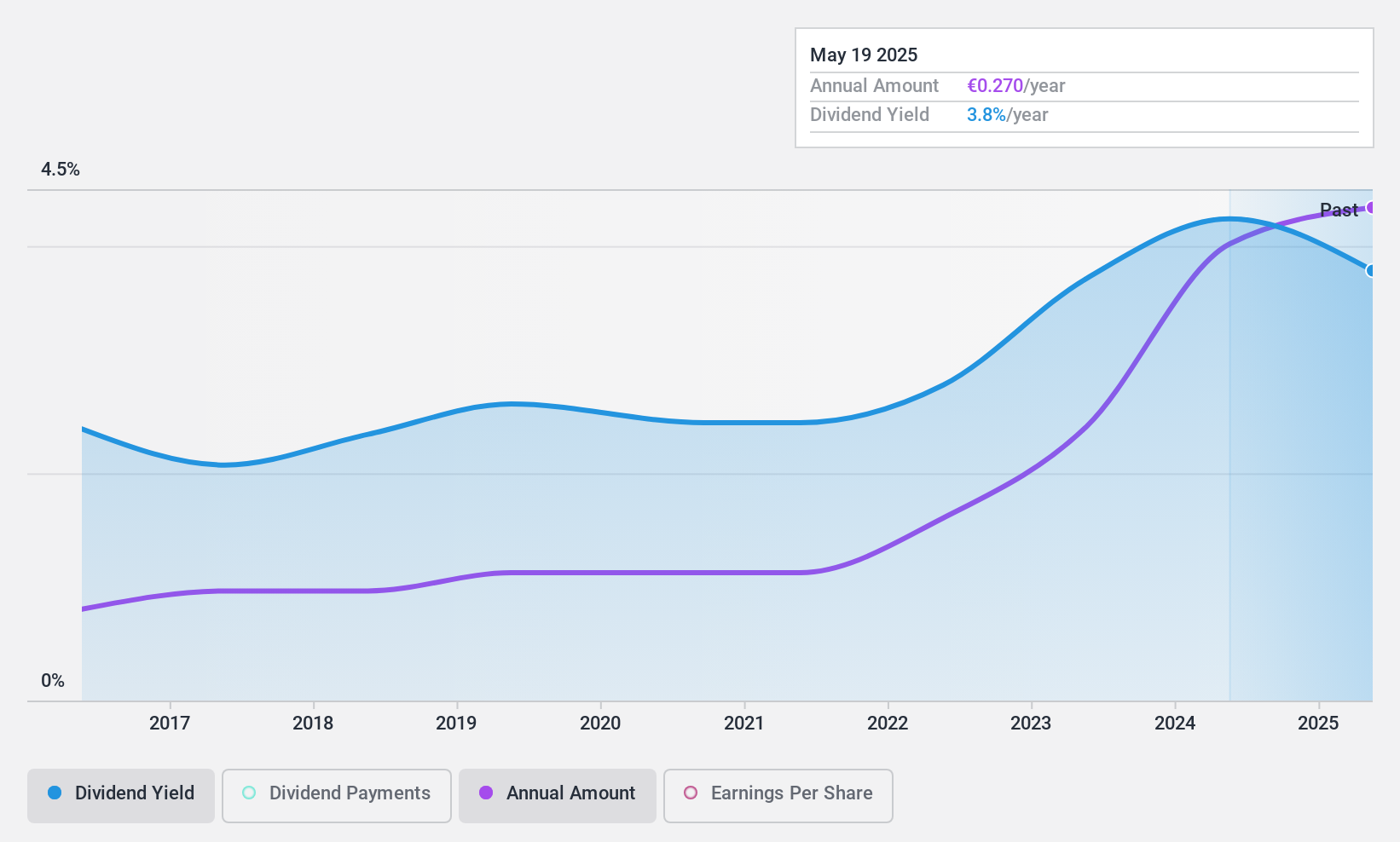

Caltagirone (BIT:CALT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Caltagirone SpA operates through its subsidiaries in the media, real estate, and publishing sectors, with a market cap of €747.15 million.

Operations: Caltagirone SpA generates revenue from various segments including €112.65 million from publishing, €186.77 million from constructions, €35.27 million from management of properties, and €1.64 billion from cement, concrete and aggregates.

Dividend Yield: 4%

Caltagirone offers a reliable dividend profile, with stable and growing dividends over the past decade. The company's dividend payments are well-covered by both earnings and cash flows, boasting a low payout ratio of 21.7% and a cash payout ratio of 9.1%. While its current yield of 4.02% is below the top quartile in Italy, it remains an attractive option for income investors due to its consistent performance and undervaluation at present trading levels.

- Unlock comprehensive insights into our analysis of Caltagirone stock in this dividend report.

- In light of our recent valuation report, it seems possible that Caltagirone is trading behind its estimated value.

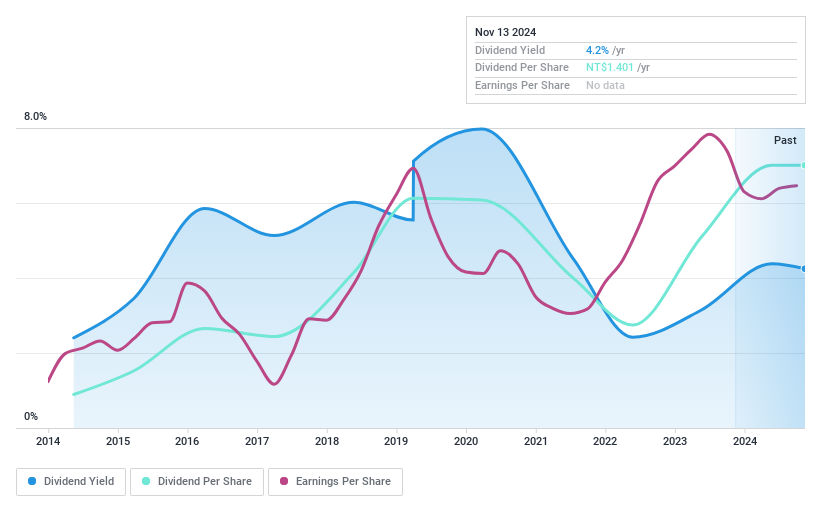

Top Union Electronics (TPEX:6266)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Top Union Electronics Corp. designs, manufactures, and provides technical support for electronic products and communication equipment in Taiwan, the United States, and China with a market cap of NT$4.77 billion.

Operations: Top Union Electronics Corp.'s revenue segments include the design, manufacturing, and technical support of electronic products and communication equipment across Taiwan, the United States, and China.

Dividend Yield: 4.3%

Top Union Electronics has demonstrated a reasonable dividend coverage, with a payout ratio of 66.7% and a cash payout ratio of 37.9%, indicating dividends are well-supported by earnings and cash flows. Despite this, the dividend yield of 4.26% is slightly below the top quartile in Taiwan, and its history shows volatility with unstable payments over the past decade. Recent earnings show modest growth in net income despite declining sales, suggesting cautious optimism for future payouts.

- Take a closer look at Top Union Electronics' potential here in our dividend report.

- Our valuation report unveils the possibility Top Union Electronics' shares may be trading at a premium.

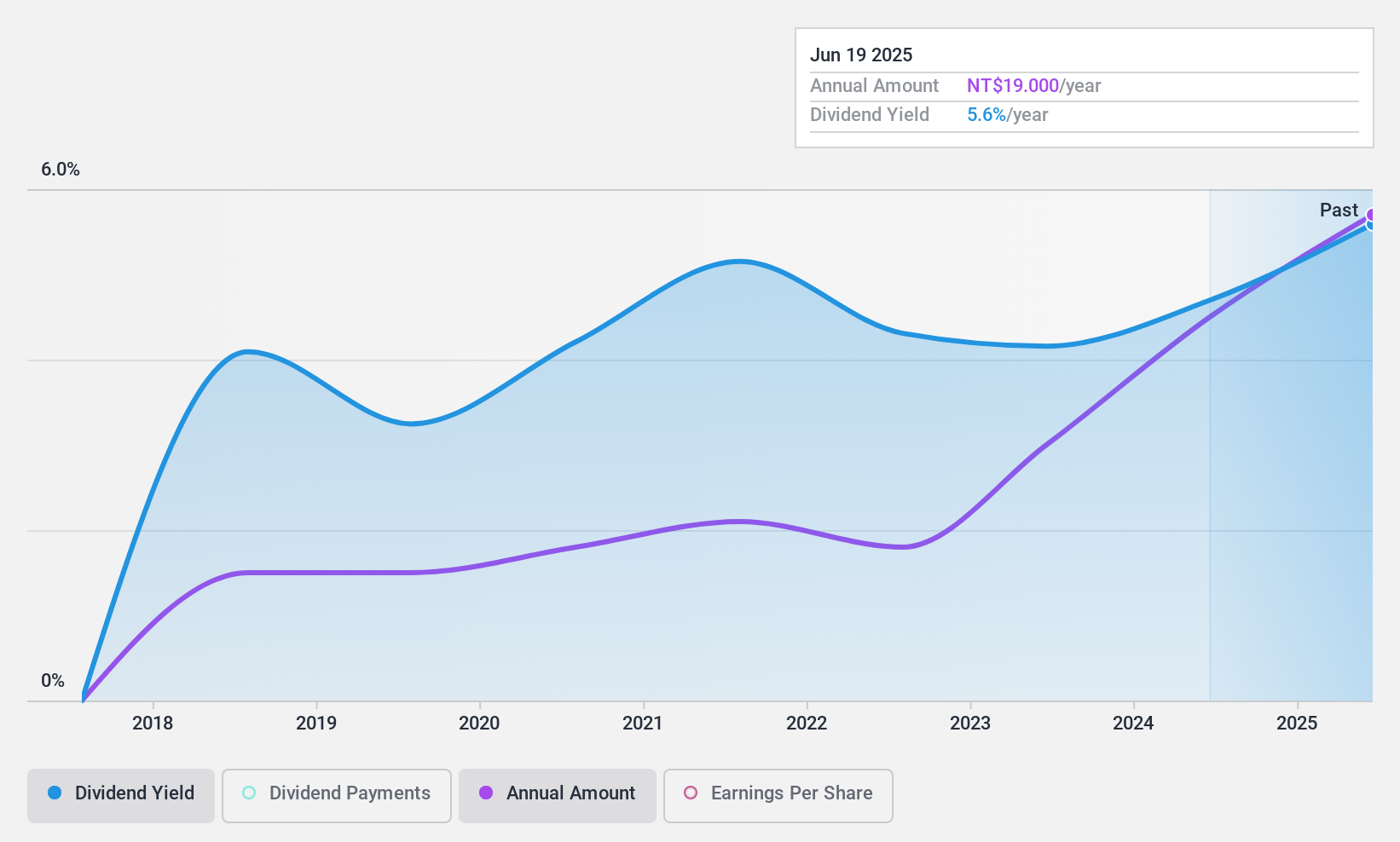

Nan Pao Resins Chemical (TWSE:4766)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nan Pao Resins Chemical Co., Ltd. operates in the manufacturing, wholesale, and retail sale of synthetic resins and plastics, adhesives, resin coatings, dyes, and pigments across multiple continents with a market cap of NT$36.11 billion.

Operations: Nan Pao Resins Chemical Co., Ltd.'s revenue is primarily derived from its operations in Taiwan (NT$8.19 billion), Vietnam (NT$7.29 billion), Mainland Area (NT$7.40 billion), Australia (NT$3.07 billion), and other regions (NT$2.56 billion).

Dividend Yield: 5%

Nan Pao Resins Chemical's dividend yield of 5.01% ranks in the top 25% of Taiwan's market, supported by a payout ratio of 68.5% and cash payout ratio of 67.9%, ensuring dividends are covered by earnings and cash flows. Despite only seven years of payments, dividends have grown steadily with minimal volatility. Recent earnings reports show robust growth, with second-quarter net income rising to TWD 672.37 million from TWD 456.66 million year-over-year, supporting sustainable payouts.

- Get an in-depth perspective on Nan Pao Resins Chemical's performance by reading our dividend report here.

- The analysis detailed in our Nan Pao Resins Chemical valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Navigate through the entire inventory of 1941 Top Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nan Pao Resins Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4766

Nan Pao Resins Chemical

Engages in the manufacturing, wholesale, and retail sale of synthetic resins and plastics, adhesives, resin coatings, dyes, and pigments in Asia, Oceania, Taiwan, Europe, America, and Africa.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives