As global markets navigate the uncertainties brought on by policy shifts and economic indicators, investors are increasingly looking at dividend stocks as a potential source of steady income amid fluctuating indices. With U.S. stocks experiencing volatility due to changing political landscapes and interest rate expectations, selecting dividend-paying stocks with strong fundamentals can offer a measure of stability in an unpredictable environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.61% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.57% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.15% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.76% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.52% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.37% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.57% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

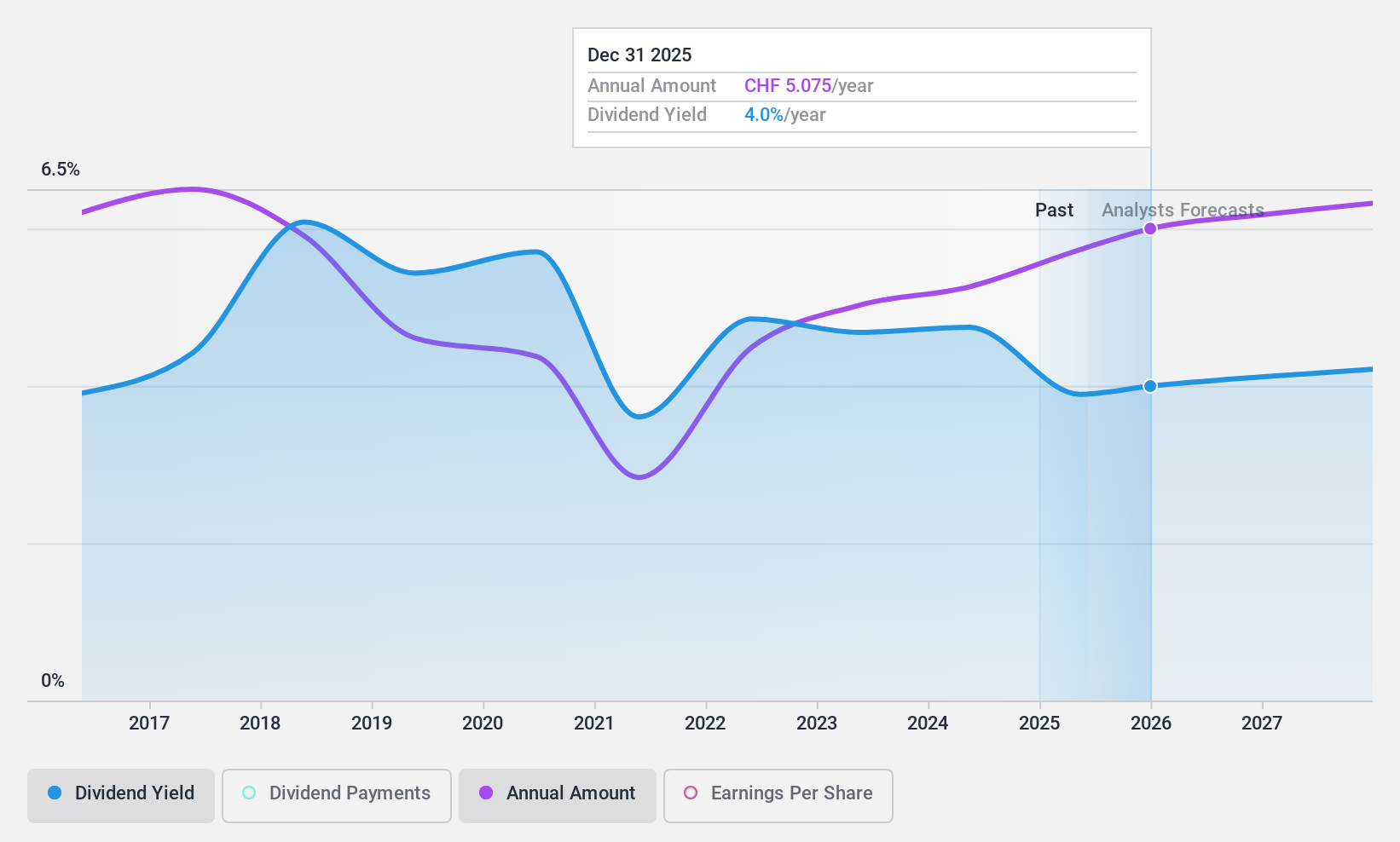

Burkhalter Holding (SWX:BRKN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Burkhalter Holding AG, with a market cap of CHF965.95 million, operates through its subsidiaries to offer electrical engineering services to the construction sector in Switzerland.

Operations: Burkhalter Holding AG generates its revenue primarily from electrical engineering services, amounting to CHF1.18 billion.

Dividend Yield: 4.9%

Burkhalter Holding's dividend yield is in the top 25% of Swiss market payers, but its dividend history is unreliable due to volatility. The company has a high payout ratio of 87.4%, indicating dividends are covered by earnings and cash flows, yet it carries significant debt. Despite recent revenue and net income growth, its removal from the S&P Global BMI Index may concern investors focused on stability. The price-to-earnings ratio suggests relative value compared to the broader Swiss market.

- Take a closer look at Burkhalter Holding's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Burkhalter Holding is priced higher than what may be justified by its financials.

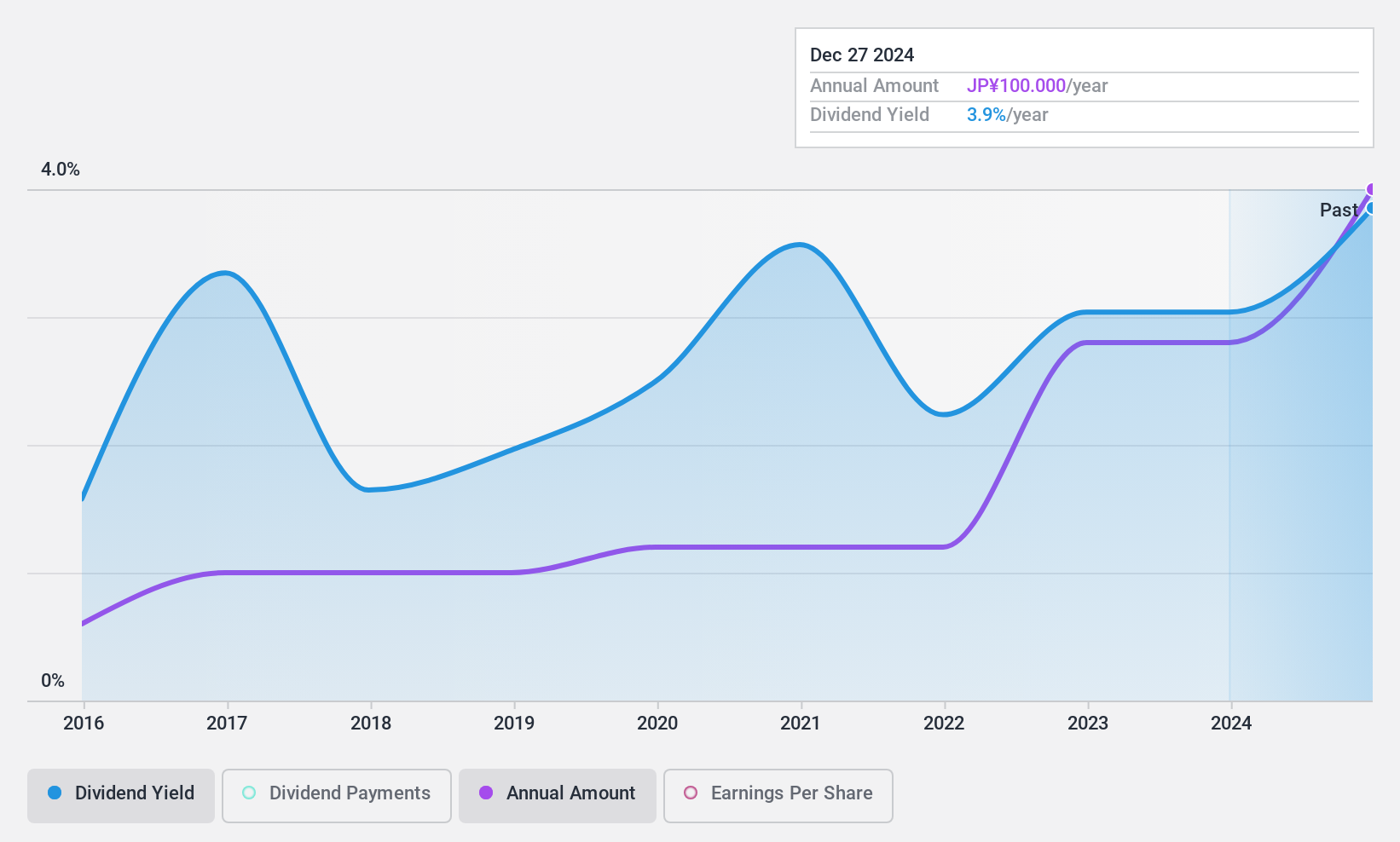

Look Holdings (TSE:8029)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Look Holdings Incorporated is engaged in the planning, manufacturing, and sale of women's apparel and related accessories both in Japan and internationally, with a market cap of ¥19.04 billion.

Operations: Look Holdings generates revenue through the planning, manufacturing, and sale of women's apparel and related accessories in both domestic and international markets.

Dividend Yield: 3.9%

Look Holdings offers a compelling dividend profile with stable and growing payments over the past decade. Its dividend yield of 3.9% ranks in the top 25% of Japanese market payers, supported by a low payout ratio of 30.2%, ensuring coverage by earnings and cash flows despite a higher cash payout ratio of 79.5%. The price-to-earnings ratio at 11.1x suggests value compared to the broader Japanese market, enhancing its attractiveness for income-focused investors.

- Click here and access our complete dividend analysis report to understand the dynamics of Look Holdings.

- Our valuation report unveils the possibility Look Holdings' shares may be trading at a premium.

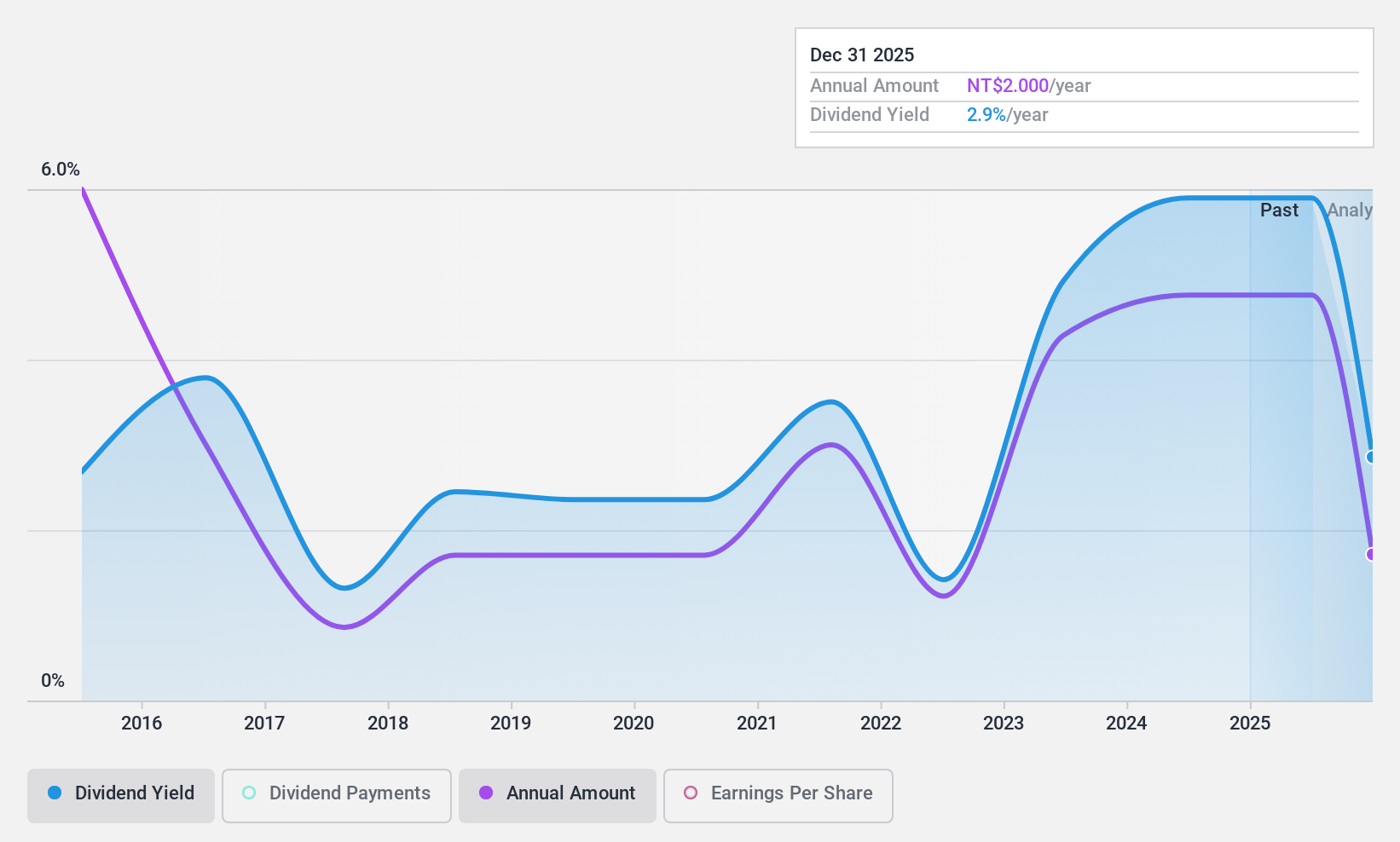

Swancor Holding (TWSE:3708)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swancor Holding Co., LTD. is involved in the manufacture and trading of chemical materials both in Taiwan and internationally, with a market cap of NT$11.34 billion.

Operations: Swancor Holding's revenue is primarily derived from its Composite Material Department, which generated NT$7.54 billion.

Dividend Yield: 5.4%

Swancor Holding's dividend yield of 5.36% places it in the top 25% of Taiwan's market, yet its sustainability is questionable due to a high cash payout ratio (94.3%) and volatile payment history over the past decade. Despite a covered payout ratio (78.9%), earnings are forecasted to decline by 10.2% annually over the next three years, challenging future dividend stability. Recent executive changes may impact strategic direction and governance effectiveness from January 2025 onward.

- Delve into the full analysis dividend report here for a deeper understanding of Swancor Holding.

- The valuation report we've compiled suggests that Swancor Holding's current price could be inflated.

Seize The Opportunity

- Delve into our full catalog of 1960 Top Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8029

Look Holdings

Plans, manufactures, and sells women apparels and related accessories in Japan and internationally.

Flawless balance sheet 6 star dividend payer.