- Taiwan

- /

- Semiconductors

- /

- TWSE:3014

3 Dividend Stocks Yielding Up To 5.7%

Reviewed by Simply Wall St

Global markets have experienced a notable upswing, with major U.S. stock indexes rebounding due to easing inflation and robust bank earnings, while European indices have risen on the back of slower-than-expected inflation. Amid these dynamic market conditions, investors often look towards dividend stocks as a way to generate steady income; these stocks can provide attractive yields and potentially offer some stability in uncertain economic environments.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.13% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.47% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

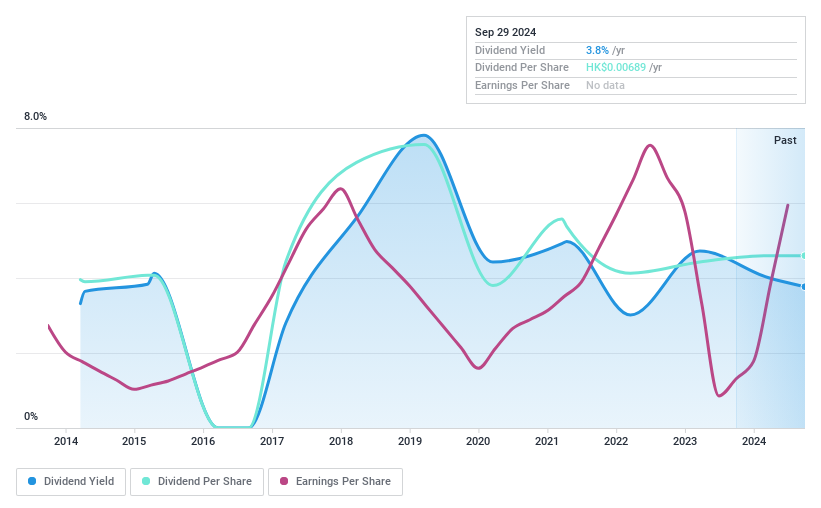

China Starch Holdings (SEHK:3838)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Starch Holdings Limited is an investment holding company that manufactures and sells cornstarch, lysine, starch-based sweeteners, modified starch, and other corn-based products in China with a market cap of HK$1.12 billion.

Operations: China Starch Holdings Limited generates revenue from two main segments: Upstream Products, which account for CN¥9.80 billion, and Fermented and Downstream Products, contributing CN¥3.86 billion.

Dividend Yield: 3.5%

China Starch Holdings demonstrates a strong capacity to cover its dividends, with a low payout ratio of 10.4% and a cash payout ratio of 25.8%, ensuring dividends are well-supported by earnings and cash flows. However, the dividend track record is unstable, having been volatile over the past decade with significant annual drops. While the price-to-earnings ratio of 2.9x suggests good value compared to the Hong Kong market average, dividend reliability remains questionable due to inconsistent payments.

- Click to explore a detailed breakdown of our findings in China Starch Holdings' dividend report.

- Upon reviewing our latest valuation report, China Starch Holdings' share price might be too optimistic.

Goldsun Building Materials (TWSE:2504)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Goldsun Building Materials Co., Ltd. operates in the production and sale of premixed concrete, cement, and calcium silicate board in Taiwan and Mainland China, with a market cap of NT$52.14 billion.

Operations: Goldsun Building Materials Co., Ltd. generates revenue primarily from its Taiwan ready-mixed business, which accounts for NT$18.78 billion, and the Ready-Mixed Cement Business in Mainland China, contributing NT$1.06 billion.

Dividend Yield: 4.7%

Goldsun Building Materials shows a mixed dividend profile. While its 4.74% yield ranks in the top 25% of the TW market, dividend payments have been volatile over the past decade and are not well-covered by cash flows, with a high cash payout ratio of 1202.4%. Earnings grew significantly last year, but future declines are forecasted. Despite trading at a significant discount to estimated fair value, large one-off items affect financial results and reliability concerns persist.

- Take a closer look at Goldsun Building Materials' potential here in our dividend report.

- Upon reviewing our latest valuation report, Goldsun Building Materials' share price might be too pessimistic.

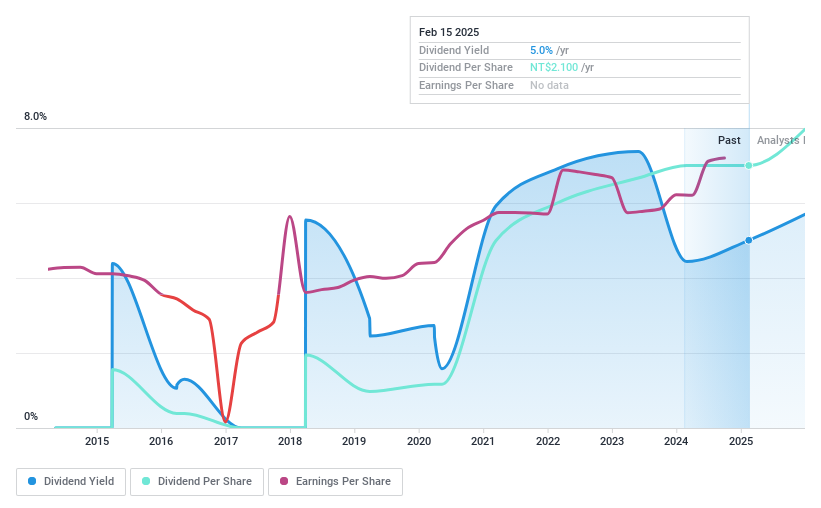

ITE Tech (TWSE:3014)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ITE Tech Inc, a fabless IC design company, specializes in I/O, keyboard, and embedded controller technology products with a market cap of NT$23.24 billion.

Operations: ITE Tech Inc generates its revenue primarily from Integrated Circuits, amounting to NT$6.44 billion.

Dividend Yield: 5.7%

ITE Tech offers a compelling dividend yield of 5.71%, placing it in the top 25% of the TW market. However, its dividends are unreliable due to past volatility and insufficient coverage by free cash flows, with a cash payout ratio of 106.9%. Although earnings have grown by 11.9% over the past year and are sufficient to cover current payouts, sustainability issues remain due to high payout ratios and recent executive changes may impact future stability.

- Unlock comprehensive insights into our analysis of ITE Tech stock in this dividend report.

- Our expertly prepared valuation report ITE Tech implies its share price may be too high.

Seize The Opportunity

- Explore the 1981 names from our Top Dividend Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3014

ITE Tech

A fabless IC design company, provides I/O, keyboard, and embedded controller technology products in Taiwan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives