- Taiwan

- /

- Metals and Mining

- /

- TWSE:2015

Discovering Three Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets experience a rebound, with major U.S. indices climbing higher on the back of easing core inflation and robust bank earnings, small-cap stocks have shown promising momentum, as seen in the notable rise of the S&P MidCap 400 and Russell 2000 indices. In this environment of cautious optimism and shifting economic indicators, identifying small-cap stocks with strong fundamentals and growth potential can be key to uncovering opportunities amidst broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Indofood Agri Resources | 34.58% | 4.29% | 50.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Ve Wong | 11.84% | 0.61% | 3.56% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Commercial Bank International P.S.C | 0.33% | 5.59% | 28.69% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Burkhalter Holding (SWX:BRKN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Burkhalter Holding AG, with a market cap of CHF1.02 billion, operates through its subsidiaries to deliver electrical engineering services to the construction sector primarily in Switzerland.

Operations: Burkhalter Holding generates revenue of CHF1.18 billion from its electrical engineering services in the construction sector.

Burkhalter Holding, a Swiss construction entity, showcases solid financial performance with earnings growth of 10.3% over the past year, outpacing the industry average of 8%. The company is profitable and free cash flow positive, indicating robust operational efficiency. However, its net debt to equity ratio stands at a high 52.9%, suggesting significant leverage. Despite this, interest payments are well covered by EBIT at 46 times coverage. With a price-to-earnings ratio of 19.2x below the Swiss market average of 21.4x, Burkhalter seems attractively valued for potential investors seeking opportunities in niche markets.

Kyokuto Securities (TSE:8706)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kyokuto Securities Co., Ltd. operates as a financial instrument operator in Japan with a market cap of ¥50.98 billion.

Operations: Kyokuto Securities generates revenue primarily from its financial instrument operations in Japan. The company has a market capitalization of ¥50.98 billion.

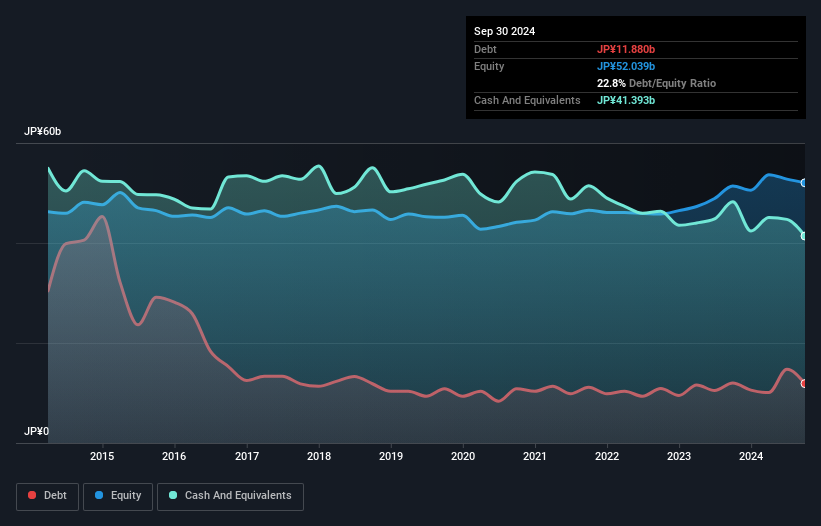

Kyokuto Securities, a financial firm with a compact market presence, showcases promising metrics. Its earnings surged by 34% last year, outpacing the Capital Markets industry's 28% growth. The price-to-earnings ratio stands at 11x, undercutting Japan's market average of 13x, suggesting potential undervaluation. Over five years, its debt-to-equity ratio slightly improved from 24% to about 23%, indicating prudent financial management. While there's no clear data on whether interest payments are well-covered by EBIT, Kyokuto's non-cash earnings remain robust. Despite not being free cash flow positive recently, the company holds more cash than total debt which likely supports its stability.

- Navigate through the intricacies of Kyokuto Securities with our comprehensive health report here.

Explore historical data to track Kyokuto Securities' performance over time in our Past section.

Feng Hsin Steel (TWSE:2015)

Simply Wall St Value Rating: ★★★★★★

Overview: Feng Hsin Steel Co., Ltd. is involved in the manufacturing, processing, and trading of steel products in Taiwan with a market capitalization of approximately NT$39.14 billion.

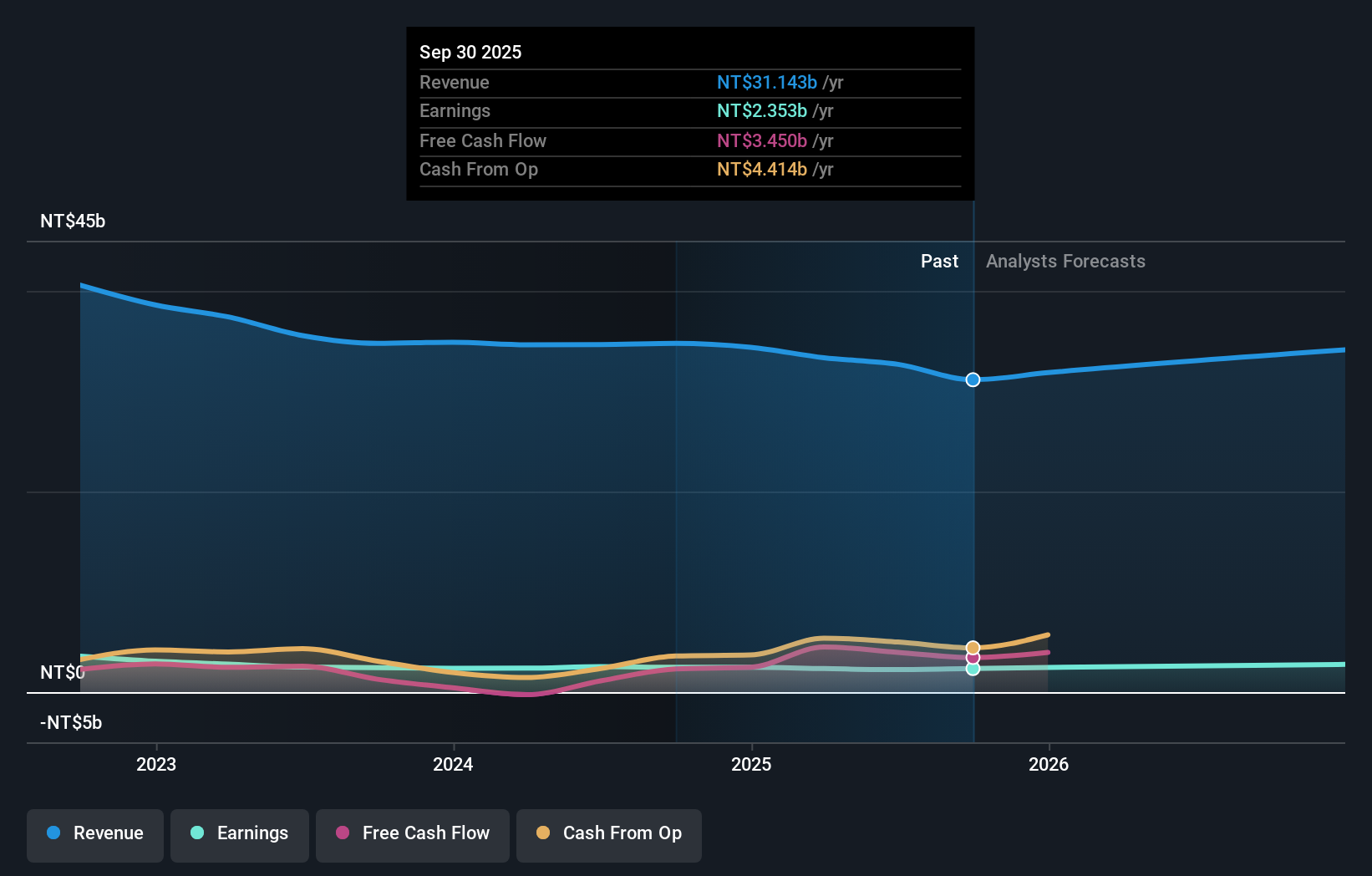

Operations: Feng Hsin Steel generates revenue primarily from the manufacture and processing of various steel products, amounting to NT$34.77 billion. The company's financial performance can be analyzed through its market capitalization of approximately NT$39.14 billion, reflecting its position in the steel industry within Taiwan.

Feng Hsin Steel, a relatively modest player in the steel industry, has shown steady earnings growth of 2.6% annually over the past five years. Despite not outpacing the broader Metals and Mining sector's 12.3% growth last year, it trades at 12.3% below its estimated fair value, suggesting potential undervaluation. The company's debt-to-equity ratio improved from 7.9 to 5.5 over five years, indicating prudent financial management with more cash than total debt on hand. Recent earnings reports reveal third-quarter sales of TWD 8.18 billion and a net income of TWD 456 million, reflecting stable performance amid industry challenges.

Taking Advantage

- Click this link to deep-dive into the 4655 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2015

Feng Hsin Steel

Manufactures, processes, and trades steel products in Taiwan.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives