- Singapore

- /

- Industrials

- /

- SGX:C07

3 Dividend Stocks To Consider With Yields Up To 6.1%

Reviewed by Simply Wall St

In the midst of geopolitical tensions and concerns about consumer spending, global markets have experienced notable fluctuations, with major U.S. indexes closing lower despite midweek gains. Amidst this backdrop, dividend stocks can offer a measure of stability and income potential for investors seeking to navigate uncertain economic conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.91% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.61% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.03% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.06% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.37% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.23% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.90% | ★★★★★★ |

Click here to see the full list of 2010 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

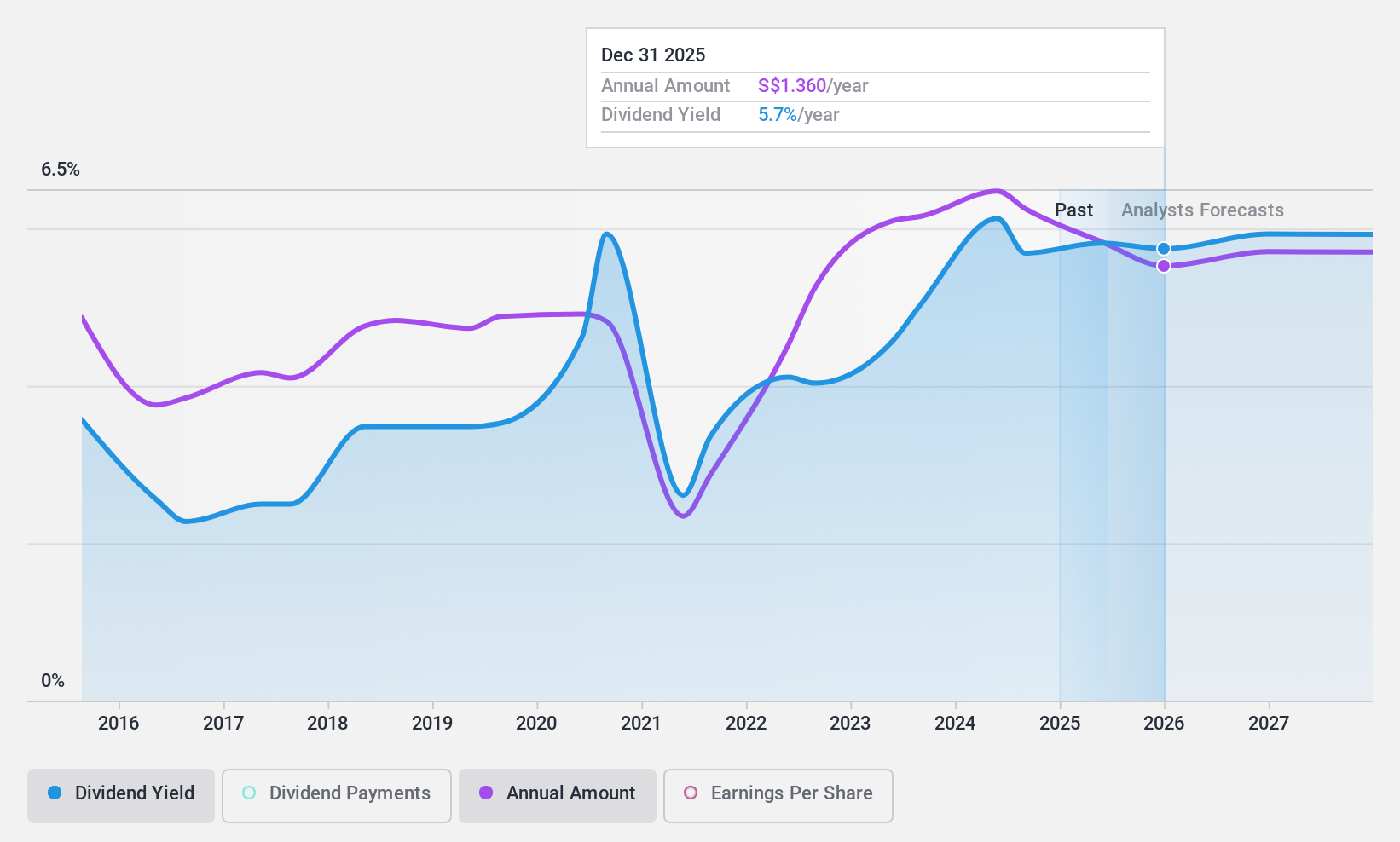

Jardine Cycle & Carriage (SGX:C07)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jardine Cycle & Carriage Limited is an investment holding company involved in diverse sectors such as financial services, heavy equipment, mining, construction and energy, agribusiness, infrastructure and logistics, information technology, and property across Indonesia and internationally with a market cap of SGD10.50 billion.

Operations: Jardine Cycle & Carriage Limited generates revenue from various sectors including financial services, heavy equipment, mining, construction and energy, agribusiness, infrastructure and logistics, information technology, and property.

Dividend Yield: 5.9%

Jardine Cycle & Carriage's dividends are well-covered by earnings and cash flows, with payout ratios of 44.4% and 30.8%, respectively, despite a volatile dividend history over the past decade. Trading at 45.8% below estimated fair value, it offers a competitive dividend yield in Singapore's market top quartile. Recent executive changes include Jean-Pierre Felenbok joining the Audit & Risk Committee and adjustments following Mikkel Larsen's passing to maintain board independence.

- Take a closer look at Jardine Cycle & Carriage's potential here in our dividend report.

- The analysis detailed in our Jardine Cycle & Carriage valuation report hints at an deflated share price compared to its estimated value.

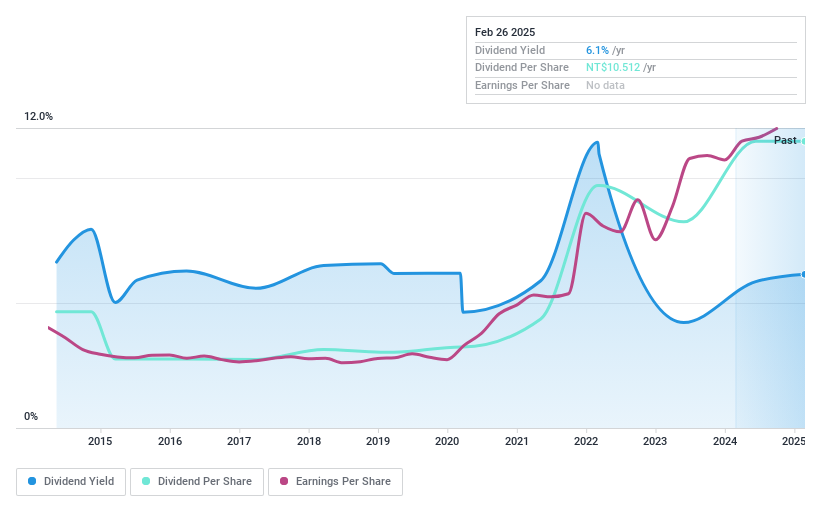

CTCI Advanced Systems (TPEX:5209)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: CTCI Advanced Systems Inc., along with its subsidiaries, offers system integration services across the hydrocarbon, power, industry, transportation, and high technology sectors both in Taiwan and internationally, with a market cap of NT$4.83 billion.

Operations: CTCI Advanced Systems Inc. generates revenue from system integration (NT$1.23 billion), project construction (NT$5.79 billion), and sales (NT$165.54 million).

Dividend Yield: 6.2%

CTCI Advanced Systems trades at 44.1% below its estimated fair value, offering a dividend yield of 6.17%, placing it in Taiwan's market top quartile. Despite an unstable and volatile dividend history over the past decade, dividends are covered by earnings with a payout ratio of 75.2% and cash flows at 41.5%. Earnings grew by 11.2% last year, supporting the sustainability of current payouts despite historical volatility in payments.

- Click here and access our complete dividend analysis report to understand the dynamics of CTCI Advanced Systems.

- Upon reviewing our latest valuation report, CTCI Advanced Systems' share price might be too pessimistic.

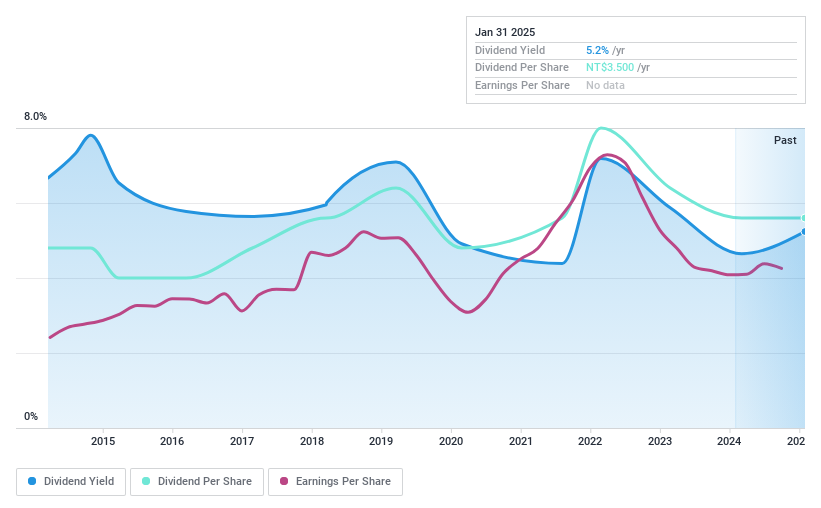

Feng Hsin Steel (TWSE:2015)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Feng Hsin Steel Co., Ltd. manufactures, processes, and trades steel products in Taiwan with a market cap of NT$40.94 billion.

Operations: Feng Hsin Steel Co., Ltd. generates revenue primarily from the manufacture and processing of various angle irons, round irons, flat irons, and related products, amounting to NT$34.77 billion.

Dividend Yield: 4.9%

Feng Hsin Steel offers a dividend yield of 4.92%, ranking in the top 25% of Taiwan's market. Dividends are covered by earnings with a payout ratio of 82.3% and cash flows at 87.9%, but have been volatile over the past decade, experiencing significant drops exceeding 20%. Although trading slightly below its estimated fair value, the stock's dividend history is unreliable despite earnings growth averaging 2.6% annually over five years.

- Click here to discover the nuances of Feng Hsin Steel with our detailed analytical dividend report.

- Our expertly prepared valuation report Feng Hsin Steel implies its share price may be too high.

Seize The Opportunity

- Dive into all 2010 of the Top Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:C07

Jardine Cycle & Carriage

An investment holding company, engages in providing the financial services, heavy equipment, mining, construction and energy, agribusiness, infrastructure and logistics, information technology, and property businesses in Indonesia, Singapore, and Malaysia.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)