- Taiwan

- /

- Metals and Mining

- /

- TWSE:1532

China Metal Products Co., Ltd. (TWSE:1532) Stock Catapults 27% Though Its Price And Business Still Lag The Market

China Metal Products Co., Ltd. (TWSE:1532) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 38% in the last year.

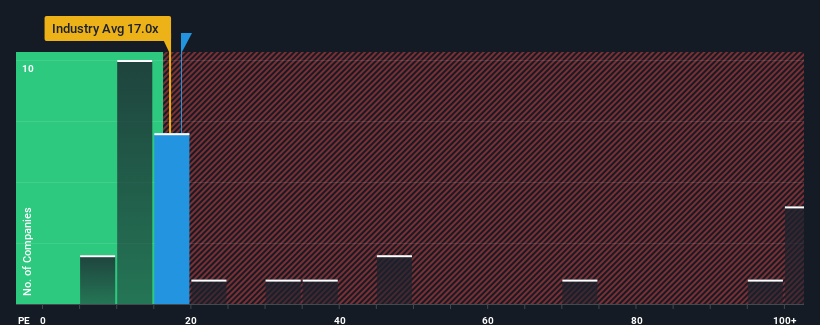

Although its price has surged higher, China Metal Products may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 18.6x, since almost half of all companies in Taiwan have P/E ratios greater than 24x and even P/E's higher than 41x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

China Metal Products has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for China Metal Products

Does Growth Match The Low P/E?

In order to justify its P/E ratio, China Metal Products would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 20% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 74% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 26% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why China Metal Products is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Key Takeaway

Despite China Metal Products' shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of China Metal Products revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for China Metal Products (2 are significant) you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1532

China Metal Products

Engages in the manufacture and sale of cast iron products in Taiwan, the United States, Japan, China, Europe, South America, and internationally.

Good value with proven track record and pays a dividend.