Rainbows and Unicorns: TSRC Corporation (TPE:2103) Analysts Just Became A Lot More Optimistic

TSRC Corporation (TPE:2103) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals. The stock price has risen 9.7% to NT$35.15 over the past week, suggesting investors are becoming more optimistic. Could this big upgrade push the stock even higher?

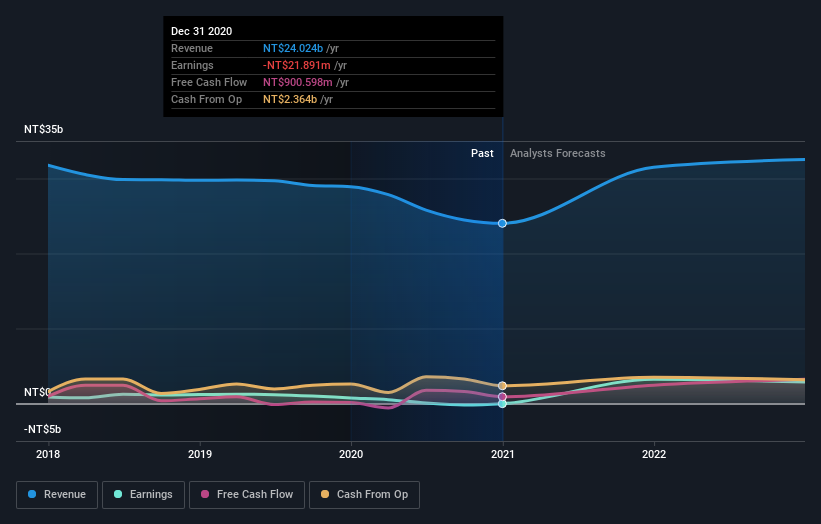

Following the upgrade, the latest consensus from TSRC's two analysts is for revenues of NT$31b in 2021, which would reflect a huge 31% improvement in sales compared to the last 12 months. The losses are expected to disappear over the next year or so, with forecasts for a profit of NT$3.91 per share this year. Previously, the analysts had been modelling revenues of NT$28b and earnings per share (EPS) of NT$1.33 in 2021. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

Check out our latest analysis for TSRC

With these upgrades, we're not surprised to see that the analysts have lifted their price target 10.0% to NT$29.33 per share. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values TSRC at NT$42.00 per share, while the most bearish prices it at NT$22.50. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. One thing stands out from these estimates, which is that TSRC is forecast to grow faster in the future than it has in the past, with revenues expected to display 31% annualised growth until the end of 2021. If achieved, this would be a much better result than the 0.4% annual decline over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 8.9% per year. So it looks like TSRC is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, TSRC could be worth investigating further.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At least one analyst has provided forecasts out to 2022, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

When trading TSRC or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TSRC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2103

TSRC

Engages in the manufacture, import, transport, and sale of various synthetic rubber and related products in Taiwan, Asia, the United States, Europe, and internationally.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)