Shiny Chemical Industrial (TPE:1773) Has Rewarded Shareholders With An Exceptional 308% Total Return On Their Investment

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For instance, the price of Shiny Chemical Industrial Company Limited (TPE:1773) stock is up an impressive 216% over the last five years. Meanwhile the share price is 3.9% higher than it was a week ago.

Check out our latest analysis for Shiny Chemical Industrial

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

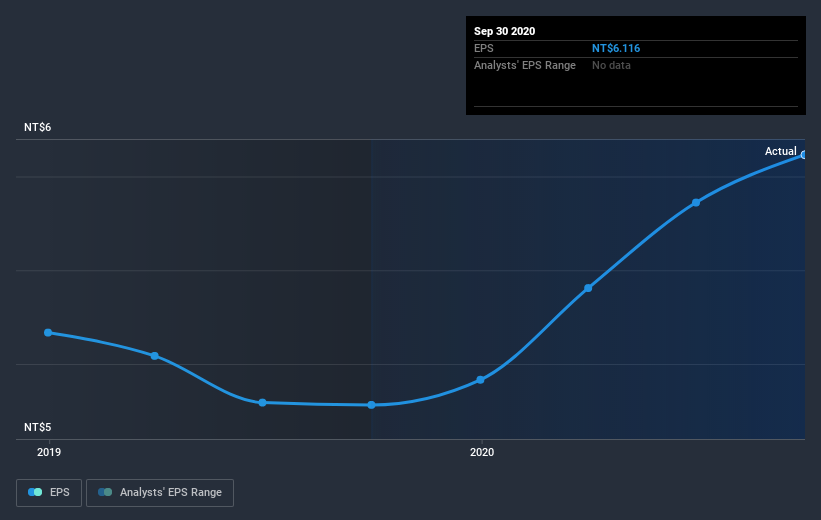

During five years of share price growth, Shiny Chemical Industrial achieved compound earnings per share (EPS) growth of 14% per year. This EPS growth is lower than the 26% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Shiny Chemical Industrial's key metrics by checking this interactive graph of Shiny Chemical Industrial's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Shiny Chemical Industrial, it has a TSR of 308% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Shiny Chemical Industrial's TSR for the year was broadly in line with the market average, at 40%. That gain looks pretty satisfying, and it is even better than the five-year TSR of 32% per year. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. Is Shiny Chemical Industrial cheap compared to other companies? These 3 valuation measures might help you decide.

Of course Shiny Chemical Industrial may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade Shiny Chemical Industrial, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1773

Shiny Chemical Industrial

Engages in the manufacturing, processing, and trading of chemical solvents in Taiwan.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives